Form Templates › Finance Forms › All Form Styles

Finance Forms

- All Forms189

- Application Forms51

- Blog Forms5

- Briefing Forms20

- Calculator Forms17

- Conditional Logic Forms25

- Contact Forms48

- Data Collection Forms7

- Eligibility Forms5

- Feedback Forms8

- Intake Forms7

- Lead Capture Forms84

- Lead Qualification Forms38

- Referral Forms5

- Registration Forms17

- Request Forms10

- Solar Forms5

- All Forms189

- Automotive Forms14

- B2B Forms21

- Debt Forms10

- E-Commerce Forms8

- Finance Forms30

- Healthcare Forms17

- Insurance Forms12

- Marketing/ Digital Agency Forms26

- Mortgage Forms7

- Real Estate Forms27

- Recruitment Forms6

- SaaS Forms8

- Startup Forms2

- Training Forms8

- Travel Forms5

- Utilities Forms4

- Web Design Agency Forms22

Choose form style

Form Templates › Finance Forms › All Form Styles

Finance Forms

- Form Design ServiceBuild My Form

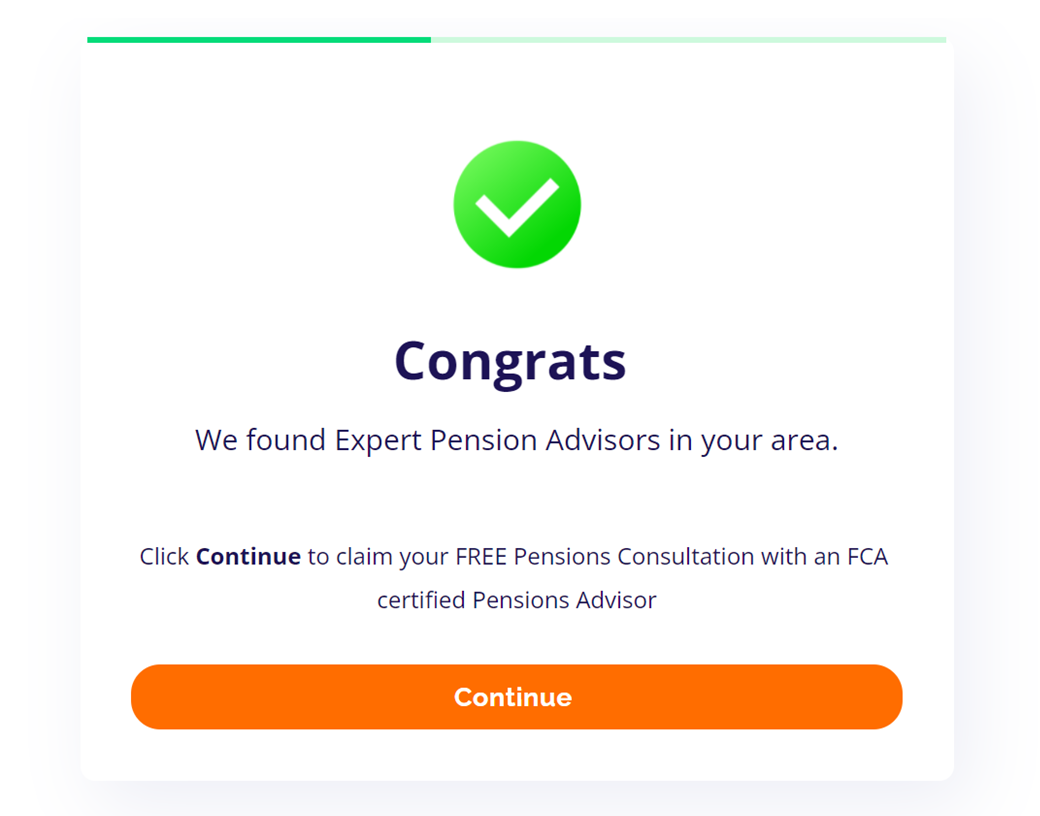

Pension Advisor Search Form

Pension Advisor Search Form

A Dynamic Pension Advisor Search Form is a type of online form that helps users find a suitable pension advisor based on their location and specific needs. The form typically asks for details such as the user’s location, the type of advice they are looking for, their age, their retirement goals, and any other relevant information.

Once the user submits the form, the system will generate a list of suitable advisors in the user’s area, along with their contact information and any other relevant details. This type of form is designed to help users make informed decisions about their pension planning and find an advisor who can provide them with the support and guidance they need.

A Dynamic Pension Advisor Search Form is a tool designed to help individuals find pension advisors that meet their specific needs. Users can input information such as their location, pension goals, and preferences for advisor experience and qualifications, and the form will generate a list of suitable pension advisors.

This type of form is typically used by people who are looking for professional advice on managing their retirement savings, and who want to make sure they find an advisor who is a good fit for their needs. Pension advisors and financial firms can also benefit from this type of form by using it to generate leads and connect with potential clients who are interested in their services.

