Optimizing Trades: The Power of Modern Tools

Like a seasoned sailor navigating the vast ocean, you too can traverse the complex world of trading using modern tools. Nowadays, trading isn't just about instinct or luck; it's about leveraging advanced technology to optimize trades. You can rely on automated systems, data analysis, artificial intelligence, and machine learning to make calculated decisions.

They're not just fancy terms; they're powerful tools that can amplify your trading prowess. Be it through desktop software or mobile platforms, these tools are reshaping the way we trade. So, let's dive in, understand these tools better, and see how they can give you an edge in the trading world.

Understanding Modern Trading Tools

You've got a multitude of modern trading tools at your fingertips, each designed to enhance your decision-making process and optimize your trades. They're not just fancy add-ons; they've become vital components of today's trading landscape. But understanding them is the key to harnessing their full potential.

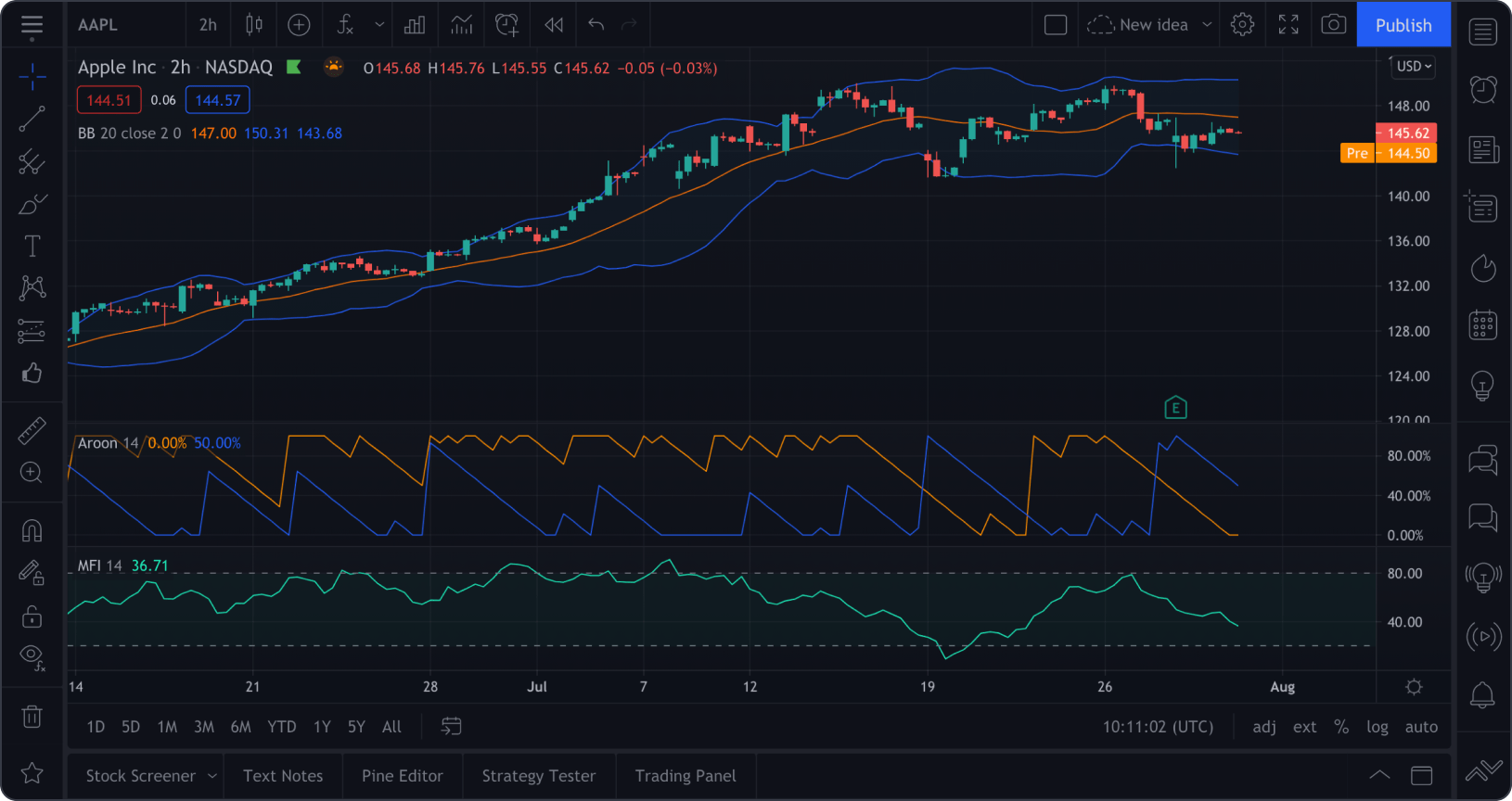

Firstly, charting tools are your visual aids, providing a graphical representation of market activities. They allow you to observe trends, patterns, and indicators, offering a comprehensive view of the market's heartbeat. You're not shooting in the dark; you're making informed decisions based on data-driven insights.

Next, algorithmic trading software has revolutionized trading by automating the process. You're able to set predefined criteria for your trades, and the algorithm executes them when those conditions are met. It's like having a personal assistant who never sleeps, is constantly vigilant, and is ready to act.

Lastly, risk management tools are your safety nets. They help you set stop-loss and take-profit levels, protecting your trades from extreme market fluctuations. It's not about eliminating risk entirely; it's about managing it effectively. In a nutshell, to optimize your trades, you need to know your tools. They're not just accessories; they're your analytical, strategic partners in trading.

Influence of Technology on Trading

Technology's influence on your trading strategies and outcomes can't be overstated in today's trading world. It's a game-changer that's revolutionized how you approach markets. Automation, for instance, allows you to execute trades with precision and speed that surpass human capabilities. You no longer need to monitor the markets around the clock; algorithms can do it for you, spotting trading opportunities in real time. Thanks to technological advances, high-frequency trading (HFT) is now the norm.

Data analytics is another critical factor. It gives you the power to predict market trends and make informed decisions. With technology, you can analyze massive volumes of data, including historical and real-time market data, to spot patterns and trends and generate forecasts. Lastly, there's the democratization of trading. Technology has made trading more accessible to the masses, reducing the barriers to entry. Now, anyone can trade from anywhere, anytime, with apps and online platforms.

