The Evolution Of AI-Powered Underwriting - What's More To Expect?

Insurance comes in all shapes and sizes. Moreover, on a broader level, they can be classified into two categories - personal insurance and business insurance. Personal insurance covers life insurance, auto-insurance, health insurance, disability insurance, and others; whereas business insurance is general liability insurance that protects a business from third party legal suits.

The BFSI sector has always been a leader in adapting to new changes. However, adaptation to AI is not an exception either. For instance, adoption of artificial intelligence in their day-to-day operations was around 1% in 2016–17, but it grew to 63% in 2023, and it’s bound to grow in the coming years.

This not only tells us how rapid the adoption of AI in Insurance underwriting is, but it also suggests that if you’re not a part of this journey, you’re bound to be left behind.

Current Scenario Of AI Adoption In Insurance Underwriting And Future Trends

It’s not about the future anymore. The wave of AI is already here, and changing the way we work. The insurance industry is already adopting digitization in its day-to-day functions:

1. Insurers are digitizing manual underwriting

Paper-based insurance underwriting does not work anymore. The reasons are simple - manual data entry is painfully slow, and the possible error rate in data capture and entry is too high. For instance, the error rate for manual data capture and entry could be as high as 30%.

Artificial intelligence-based automated underwriting solutions solve this problem to a great extent, as they are faster and more efficient. AI-based document processing solutions can achieve up to 99%+ data capture accuracy from insurance application forms, ID verification documents, and income verification papers. The advantage AI-based solutions have over traditional data capture solutions, such as optical character recognition services and rule-based solutions, is their adaptability. These solutions can adapt to different variations of the same document types, which saves organizations the trouble of training data capture models every time there is a slight variation in the document type.

Also, it’s not just about data capture and entry. The scope of AI goes beyond that to chatbots, engaging with customers, and giving your customers a touchless experience.

2. Data-driven risk assessment

AI-based solutions can provide analysis and deeper insights into applicants based on the captured data, and help organizations assess risk better.

Let’s put this into perspective with a real-life example.

Bank of America is using machine learning models to predict which loans are most likely to default. These models are trained on a dataset that includes information about borrowers' credit scores, debt-to-income ratios, and employment histories. This has helped Bank of America reduce its loan losses by 20%.

3. Human intervention in decision-making

AI-based data capture solutions are not 100% foolproof either. However these models are good at understanding their limitations. That’s why, whenever they come across anything that is beyond their defined scope, they can mark it as an exception.

By doing so, these solutions can divide all the insurance into 2 categories:-

A. Insurance is straightforward enough for underwriters to “auto-bind”. That way, they can leave it all to AI models end-to-end and focus on something else.

B. Insurance that can be held for the team to look into and review.

This classification ensures that your underwriters are reviewing only the exceptions. That cuts the effort required in underwriting by 80%.

4. Predictive analysis in underwriting

With an abundance of data, these AI-models can deduce a pattern based on data points and map it to risk assessment. Consequently, insurers can make more accurate predictions and risk assessments.

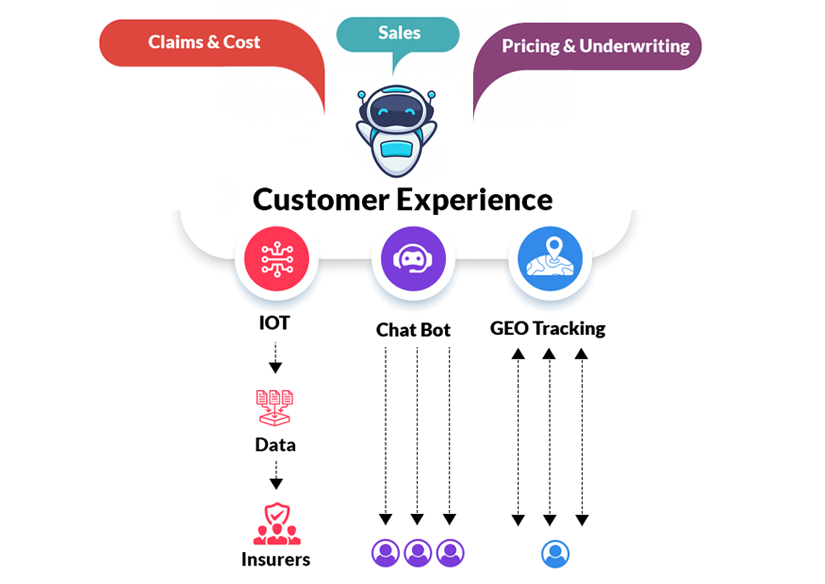

With the help of the IoT, more and more devices, such as cars, fitness trackers, home assistants, smartphones, and smart watches, are already interconnected. The list will continue to grow by adding clothing, eyewear, home appliances, medical devices, and shoes to it. According to an estimate, there will be up to one trillion connected devices by 2025.

The newly created data from these devices will help insurers understand their clients more deeply, resulting in accurate predictions and risk assessments.

5. Real-time data access

With these models, data is at your fingertips. You can have this data at any time to make a quick decision.

