Capital markets are experiencing a significant upheaval due to the unrelenting growth of technology. Financial institutions are adopting new solutions that change how they operate, engage, and provide services. In this article, we look at how technology alters financial institutions in capital markets.

How Technology is Shaping Capital Markets Financial Institutions

Technology has become the backbone of contemporary financial institutions inside capital markets. Technology simplifies and optimizes many services, from front-end operations to back-office procedures. Routine operations are being revolutionized by automation, allowing institutions to manage enormous numbers of transactions with increased speed, accuracy, and cost-effectiveness. You can read more information by simply clicking on the link: https://www.luxoft.com/industries/capital-markets. Straight-through processing (STP) systems guarantee that transactions are executed seamlessly, eliminating human mistakes and increasing operational dependability.

New Technologies and Financial Innovation Trends

The financial environment constantly changes due to new technologies and innovative trends. Blockchain, or distributed ledger technology, has emerged as a disruptive force. Its decentralized and tamper-proof design improves transparency, security, and efficiency in capital market activities, including settlements and transaction confirmations. Cloud computing has transformed data storage and scalability, allowing institutions to safely and cost-effectively manage vast data.

Big data analytics and machine learning liberate valuable insights from massive data sets, allowing institutions to make educated judgments, analyze market trends, and develop individualized investment plans. RPA automates monotonous operations, enabling financial firms to redeploy their human resources to higher-value activities. These new technologies and trends alter financial innovation and increase capital market agility and competitiveness.

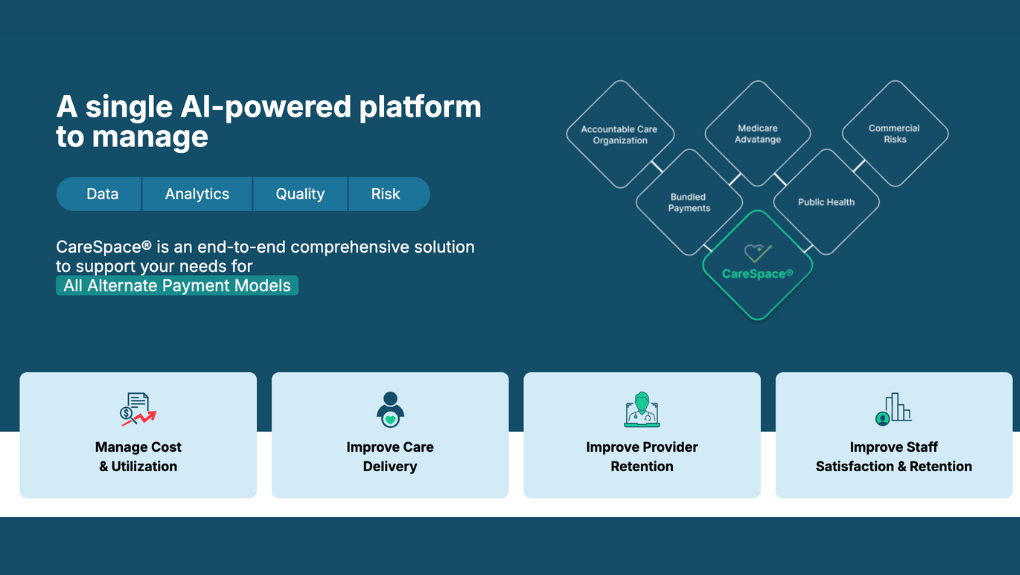

Artificial Intelligence in Capital Markets

AI is a game changer in capital markets, providing financial organizations with superior analytics and decision-making capabilities. AI systems analyze massive volumes of data in real-time, discovering patterns, market trends, and investment possibilities. AI-powered trading systems execute transactions quickly, employing machine learning models that constantly learn from market dynamics and optimize investing strategies. Furthermore, AI-powered risk management systems help institutions to detect and mitigate possible hazards more accurately and quickly.

Mobile Technology and Fintech Solutions in Capital Markets

Mobile technology and fintech solutions have revolutionized the customer experience in capital markets. Investors may use mobile applications and platforms to get real-time market data, portfolio management tools, and quick transaction execution. Fintech firms provide easy-to-use interfaces, streamlined account opening procedures, and tailored investment suggestions.

As part of this digital evolution, many investors also seek guidance from a certified financial advisor to make informed, tech-assisted investment decisions and long-term financial plans.

Mobile and fintech technologies enable financial institutions and their customers to communicate in real-time. Chatbots and virtual assistants give 24-hour service, answer questions, and provide personalized investing advice. AI algorithms are used by robo-advisors to assess investors' characteristics and preferences, resulting in automated investment recommendations and portfolio rebalancing.

Cybersecurity in the Age of Digital Finance

As financial institutions adopt digital finance, a topic explored by many finance blogs, it is critical to have adequate cybersecurity safeguards The linked structure of financial markets and the increase in online transactions create significant hurdles in securing sensitive data and combating cyber attacks. To guard against unwanted access and data breaches, institutions must invest in sophisticated cybersecurity technology such as encryption, multi factor authentication, and intrusion detection systems. Regular security audits, personnel training programs, and proactive threat information collecting are essential for ensuring a safe digital environment in the financial markets.

Conclusion

Technology is transforming financial institutions and capital markets, ushering in a new age of efficiency, agility, and customer-centricity. Each aspect is crucial in transforming the environment from artificial intelligence to new technologies, consumer experience to cybersecurity. Financial institutions may unleash new possibilities, improve risk management, and deliver seamless experiences for investors by adopting technology innovations.