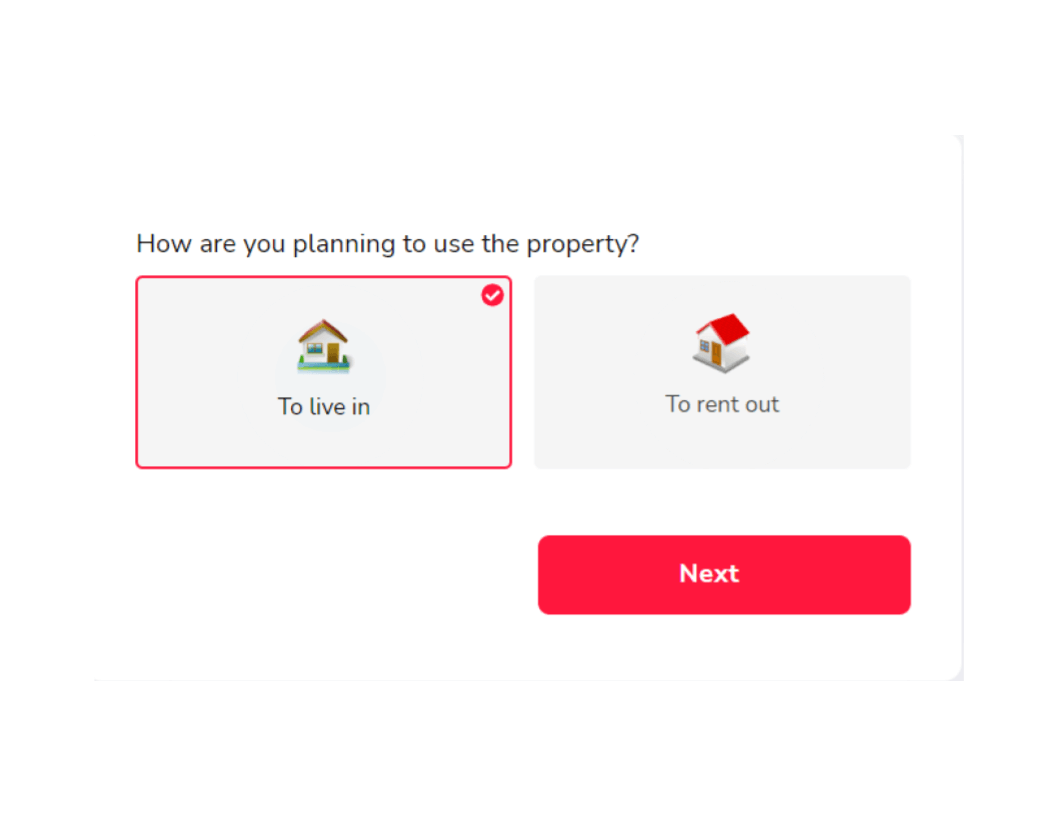

Remortgage Application Form

Remortgage Application Form

A Remortgage Application Form is a document that is used to apply for a new mortgage on a property that already has a mortgage on it. It is typically used to replace an existing mortgage with a new one, often to take advantage of a better interest rate or to release equity from the property.

The form will typically require information about the borrower’s income, employment, credit history, and details about the property in question. The lender will use this information to determine whether to approve the remortgage and under what terms.

A Remortgage Application Form is a form designed to gather information from individuals who are interested in refinancing their current mortgage. This form helps lenders to assess whether an applicant is eligible for a new mortgage with better terms, such as a lower interest rate, and to process their application.

People who are looking to refinance their current mortgage can benefit from a Remortgage Application Form, as it provides an easy and efficient way to apply for a new mortgage with potentially better terms. Lenders and mortgage brokers also benefit from this form as it allows them to gather important information about the applicant’s financial situation and credit history, which they can use to make an informed decision about whether to approve the application.