The Rise of Trading Software

As trading software continues to evolve, you're now able to leverage these powerful tools to enhance your trading strategies and increase your profitability. These advanced platforms offer a myriad of features that can simplify and streamline your trading operations. They provide real-time market data, advanced charting tools, and sophisticated algorithms to predict market trends.

You can now execute trades with greater speed and precision, which is essential in today's volatile and fast-paced markets. Automated trading software can also mitigate the risks associated with human error and emotional decision-making. You're now able to set predefined criteria and let the software execute trades when those conditions are met. This ability to 'set and forget' trades can free up your time and reduce the stress associated with manual trading.

In addition, the rise of cloud-based trading software means you can access your trading platform from anywhere, at any time. You're no longer tied to your desktop and can monitor the markets and execute trades even when you're on the move.

As we explore the advantages of automated trading systems, let's delve into how incorporating backtesting software can further optimize your trading operations and elevate your profitability.

Benefits of Automated Trading Systems

Leveraging automated trading systems offers several benefits. Firstly, it enhances efficiency, reduces risk, and increases profitability in trading operations. Automation takes over repetitive tasks, allowing traders to focus on strategic decision-making. Additionally, the system is optimized to execute trades at the best possible time, minimizing slippage and maximizing profit.

Another advantage of automated trading systems is the elimination of emotional trading. This eliminates impulsive decisions and reduces risk. The system strictly adheres to pre-set parameters, effectively managing risk exposure. Moreover, it allows for diversification by trading in multiple accounts or strategies simultaneously, further spreading the risk.

Furthermore, automated trading operates around the clock, taking advantage of different time zones and markets. Traders are not tied to their computers, ensuring they don't miss out on potential trading opportunities. Additionally, these systems can process vast amounts of information and execute trades based on complex algorithms, surpassing human capacity.

In the rapidly changing world of trading, the benefits of automated systems are clear. They offer a strategic, efficient, and low-risk way to optimize trades. With this powerful tool, traders are well-equipped to navigate the complexities of modern trading.

