Imagine if your ideal clients could easily discover your financial services brand while browsing online or navigating their day.

What if we told you that with a few simple strategies, you can do just that?

Let’s take a closer look at how to make it effortless for your target market to find you and reach out when they’re ready.

What are lead generation strategies for financial services?

Lead generation strategies for financial services involve using tactics to attract and convert potential clients. These include targeted content marketing, SEO, paid ads, and referral programs. The goal is to generate and capture high-quality leads interested in financial products or services.

Benefits of lead generation strategies for financial services

Some of the top benefits of using lead generation strategies as a financial service brand include:

Increased client acquisition

Attracting more qualified leads can help you grow your client base with people who are genuinely interested in your services. This boosts your chances of converting leads into customers.

Enhanced brand visibility

Targeted content and SEO help improve your brand’s visibility so it’s easier for potential clients to find and trust you. This also positions your firm as a key player in the market.

Improved ROI

Focusing on high-potential leads makes your marketing efforts more cost-effective.

Better customer insights

Collecting data on leads helps you understand their needs and preferences. Then, you can tailor your services and messaging to better meet their expectations.

Stronger customer relationships

Lead nurturing builds trust and rapport. By offering valuable content and personalized follow-ups, you can create a positive experience that encourages prospects to choose your services.

But which lead generation strategies should you use?

Read on to find out.

3 Effective lead generation strategies for financial services (with real brand examples)

When you’re in the financial service sector, you need to think about practical ways your ideal customer can come across your brand. (And give you their contact details.)

Why?

You’re competing in a crowded and highly competitive market. This means prospects need a good reason to enter your world. Trust is also a significant factor. Leads may be cautious or feel overwhelmed when encountering a financial services brand.

However, with the following three strategies, you can meet your ideal customers where they are, give them quick and easy ways to contact you, and help foster trust in your brand.

Get ready to bookmark these strategies! 📑

1. Target unique keywords based on your audience’s search intent

Create ad and SEO campaigns that highlight both your products’ unique benefits and your audience’s search intent.

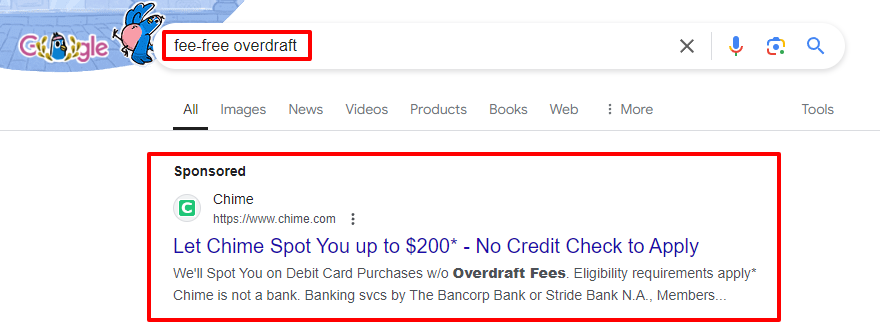

For example, Chime runs paid ads on Google and shows up in organic search engine results pages (SERP) for the key phrase “fee-free overdraft.” Fee-free overdrafts are a unique benefit the brand offers — and it’s also one of the top phrases its audience searches for.

In the image below, you’ll notice the financial services brand paid for the top sponsored position on Google for this term:

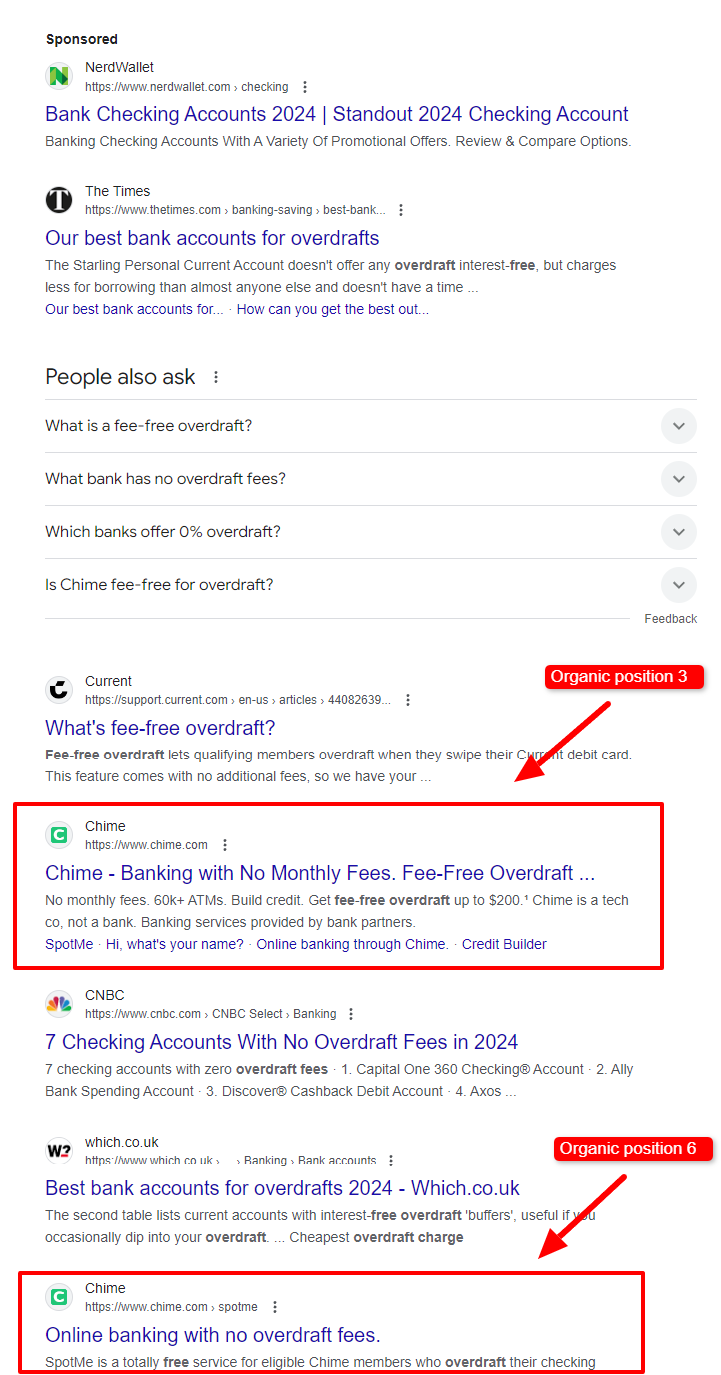

The brand also ranked in the third and sixth organic SERP positions on Google for the term.

In fact, no other financial services brand is mentioned as often for this keyword on SERP page one. This positions Chime as the top option for users looking for an online credit card for building credit with fee-free overdrafts.

The lesson here?

Repeated brand mentions on SERPs help build trust with your target audience. (Especially with new potential customers who’ve never heard of you.) Seeing your brand pop up in Google search results could convince a lead to sign up for your email updates — or even open an account.

How to follow suit:

Run paid ads that target unique benefits and keywords your audience searches for. Be sure also to build organic content around these keywords and integrate them naturally on your website and landing pages.

2. Encourage opt-ins and demos with calls-to-action buttons

Add plenty of call-to-action (CTA) buttons on your home page and relevant product pages. This benefits both you and website visitors.

It gives users quick and easy ways to get in touch with you and learn more about your products and services. It also helps you quickly capture their contact details to guide them through your funnel with lead nurturing campaigns.