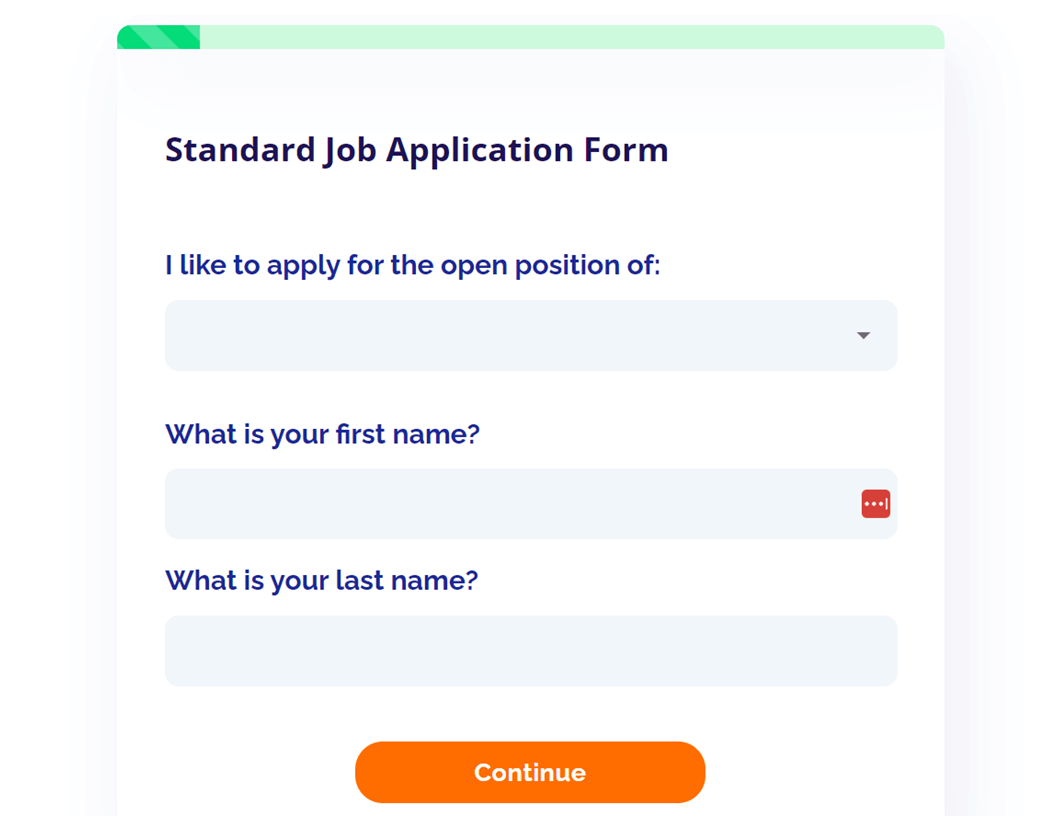

Standard Job Application Form

Standard Job Application Form

Our standard job application form provides information about a candidate’s background, skills, education, and work history. The form includes fields for personal information, employment history, education, references, and any other relevant information requested by the employer. Benefits of using a standard job application form include:

Consistency: Using a standard job application form ensures that all candidates provide the same information, making it easier to compare and assess applicants;

Efficient screening process: The standard job application form makes it easier for recruiters to quickly identify qualified candidates;

Legal compliance: The standard job application form helps employers comply with equal employment opportunity laws by avoiding questions that may discriminate against protected classes;

Organization: All candidate information is collected in one place, making it easier to keep track of and access when needed;

Time-saving: The standard job application form streamlines the recruitment process by eliminating the need for recruiters to create a new form for each job opening;

Overall, using a standard job application form can help make the recruitment process more efficient, organized, and legally compliant.

