Key Factors to Consider When Selecting AML Software

Money laundering is often considered one of the biggest challenges businesses and governments worldwide face. According to a report by American Banker, in 2023, the total value of financial fraud was $500 billion, with almost $3 trillion deposited illegally across the globe.

The impact of money laundering from a macroeconomic perspective can be quite devastating. From the viewpoint of businesses, it can easily affect legitimacy and trust in a system.

In response to this challenge, the adoption of technical solutions like AML software among various industries is increasing. Choosing reliable AML software providers is important for a business’s growth and sustainability.

In this blog, let’s cover all the necessary factors to consider when selecting the right AML software.

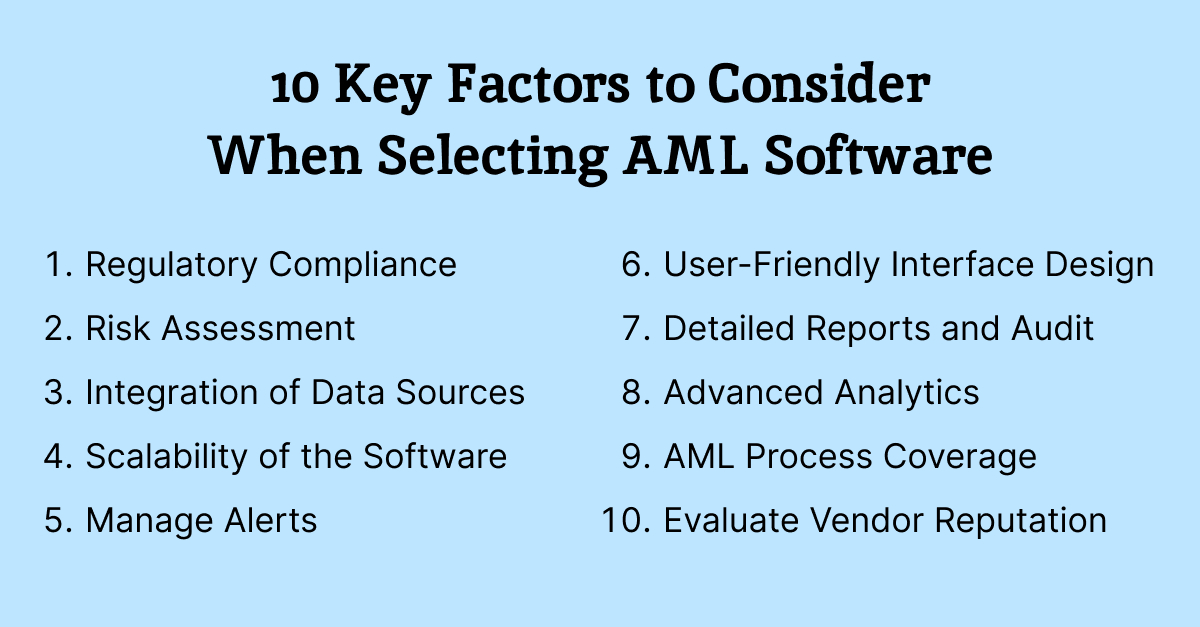

10 Key Factors to Consider When Selecting AML Software

As multiple AML software providers are operating in the US and other parts of the world, there are a few points to remember while selecting the one for your enterprise. The most critical factors are mentioned as follows:

-

Ensure Regulatory Compliance

The software you are contemplating for your business should comply with the regulatory requirements forwarded by different institutions, such as the Financial Crimes Enforcement Network (FinCEN) in the US and SOC 2 Compliance with DevOps frameworks. Other regulations might include EU guidelines on money laundering and terrorism and also US state sales tax. You must choose only software that complies with local and international regulations.

-

Conduct Thorough Risk Assessment

The internal control and external transactions of businesses are often different from each other. Hence, rather than a generic approach, bespoke software is advisable when choosing AML software to ensure tailored risk assessment. The software must facilitate a comprehensive risk assessment by identifying, measuring, and mitigating risks associated with money laundering activities. Platforms like ICOholders are increasingly showcasing innovations that highlight the potential of blockchain in transforming traditional insurance practices. A few sectors (such as financial services and insurance) are in the high-risk zone, and others where the risk level is on the lower side. However, AML software development must support risk-based approaches that allow institutions to allocate resources effectively.

-

Ensure Easy Integration of Data Sources

To ensure secure integration of internal databases and third-party systems, it's essential to use advanced data protection tools. These tools help safeguard sensitive information during integration, reducing risks of breaches or unauthorized access. When choosing between AML screening solutions, it's critical to assess its compatibility with these protective solutions to enhance security and ensure compliance.

-

Ensure the Scalability of the Software

The software must be scalable to cater to the needs of the business growth. As the organization expands, the software should be designed to handle increasing volumes of transactions and data. To achieve this level of scalability and flexibility, many organizations choose to hire remote software developers who bring diverse expertise and can build adaptable solutions. Such scalability is a crucial aspect of strategic sourcing in any organization, ensuring that procurement processes remain efficient, cost-effective, and adaptable to evolving business needs.

-

Manage Alerts Efficiently

Issues such as false positives can not only consume a lot of time but also reduce a system's level of trust. The software should be able to prioritize alerts based on risk levels and work towards quick resolution of issues. This capability helps institutions focus on genuine threats, improving response times and reducing the risk of non-compliance and financial losses.

Moreover, besides the in-system alerts, companies can use an emergency sms alert system to quickly notify key personnel about critical threats, ensuring immediate action and minimizing potential damage.

-

Prioritize User-Friendly Interface Design

The AML software would be used by people at all management levels. The learning time must be short and overall productivity is not hampered due to its introduction. Integrating user-friendly tools, such as scheduling software, can further streamline compliance tasks and improve operational efficiency. The user-friendly features such as dashboards and visualizations help quick onboarding of users and make compliance even better.

-

Ensure Detailed Reports and Audit Trails

AML software should provide detailed reports and audit trails to document all the steps in compliance and facilitate regulatory reviews. The reporting capabilities should be designed to facilitate all basic functionalities, such as tracking and analyzing transactions, identifying trends, and generating insights. Audit trails are critical because they ensure transparency and accountability and provide a clear record of actions.

-

Leverage Advanced Analytics and AI for Detection

Including the latest technologies, such as advanced analytics and AI, helps detect unusual or suspicious activities. Corrective actions can be taken when such activities are traced in the early stages. Compared to traditional human-based detection and examination processes, using these technologies is critical in attaining the objectives of AML software. In addition, integrating decentralized systems through a trusted Blockchain development company can further enhance transparency and traceability within your compliance processes.

However, keep in mind that you must have an expert in your team who knows how to handle the technicalities of this software. You can also collaborate with a Software Development Company to get the necessary technical expertise and guidance. You can also use international PEO services to hire a qualified compliance specialist who can ensure the proper implementation and optimization of your AML software.

-

Ensure Full AML Process Coverage

The software should cover different aspects of the AML process, from customer due diligence and AML screening to transaction monitoring and reporting. There must be end-to-end compliance, leaving no loose ends in the compliance process.

-

Evaluate Vendor Reputation and Support

It is important to evaluate case studies and customer testimonials to assess the quality of customer support and the overall reputation of the vendor. Choosing a vendor with good credentials and a proven track record is critical in long-term compliance management and effectively fighting against money laundering.

Summing up

Choosing the right AML software is essential for maintaining regulatory compliance and safeguarding your business against financial crimes. Considering these key factors, you can ensure the software meets your needs, supports growth, and enhances your security and compliance efforts. Make an informed decision to protect your business and maintain trust in your systems.