Blockchain Accounting Solutions: Ensuring Growth in Business Finance

In an era of digital transformation, emerging technologies continue to impact various industries, and one great example is blockchain, which promises to revolutionize the landscape of accounting and finance. If you want to learn more about the emergence of blockchain in accounting, its potential impacts on the business finance sector, the value it brings to finance and accounting operations, and the challenges it currently faces, read on.

Emergence of Blockchain Technology in Accounting

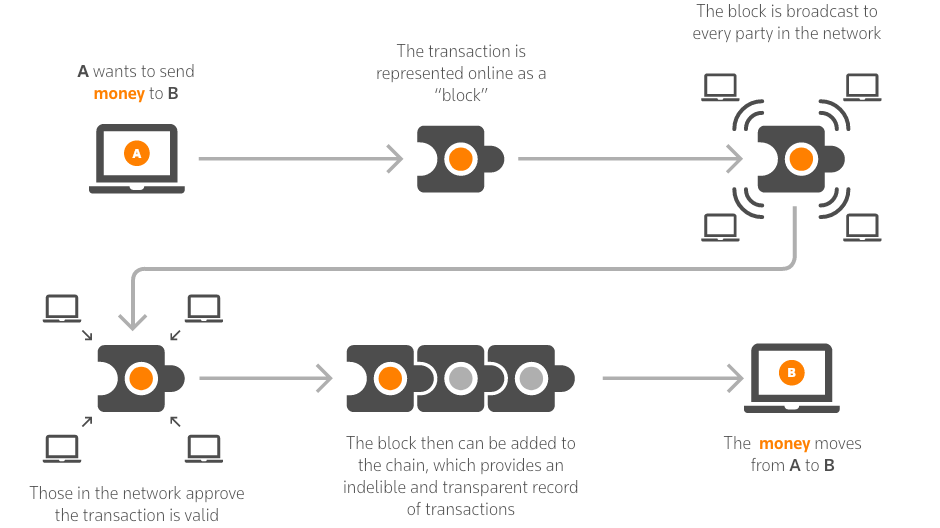

The emergence of blockchain in accounting is radically transforming the methods of recording and verifying financial transactions. It revolutionizes the traditional system by introducing a transparent, secure, and efficient process of handling financial data. Blockchain technology employs a network of computers, commonly referred to as nodes, to authenticate and record transactions in a sequential and overt manner.

This eliminates the requirement for intermediaries, thereby reducing the risks associated with fraud and manipulation. Furthermore, it facilitates real-time auditing, enabling businesses to monitor their financial activities more conveniently and adhere to regulations. Through its integration, the accounting industry is making a considerable shift towards enhancing transparency, security, and efficiency of financial transactions.

Impact of Blockchain on the Business Finance Sector

Discussing the influence of blockchain technology on the business finance sector, three essential elements surface: cost and security, automation, and speed of operations.

Cost & Security

Traditional accounting systems often incur extensive costs due to manual processes, multiple intermediaries, and human errors. Blockchain technology, however, presents a more economical alternative. By removing intermediaries and automating processes, blockchain accounting solutions can substantially lower costs linked to auditing, account reconciliation, and data entry.

Its decentralized nature guarantees improved security, unlike centralized systems, where a single point of failure could lead to data breaches or fraud. Blockchain technology provides a transparent and unalterable ledger, safeguarding against unauthorized access and modifications. Prioritizing cost-effective measures and security in implementing blockchain accounting solutions can revolutionize financial record management.

Automation

Blockchain accounting solutions help in automating processes, thereby enhancing operations and elevating efficiency. Traditional accounting necessitates prolonged manual data entry and reconciliation, which can be error-prone.With blockchain technology, these procedures can be automated, excluding the requirement for manual intervention and increasing precision.

Smart contracts enable the execution of transactions automatically based on designated rules. They help eliminate intermediaries and reduce human error risk. Furthermore, they provide real-time visibility into financial data, supporting fast decision-making and improved financial governance. The auditing process also stands to gain from automation as all transactions are securely recorded on the blockchain, simplifying tracking and verification of financial information.

Speed of Operations

Blockchain technology facilitates a decentralized and secure network where transactions can be processed rapidly and efficiently. By automating tasks using blockchain, cumbersome manual processes, paperwork, and intermediaries can be skipped, resulting in quicker and more seamless operations. Real-time verification and recording of transactions is another advantage of using blockchain, minimizing the time needed for task completion and enhancing overall productivity.

Cultivating Value through Digital Tools in F&A

Navigating through today's fast-paced business environment necessitates embracing digital solutions capable of enhancing the efficiency and effectiveness of F&A operations. The incorporation of digital tools such as automation, artificial intelligence, and blockchain technology can streamline processes, mitigate errors, and provide real-time insights into financial data.

Automation: Helps eliminate repetitive tasks, allowing the workforce to devote time to strategic initiatives.

Artificial intelligence's: Ability to analyze vast amounts of data can aid in making informed decisions.

Blockchain technology: With its distributed ledger system, assures transparency, immutability, and security of financial transactions.By harnessing these digital tools, finance and accounting processes can be optimized, accuracy can be enhanced, costs can be reduced, and the utmost value of business can be maximized.

By harnessing these digital tools, finance and accounting processes can be optimized, accuracy can be enhanced, costs can be reduced, and the utmost value of business can be maximized.

The use of appropriate tools to manage accounting projects is crucial for leveraging the full potential of blockchain technology. These tools can streamline workflows, improve collaboration, and enhance overall project efficiency."

Current Challenges in Adopting the Blockchain Technology in Finance

Blockchain technology, despite its potential for revolutionizing the finance sector, faces several challenges in its adoption. These issues need to be addressed for widespread adoption and effective utilization of this emerging technology.

Regulatory Uncertainty

Blockchain operates in a largely unregulated environment. The lack of clear regulations and standards creates uncertainty and could potentially inhibit companies from investing in blockchain. Changes in regulations across different jurisdictions also pose a challenge to its global adoption.

Interoperability

Different blockchain platforms often do not interact seamlessly with one another, leading to problems in cross-functional operations. Hence, the lack of interoperability hinders the integration of blockchain into existing financial systems.

Scalability

As transactions increase, blockchain networks often face speed and efficiency issues, known as scalability problems. Dealing with a high volume of transactions while maintaining accuracy and speed is a significant challenge.

Security

Despite being presented as highly secure, blockchain networks are not completely invulnerable. High-profile hacking incidents have raised concerns about the security of blockchain technology.

Public Perception and Trust

Misunderstandings of blockchain technology and its association with cryptocurrencies, such as Bitcoin, have led to public skepticism. Building trust in this new technology is crucial for its widespread adoption.

Lack of Technical Expertise

The sophisticated nature of blockchain technology means individuals with specialized knowledge and skills are needed. Currently, there is a shortage of such professionals, which can slow down the process of implementing and maintaining blockchain systems. These challenges present substantial barriers to the adoption of blockchain in the finance sector. However, as custom blockchain software development will continue, solutions to these issues are likely to emerge, paving the way for the extensive adoption of blockchain technology in finance.

Conclusion

While blockchain technology holds immense potential to transform the field of finance and accounting, it is important to navigate through the challenges for successful adoption. As industries continue to identify and address these challenges, the stage is set for an even more significant shift towards transparency, efficiency, and security in financial transactions. The effects of blockchain technology will undoubtedly shape the future of the financial sector, fostering a new paradigm in business finance.