Power of Data Analysis in Trading

You'll find that delving into data analysis significantly boosts your trading success, equipping you with key insights derived from market trends, trading patterns, and financial indicators. It's not just about crunching numbers; it's about understanding the story they tell, predicting future trends, and making informed decisions.

Consider this:

Emotional Resilience: Data analysis negates emotional trading decisions. It allows you to remain objective even when the markets are volatile, giving you the confidence to navigate through uncertainty.

Risk Management: By identifying trends and patterns, you can mitigate the risks associated with trading. You're not just shooting in the dark; you're making strategic moves based on solid evidence.

Maximized Returns: Data analysis helps you identify lucrative opportunities that others may overlook. It's about being one step ahead, always.

Harnessing the power of data analysis in trading isn't a luxury; it's a necessity. It empowers you to make strategic, informed decisions, giving you an edge over others.

The Role of AI and Machine Learning

Often, you're not fully aware of how AI and machine learning are revolutionizing the trading landscape. These technologies are now essential tools for traders, providing unparalleled insights and predictive capabilities. AI uses complex algorithms to analyze vast amounts of data at lightning speed, identifying patterns and trends that would be impossible for a human to discern.

Machine learning, a subset of AI, takes it a step further. It's not just crunching numbers; it's learning from them. Machine learning algorithms adapt and improve over time, refining their predictions as they process new data. This means your trading strategies can continually evolve, becoming more accurate and profitable.

But it's not enough to just have these tools; you need to understand them. They're strategic assets, and like any asset, their value depends on how well you use them. It's a game-changer, shifting the focus from data collection to data interpretation, making the trading environment more dynamic and competitive. Now that you're aware of the role of AI and machine learning, let's take a look at another transformative technology in the trading world: mobile trading platforms.

