Effective Gamification Techniques to Boost Customer Loyalty

Businesses are increasingly using gamification strategies for customer loyalty These techniques use game-like aspects, such as prizes, competitions, and interactive experiences, to engage clients more thoroughly with their products and services.

Gamification stimulates regular contact, fosters a sense of accomplishment, and eventually improves client retention by appealing to customers' innate impulses. In this blog, we will examine the successful applications of these concepts across various businesses, using the banking industry as a case study.

Let's uncover the secrets of gamified banking and explore how it's boosting customer loyalty in ways never seen before.

What Are Gamification Strategies in Banking?

Banks are facing an unprecedented challenge: how to capture and maintain the attention of their customers in an increasingly competitive landscape. As traditional banking methods give way to innovative digital solutions, financial institutions are turning to an unexpected ally - gamification.

Gamification in banking is revolutionizing the way banks interact with their clientele, transforming mundane financial tasks into engaging, rewarding experiences.

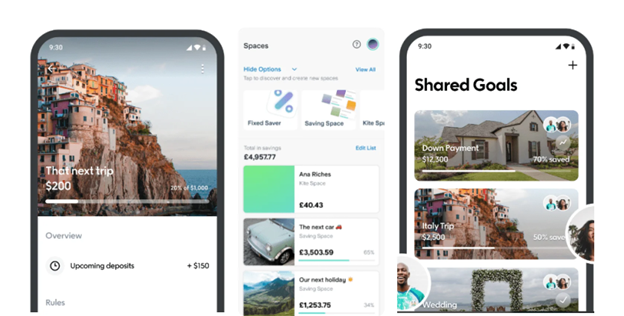

From mobile apps that make saving money feel like a thrilling quest to personalized avatars guiding customers through their financial journey, gamification is reshaping the face of modern banking. But how exactly does this strategy work, and why are leading banks investing heavily in these playful tactics?

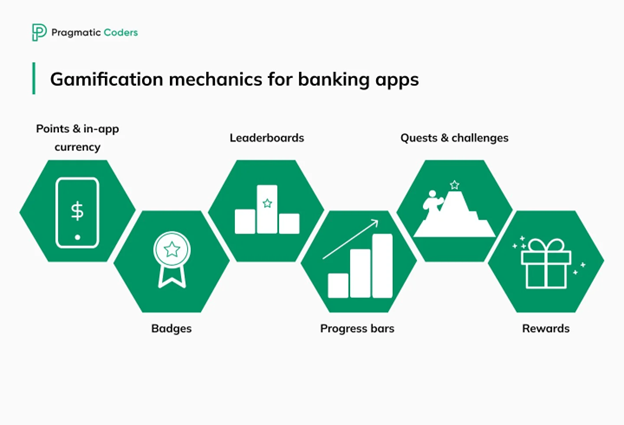

At its core, gamification in banking involves applying game-design elements and principles to non-game contexts. It's not about turning banking into a game but rather about leveraging the psychological triggers that make games so engaging and applying them to financial services.

The psychology behind gamification taps into fundamental human desires:

a. The need for achievement and recognition

b. The drive for social connection and competition

c. The satisfaction of making progress and leveling up

What Are the Benefits of Gamification Strategies in Banking?

By harnessing these intrinsic motivators, banks aim to achieve several key objectives:

1. Increased engagement: Encouraging customers to interact more frequently with their banking apps and services. A 2021 Zaguan University study of 208 Mint app users found that gamification boosts motivation and adoption of personal financial management apps.

2. Enhanced retention: Creating a more enjoyable experience that keeps customers coming back.

3. Improved financial literacy: Making learning about complex financial concepts fun and accessible.

4. Greater customer satisfaction: Providing a sense of accomplishment and reward in managing finances.

The potential impact on a bank's bottom line is significant. Gamification strategies can lead to:

a. Higher customer acquisition rates

b. Increased cross-selling opportunities

c. Improved brand loyalty and advocacy

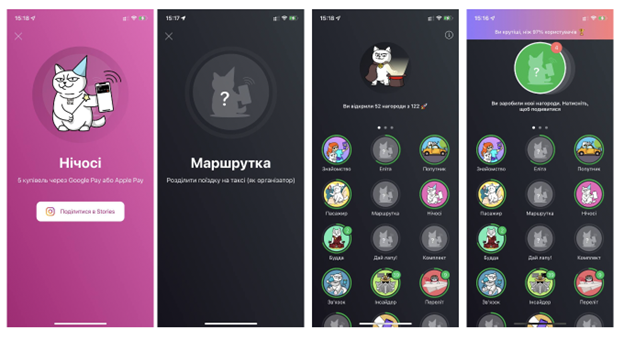

For instance, Monobank, a virtual bank in Ukraine, saw a remarkable boost in its daily active users and customer retention rates after implementing gamified elements like achievement badges for completing various banking tasks.

Points and Badges Systems

One of the most straightforward yet effective gamification techniques is the implementation of points and badge systems. This strategy borrows directly from the world of video games, where players earn points for completing tasks and receive badges as visual representations of their achievements.