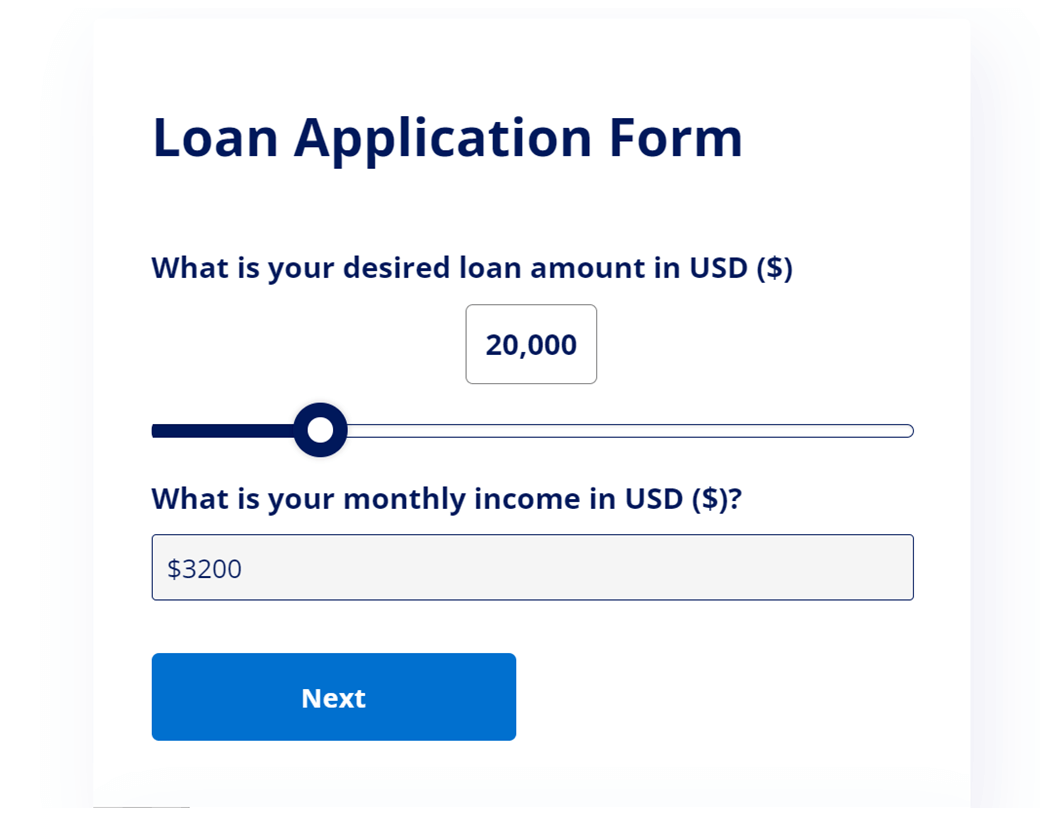

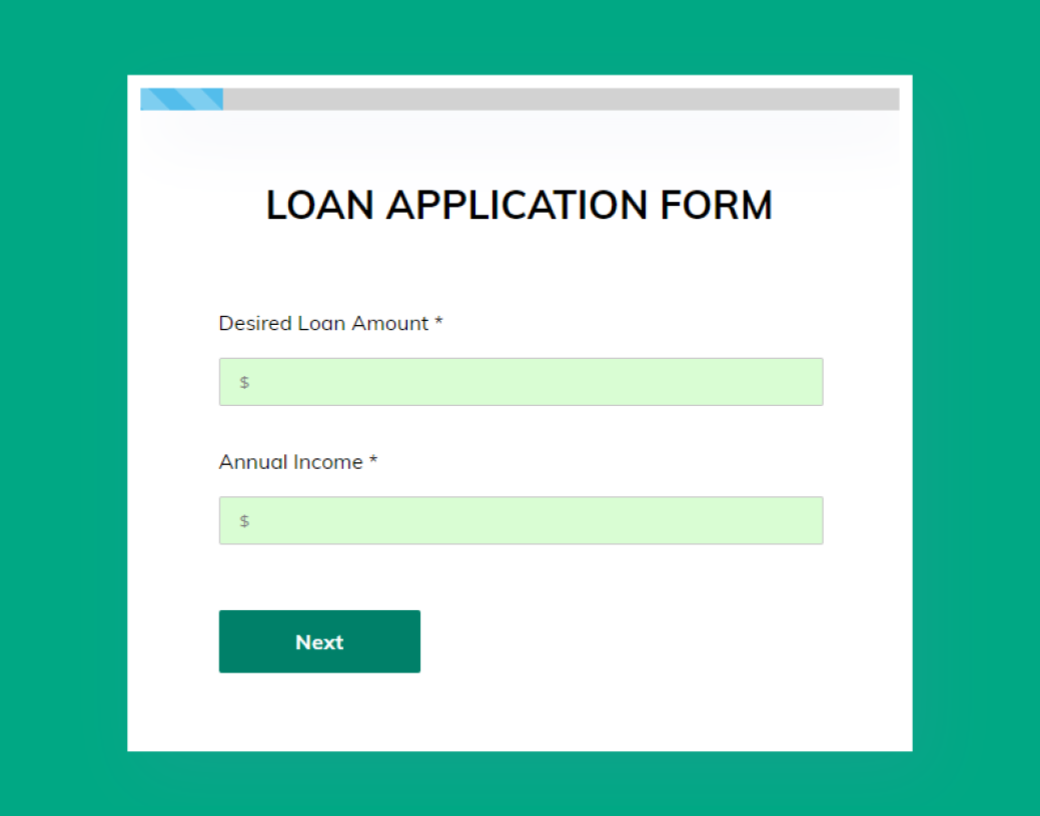

Simple Loan Application Form

Simple Loan Application Form

Simple Loan Application Form Template – Streamline Your Lending Process! Are you tired of manually collecting and organizing loan applications from potential borrowers? Look no further, our Simple Loan Application Form Template is here to simplify your lending process! With an intuitive and user-friendly design, our template allows you to gather all the necessary information from your borrowers in a streamlined and efficient manner. Benefits of using our Loan Application Form Template include: Customizable fields to fit the specific requirements of your lending business Electronic submission and storage of loan applications for easy tracking and management Secure and confidential handling of sensitive information Increased efficiency and productivity by automating the loan application process Whether you’re a bank, credit union, or private lender, our Simple Loan Application Form Template will streamline your lending process and provide a professional and organized experience for your borrowers. Try it out today and experience the difference!

Loan application form templates are used by individuals or organizations to collect information from prospective borrowers in order to assess their creditworthiness and determine whether to approve or deny their loan request. The template usually includes fields for personal and financial information, such as employment history, income, expenses, and debt obligations. This information is used to calculate the borrower’s debt-to-income ratio, credit score, and overall ability to repay the loan. The simple loan application form template serves as a standard way for loan providers to gather the information they need to make an informed lending decision.