Utilizing Mobile Trading Platforms

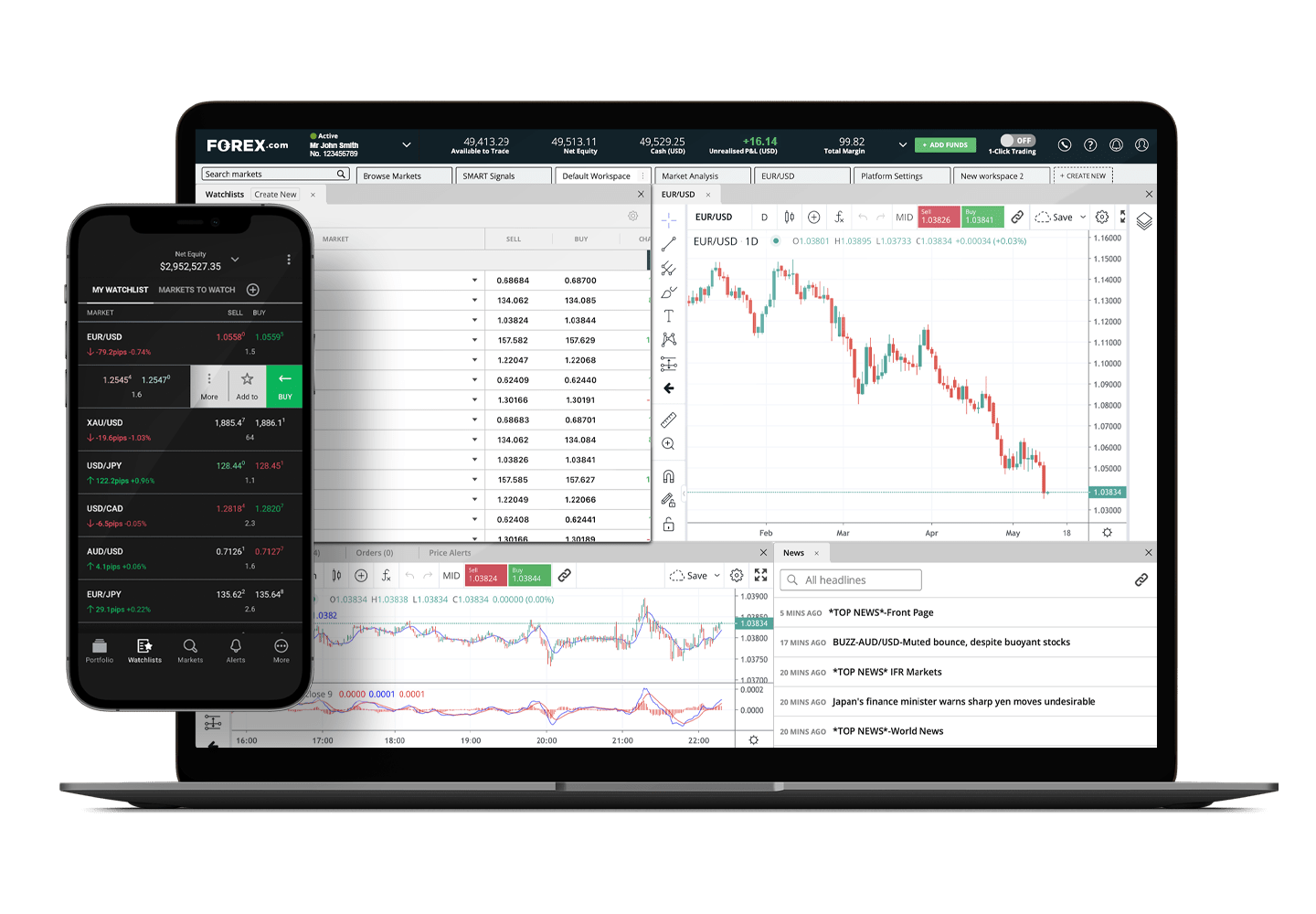

In addition to AI and machine learning, another significant tool you can't afford to ignore is mobile trading platforms. These platforms equip you with the power to trade anytime, anywhere. They're a game-changer, transforming the way you engage with the financial markets.

Consider these impactful benefits:

Efficiency and Flexibility: You're no longer chained to your desktop. Trade on the go, during your commute, or even while lounging on a beach.

Real-time Updates: With live market data at your fingertips, you're empowered to make informed decisions instantly.

Comprehensive Tools: Most platforms offer advanced tools such as charting features, market alerts, and news updates.

To optimize your trades, it's critical to leverage the functionality and convenience of these platforms. They aren't a replacement for thorough analysis and strategic planning, but they're a powerful ally in your trading journey. Choose a platform that suits your trading style and needs, and you'll be one step closer to maximizing your trading potential. Remember, in the fast-paced world of trading, your ability to adapt and utilize modern tools effectively can give you the edge you need.

Future Trends in Trading Technology

Looking ahead, you're likely to see emerging trends in trading technology that could revolutionize your trading experience. Artificial intelligence (AI) is set to take center stage. You'll see AI being harnessed to analyze market trends and predict future movements with the precision that outstrips human capability.

Blockchain technology is another trend to watch. It's poised to enhance transaction security and transparency, making your trades safer and more reliable. Additionally, there's the rise of cloud technology. With its capacity for vast data storage and analysis, it'll enable faster and more efficient trades.

On the horizon, you'll find augmented reality (AR) making inroads into trading. Imagine getting live, 3D visualizations of market trends right in front of your eyes. It's not science fiction; it's the future of trading technology. Keep an eye out for these trends. Embrace them, and they'll not only streamline your trading processes but also sharpen your strategic decisions.

The future of trading is digital, data-driven, and innovative. It's time to equip yourself with the knowledge and tools for this new era. Understanding these trends and capitalizing on them could determine your success in the ever-evolving world of trading. MetaTrader 4 download is one such tool that aligns with the evolution of trading technology. This powerful platform offers advanced features for charting, analysis, and automated trading, putting you in control of your trades with precision and efficiency.

Conclusion

In a nutshell, modern trading tools are revolutionizing the way you trade. They're not just a flash in the pan; they're here to stay. From automated trading systems to data analysis, AI, and mobile platforms, these tools offer strategic advantages that can't be overlooked. So, stay ahead of the curve, embrace these technologies, and optimize your trades. Remember, the future of trading lies in the power of these game-changing tools.