1. Points Systems

Points systems in banking apps typically work by rewarding customers for various financial activities:

a. Making regular deposits into savings accounts

b. Paying bills on time

c. Using specific bank services or products

d. Referring new customers

These points can often be redeemed for tangible rewards, such as cashback, discounts on banking services, or even real-world prizes. The key is to make the points valuable enough to motivate action while ensuring they align with the bank's business goals.

2. Badge Systems

Badge systems complement points by providing visual acknowledgment of customer achievements. These digital accolades can represent:

a. Milestones in savings goals

b. Streaks of responsible financial behavior

c. Mastery of specific financial skills or knowledge

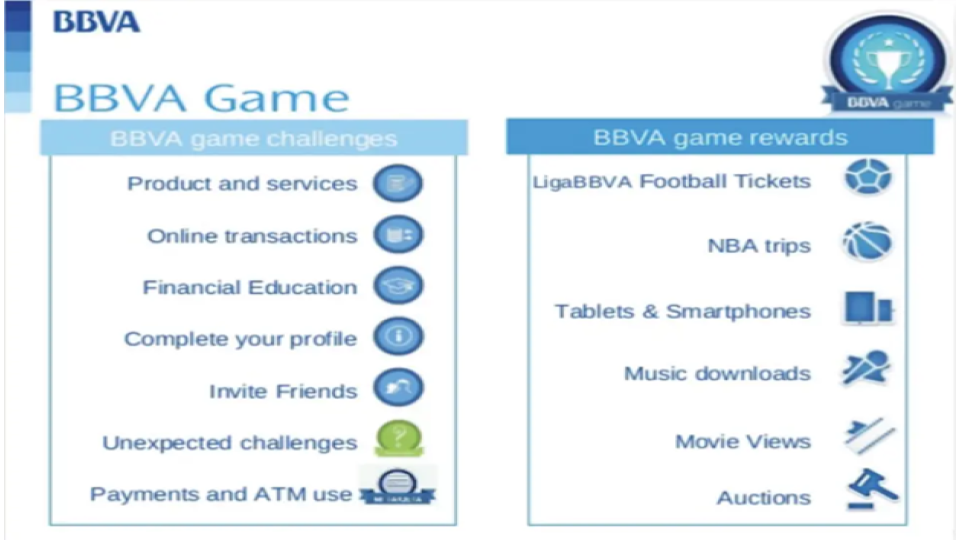

A prime example of successful implementation is the BBVA Game by BBVA Bank in Spain. This innovative program not only awarded points for transactions but also created an entire virtual economy around the points system. Customers could earn rewards like digital downloads and even football tickets, turning routine banking tasks into an exciting quest for prizes.

The results were impressive:

a. Over 100,000 participants joined in the first 6 months

b. Significant increase in online banking engagement

c. BBVA won the 2013 Bank Innovation Award for this initiative

Levels and Leaderboards

Building on the foundation of points and badges, many banks are now implementing more advanced gamification strategies like levels and leaderboards. These elements tap into our innate desire for progression and competition.

Levels

Levels in banking apps work similarly to those in video games. As customers engage more with their finances, they can progress from a "Savings Novice" to a "Finance Master." Each level might unlock new features, better interest rates, or exclusive services. This system encourages continued engagement and provides a clear path for financial growth.

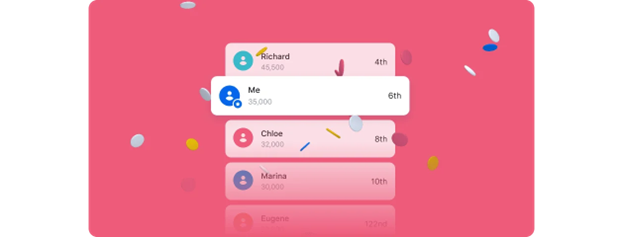

Leaderboards

Leaderboards take this a step further by introducing a competitive element. For example, Revolut, a digital banking platform, created a university leaderboard where students competed to complete their onboarding process. The prize? Free premium banking services. This clever approach turned a typically mundane task into a campus-wide competition, dramatically increasing sign-up rates and engagement among young users.

While leaderboards can be highly effective, banks must implement them carefully to avoid discouraging lower-ranking users. The focus should be on personal improvement rather than outperforming others.

Conclusion

Gamification is more than just a trendy gimmick; it's a powerful strategy for increasing customer engagement, improving financial literacy, and fostering long-term loyalty. By tapping into our natural affinity for games, banks are making the world of finance more accessible, enjoyable, and rewarding for their customers.

As we've seen, from simple points and badges to sophisticated personalized avatars, gamification can take many forms. The most successful implementations are those that align closely with both customer needs and business objectives.

While the future of banking may look more like a game than ever before, the stakes remain very real. As financial institutions continue to innovate in this space, they have the potential to not only transform their relationships with customers but also to contribute to better financial outcomes for individuals and society as a whole.