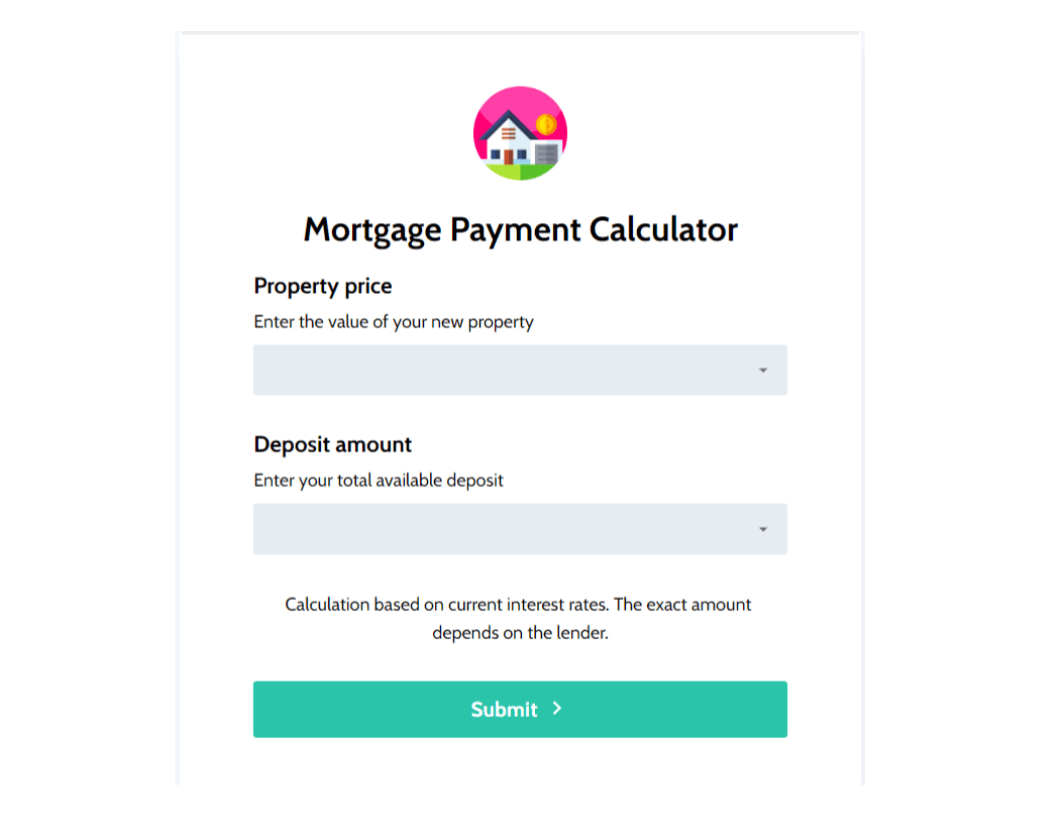

Mortgage Payment Calculator

Mortgage Payment Calculator

A Mortgage Payment Calculator form is an online tool that helps users estimate their mortgage payments based on various factors such as loan amount, interest rate, loan term, and down payment amount. The form typically requires the user to input information such as the loan amount, interest rate, loan term, and other relevant data, and then calculates the estimated monthly mortgage payment.

This type of form is often used by individuals who are considering buying a home and want to get a better understanding of the potential costs associated with a mortgage. Mortgage lenders and brokers may also offer this type of form on their websites as a tool to help potential clients.

A Mortgage Payment Calculator form is a tool that allows potential homebuyers to estimate the monthly mortgage payments they would need to make based on the loan amount, interest rate, and other factors. This form can benefit both homebuyers and mortgage lenders or brokers.

Homebuyers can use the calculator to get an idea of the affordability of a potential home, to compare different mortgage options, and to plan their monthly budgets. Lenders and brokers can use the form to attract potential customers and to provide an initial estimate of mortgage payments for prospective borrowers.