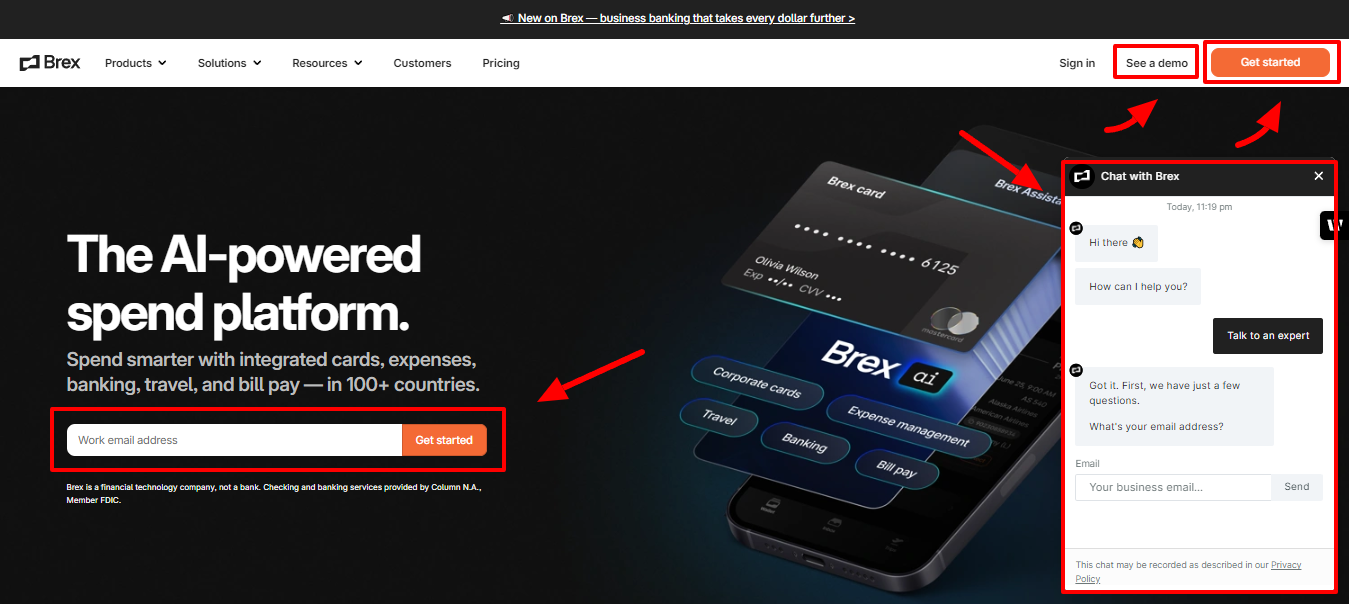

For example, Brex has the following four CTAs on its home page:

- “Chat with Brex” at the bottom right to help users access its chatbot

The bot also asks for the user’s email address

- “See a demo” at the top right to help users book demos

- “Get started” at the top right to help users sign up

- “Get started” above the fold to help users sign up

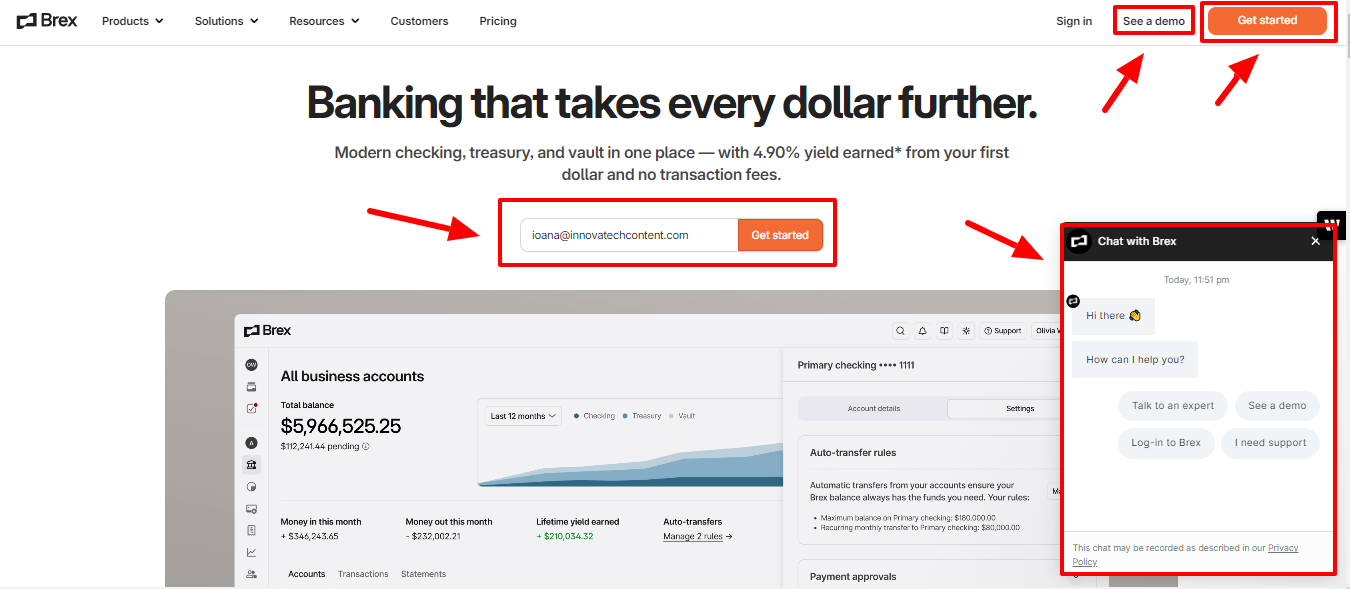

Brex has also included the same CTAs on relevant product pages, like its business bank account product page:

But it doesn’t just rely on its CTA buttons. It also showcases how its products cater to its target customers’ core needs. It emphasizes its high business checking account interest rates, spending automation, and vault with enterprise-grade security.

This gives users even more reasons to reach out to them or give one of their products a try.

The lesson here?

Adding CTAs to your web pages encourages prospective clients to give you their contact details and try your products. Including benefits language and features your ideal customer craves also gives them more reasons to click one of your CTA buttons.

How to follow suit:

Add short, action-focused CTAs on your home, product, and landing pages. Give users several options, such as signing up for your email newsletter, booking a demo, chatting with an agent, or starting a new account. If they’re the right fit, they’re bound to pick one of them!

3. Capitalize on your customers’ network with referral campaigns

Give your existing customers a good reason to refer your financial institution to others.

And what better way to entice them than by offering free money? 😉💰

While you’ll need to factor in your return on investment (ROI) and choose your referral reward amounts strategically, this is one of the easiest ways you can generate not only leads — but actual customers. It also gives your current clients a reason to stay.

Some potential clients may still be on the fence when a friend sends them your referral campaign. But the free money may be enough to nudge them to at least sign up for your email updates. For other prospects, the opportunity to get free money will be enough of a reason for them to open an account.

For others, simply receiving recommendations from trustworthy friends may be enough of a nudge to try your products (no bonuses needed).