This will be made possible with the help of ubiquitous and open-source protocols that enable the data to be shared and used across industries. The public-private partnership will play a crucial role in creating ecosystems to share data for multiple use cases under a common regulatory and cybersecurity framework. As AI continues to evolve and infiltrate every aspect of our lives, the future of cybersecurity will undoubtedly be shaped by the insurance industry's need to protect this ever-growing pool of sensitive customer data.

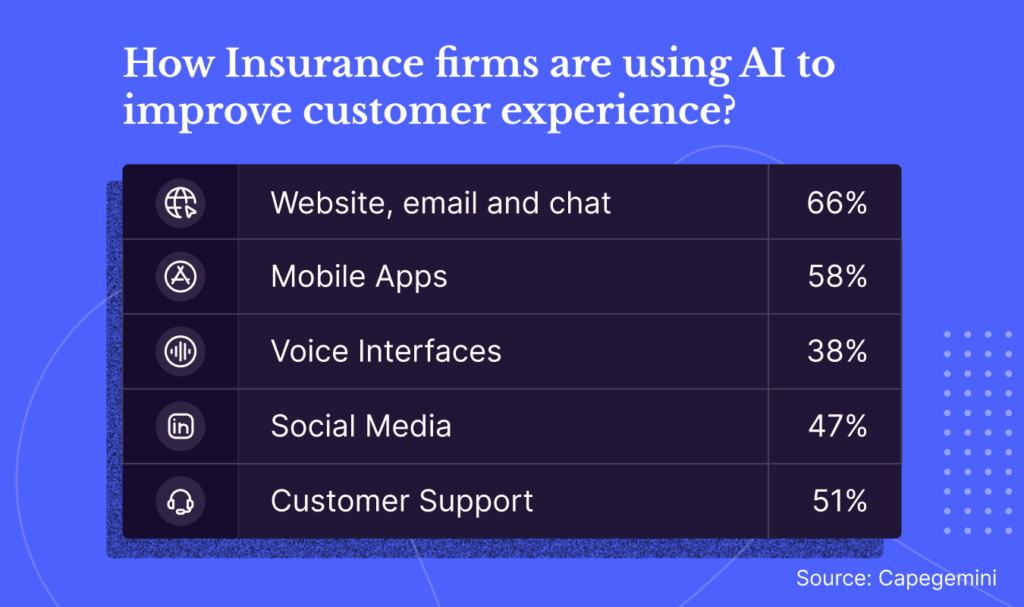

6. Enhanced customer satisfaction

Combining everything above, insurers will be able to provide a wonderful experience for their customers. According to a survey, 78% of customers expect and demand touchless interactions through voice assistants, facial recognition, or apps, to avoid human interactions and touchscreens.

Customers expect a quick turn-around time today. With the help of AI, underwriting is reduced to a few seconds as compared to several hours as done previously. The majority of underwriting will be automated, and supported by a combination of machine learning and deep learning models based on both internal data and a broad set of external data accessed through application programming interfaces and outside data and analytics providers.

Limitations Of AI Models For Underwriting

Despite offering all the above-mentioned advantages, AI comes with certain limitations. Here are some of the challenges when using AI for risk assessment:

Quality of data - Ask any data scientist, and they'll tell you how important quality of data is when it comes to training AI models. For example, train on the wrong or limited datasets, and you’d end up with the wrong outcomes.

Bias - AI models can sometimes be biased because of the limited data set they’re trained on, which can lead to unfair lending decisions.

Explainability - AI models aren’t exactly transparent as they don’t provide details on how they came up with a decision, which can make it difficult to trust them sometimes.

Cybersecurity - AI systems can be vulnerable to cyberattacks, which could lead to fraud or the theft of sensitive data.

Step-by-step Process To Prepare For AI As An Insurer

Here’s how you can get started on your journey to adopt AI in your underwriting process:-

Step 1 - Start with chatbots and intelligent assistants

As per Solera’s 2022 Innovation Index, 79% of the total “tech-savvy customers” surveyed said they would trust car insurance claims run entirely by AI. This includes receiving information, getting quotes, being verified, being notified, and getting the risk resolved. It suggests that automating repetitive tasks is essential to surviving as an insurer in 2023.

Step 2 - Ensure data security and privacy

Privacy and data security are essential when it comes to insurers. Ensure that you comply with GDPR regulations. Currently, there is nothing similar in place to grapple with the raft of ethical challenges presented by this rapid rate of AI innovation. The EU AI Act, first proposed in 2021 and expected to pass in 2024, is likely to be the world’s first international regulation for AI.

Step 3 - On-board all employees and train for the change

Having AI in your system is not enough; have a plan in place to train your employees. This plan should address all four dimensions involved in any large-scale, analytics-based initiative - data capability, organization and talent, models and tools, and change management.

Step 4 - Have an open, research-oriented environment

The next generation of successful frontline insurance workers will be in increasingly high demand and must possess a unique mix of being technologically adept, creative, and willing to work at something that will not be a static process but rather a mix of semi-automated and machine-supported tasks that continually evolve.

Conclusion

Summing up, insurers that adopt a mindset focused on creating opportunities from disruptive technologies instead of viewing them as a threat to their current business will thrive in the insurance industry in the coming years.