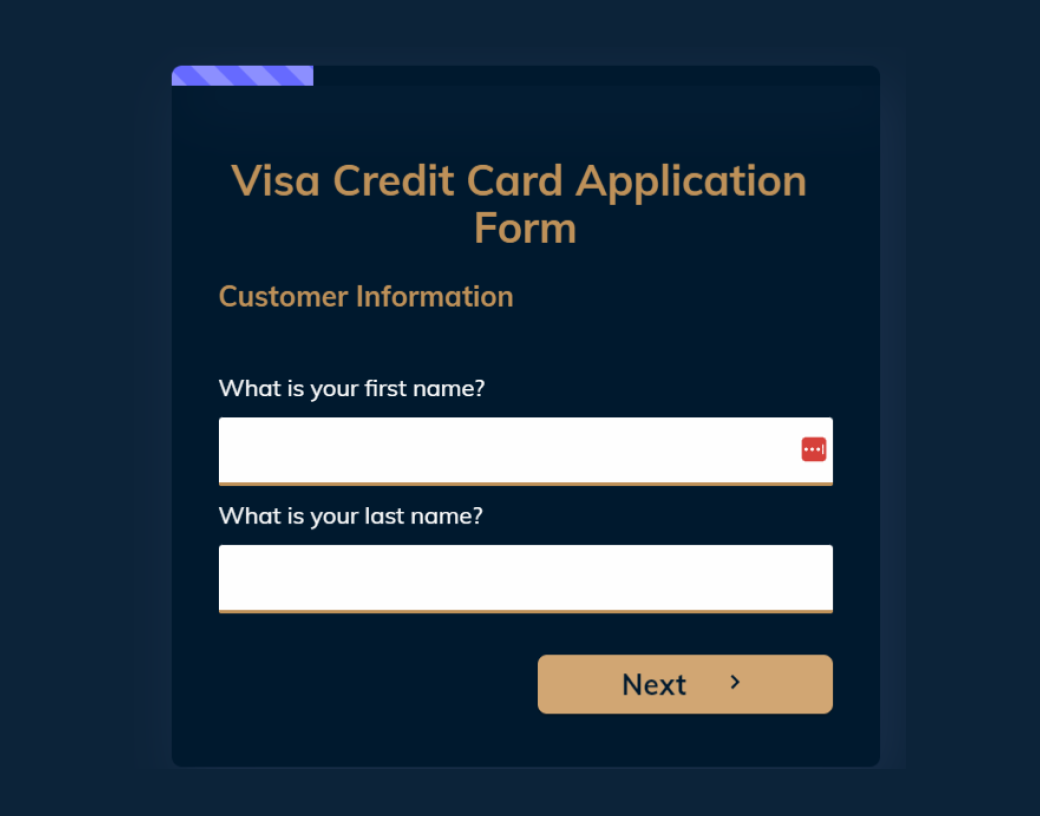

Visa Credit Card Application Form

Visa Credit Card Application Form

A Visa Credit Card Application Form is a document that individuals fill out when applying for a Visa credit card. The form typically includes personal information such as name, address, employment status, income, and credit history. The form may also require applicants to provide additional documentation such as proof of income, identification, and/or credit reports.

The information provided on the form is used by the credit card issuer to assess an individual’s creditworthiness and ability to make timely payments on the credit card. The credit card issuer benefits from this form by being able to make informed decisions about whether or not to approve an applicant for a credit card.

Applicants benefit from the form by being able to apply for a Visa credit card and potentially gain access to credit that can be used for purchases or emergencies. The Visa Credit Card Application Form is designed to collect information from individuals who wish to apply for a Visa credit card.

This form typically requests personal and financial information, such as the applicant’s name, address, income, employment status, and credit history. The credit card issuer benefits from this form by using the information collected to evaluate the applicant’s creditworthiness and determine if they are a suitable candidate for a Visa credit card. Applicants benefit by having a streamlined and organized process for applying for a credit card, and by potentially being approved for a credit card that can help them make purchases and build their credit history.

Student Loan Application Form

Student Loan Application Form

A student loan application form is a document used by students to apply for a loan to pay for their education expenses. The form typically includes fields for personal information such as name, address, and contact information, as well as information about the student’s education, such as the school they are attending, the field of study, and the expected graduation date.

The form may also include questions about the student’s income, assets, and credit history, as well as the loan amount they are requesting. The information gathered on the student loan application form is used by the lender to determine the student’s creditworthiness and ability to repay the loan. Student loan application forms can be completed online, in person, or over the phone, and are an important step in the student loan process.

Simple Loan Application Form

Simple Loan Application Form

A Simple Loan Application Form is a form used by borrowers to apply for a loan from a lender. It typically collects information such as the borrower’s personal information, income, employment status, loan amount, and desired loan terms. The lender uses the information provided in the form to evaluate the borrower’s creditworthiness and decide whether to approve the loan application.

The lender benefits from having a standardized form to collect all necessary information in one place, while the borrower benefits from being able to easily apply for a loan and receive a quick decision.

A Simple Loan Application Form is designed to collect basic information from a borrower who is interested in obtaining a loan. The form typically includes fields for personal and financial information, such as name, address, income, employment status, and desired loan amount.

The lender benefits from this form as it helps them to evaluate the creditworthiness of the borrower and determine if they meet the lender’s criteria for approval. The borrower benefits from this form by having a simple and easy way to apply for a loan, and by potentially receiving access to much-needed funds.