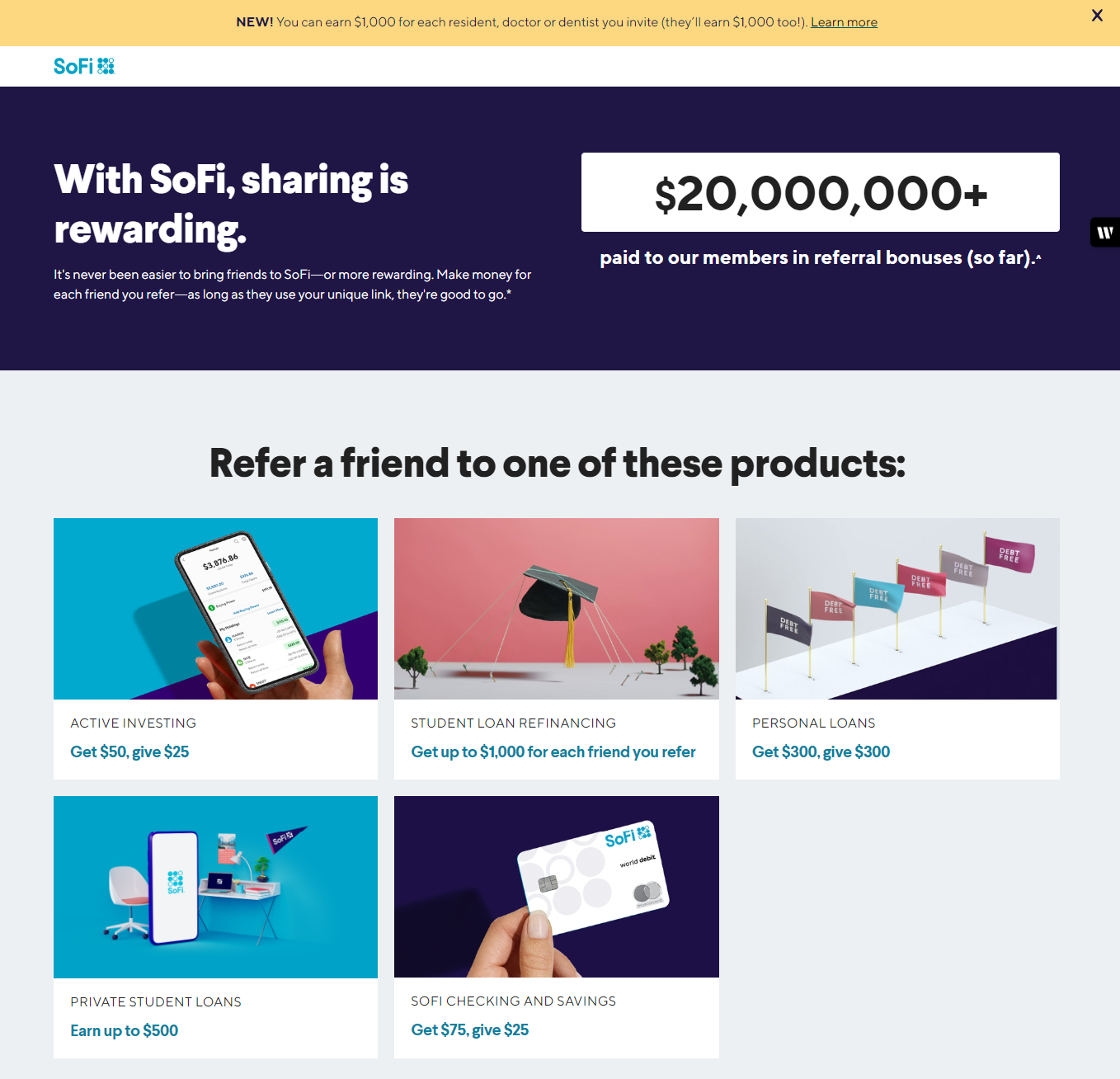

Get inspired by SoFi’s generous referral options.

The brand offers:

- Up to $1,000 for each friend for student loan refinancing referrals

- Get $50, give $25 for active investing product referrals

- Get $75, give $25 with checking and savings referrals

- Earn up to $500 with private student loan referrals

- Get $300, give $300 for personal loan referrals

In fact, it’s paid its members over $20,000,000 in referral bonuses so far.

The lesson here?

Referral programs can encourage campaign virality. This frenzy can help you grow your lead list, keep your existing customers, and encourage newbies to sign up. Referral campaigns may also help leads trust your brand more — especially if someone they trust sends over your offer or a link to your services.

How to follow suit:

Create referral programs that entice your existing customers to share your products with their friends, family, and colleagues. Add your referral programs to your website on a dedicated webpage and on your home page. Spread the word via email marketing campaigns, social media campaigns, and paid ads if the ROI makes sense.

Wrap up

Mastering lead generation in financial services requires strategic planning and cultivating trust. With targeted keywords, plenty of CTAs, and generous referral programs, you can attract and engage potential clients.

Ready to streamline your lead capture process? Check out customizable forms tailored for financial services at LeadGenApp.io.

Here’s to your success!

FAQs about crafting lead generation marketing strategies for financial service companies:

Why is lead generation important in the financial industry?

Lead generation is essential in financial services because it helps you reach the right audience, build trust, and convert prospects into loyal customers.

How can I improve my lead generation efforts?

To improve lead generation efforts, create educational content using a search engine optimization strategy, add effective calls to action across your online presence, and incentivize referrals.

What role does trust play in financial service lead generation?

Trust is critical in financial services. Clients need to feel confident in your brand before they engage with your products or services.

Can referral programs really increase lead generation?

Yes, referral programs can boost lead generation by leveraging your existing customers’ networks and offering them incentives to spread the word.