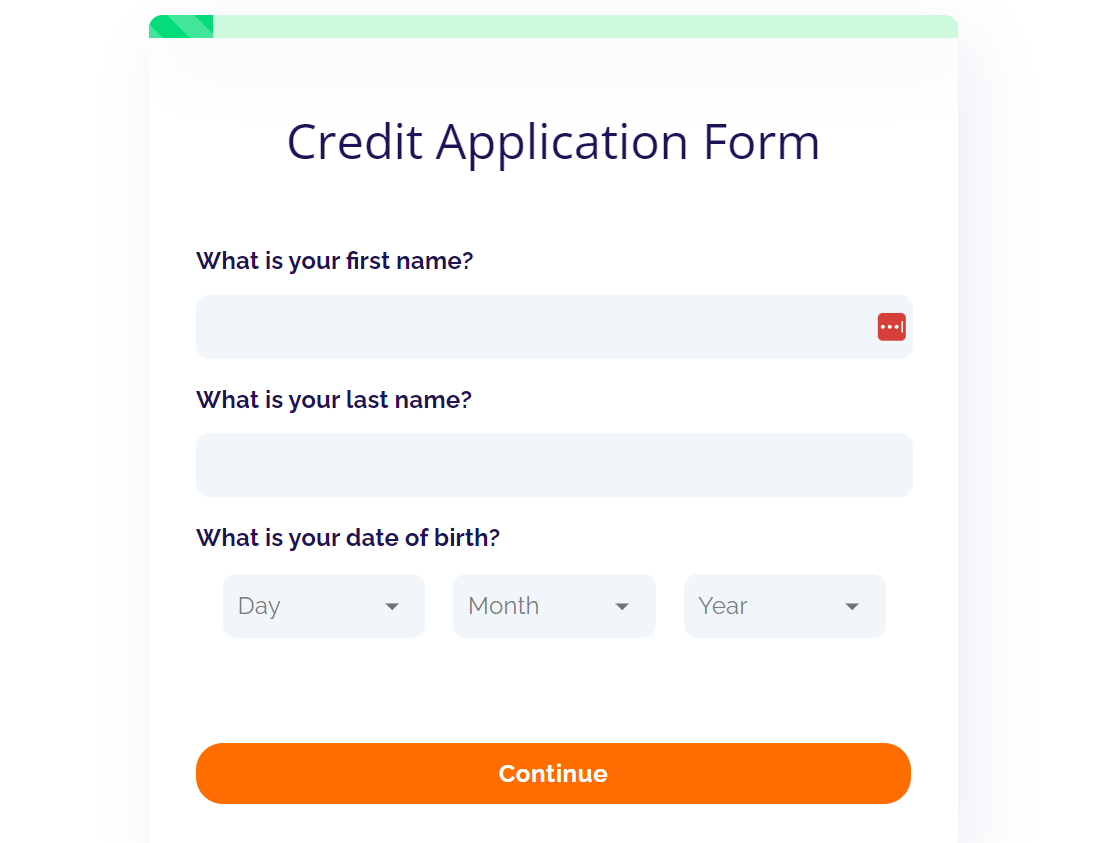

Credit Application Form

Credit Application Form

A Credit Application Form is a document used by individuals or businesses to apply for credit with a lender. It typically includes personal and financial information, such as income, employment history, and credit score, and is used by the lender to assess the applicant’s creditworthiness and determine whether to approve the credit application. The form may also include terms and conditions of the credit agreement, such as interest rates and payment schedules.

A Credit Application Form is a document used by lenders to gather information from potential borrowers applying for a loan or credit. The form typically asks for personal and financial information, such as income, employment status, and credit history, to help the lender assess the borrower’s creditworthiness and ability to repay the loan.

The Credit Application Form benefits both the lender and the borrower. The lender can use the information to evaluate the borrower’s creditworthiness and determine whether to approve or deny the application. The borrower benefits by having a clear understanding of the application requirements and the information needed to apply for the loan or credit. Additionally, filling out the form allows the borrower to organize their financial information and assess their own creditworthiness before applying for credit.

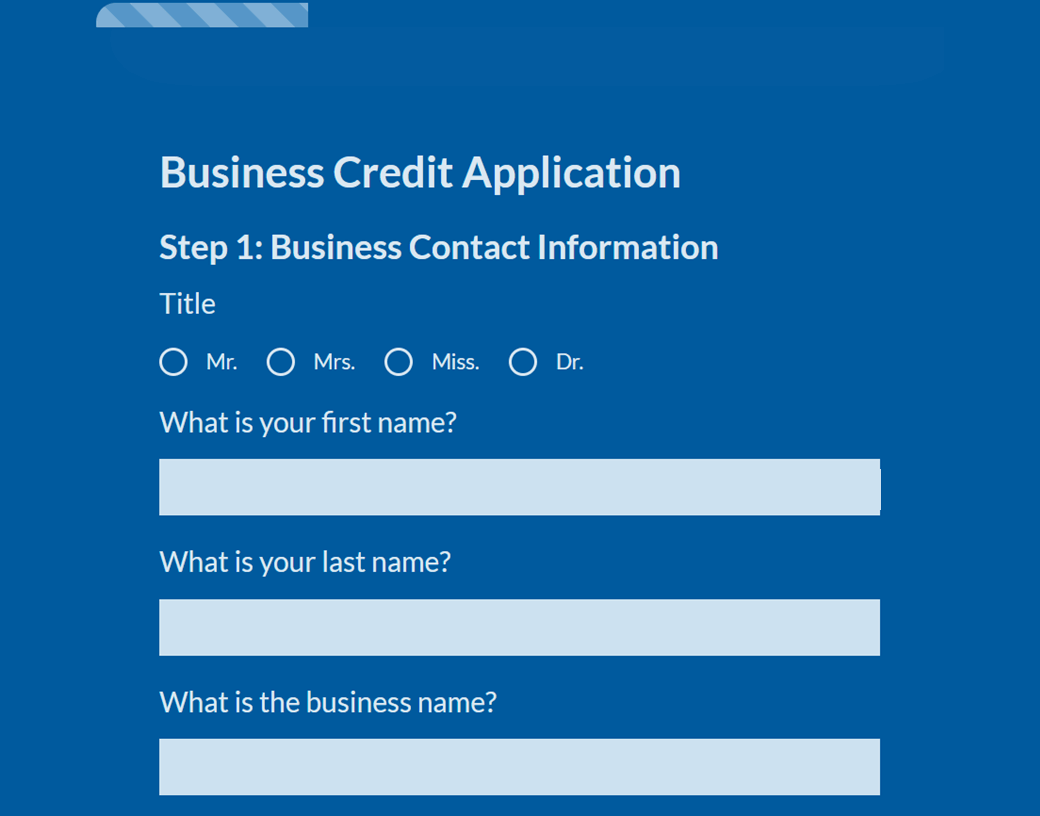

Business Credit Application Form

Business Credit Application Form

A business credit application form is used by companies to assess and approve the creditworthiness of their clients. It is typically used by suppliers, lenders, or credit providers to gather information about the potential borrower’s financial history, credit references, and business details. This form helps the lender make an informed decision on whether to extend credit to the business and determine the credit limit, interest rate, and repayment terms.

There are several benefits to using a business credit application form template:

- Standardization: A template ensures that all applicants are asked the same questions, allowing for consistent and fair assessment of their creditworthiness.

- Efficiency: Using a template streamlines the application process, reducing the time and effort required to gather information from applicants.

- Accuracy: The template provides a clear and comprehensive set of questions, helping to ensure that all relevant information is collected and reducing the risk of errors.

- Record keeping: A template provides a standardized record of the credit application, which can be easily stored and retrieved for future reference.

- Cost savings: Using a template eliminates the need to create a form from scratch, saving time and money on the design and printing of forms.

- Legal compliance: A template may include language that meets legal requirements and protects the interests of the lender or credit provider.

- Improved decision making: By gathering consistent and complete information from all applicants, a template can help lenders make more informed and confident credit decisions.

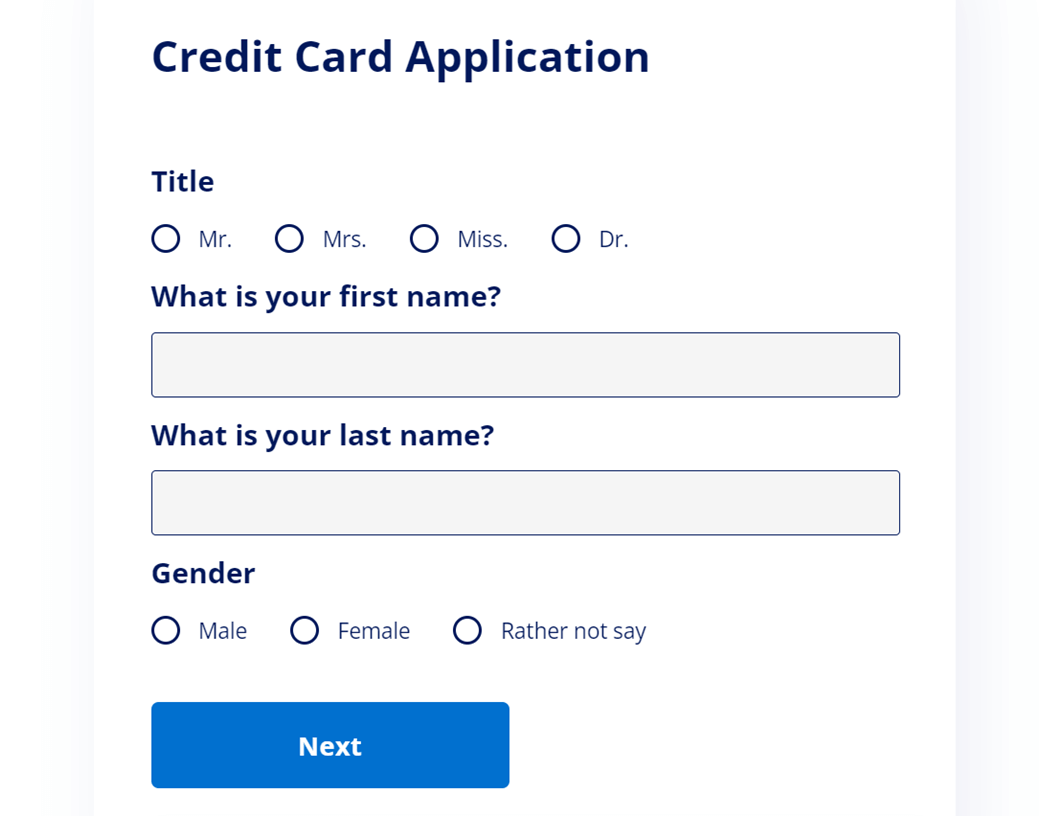

Credit Card Application Form

Credit Card Application Form

The generic credit card application form template is capable of gathering important information from potential credit card applicants. This information helps financial institutions and lending companies determine the applicant’s creditworthiness and ability to repay debt. The template can be used to gather information such as:

Personal information: name, address, date of birth, passport number, and contact information.

Employment and income: employment status, job title, employer name, and monthly income.

Financial history: credit score, debt, bill payment history, and other relevant financial information.

Credit card preferences: type of credit card requested, credit limit desired, and any additional features or benefits requested.

By gathering this information, the generic credit card application form template enables financial institutions to make informed decisions about granting credit to applicants. This helps to ensure that credit is granted to those who are most likely to repay it, thereby reducing the risk of default for the financial institution.

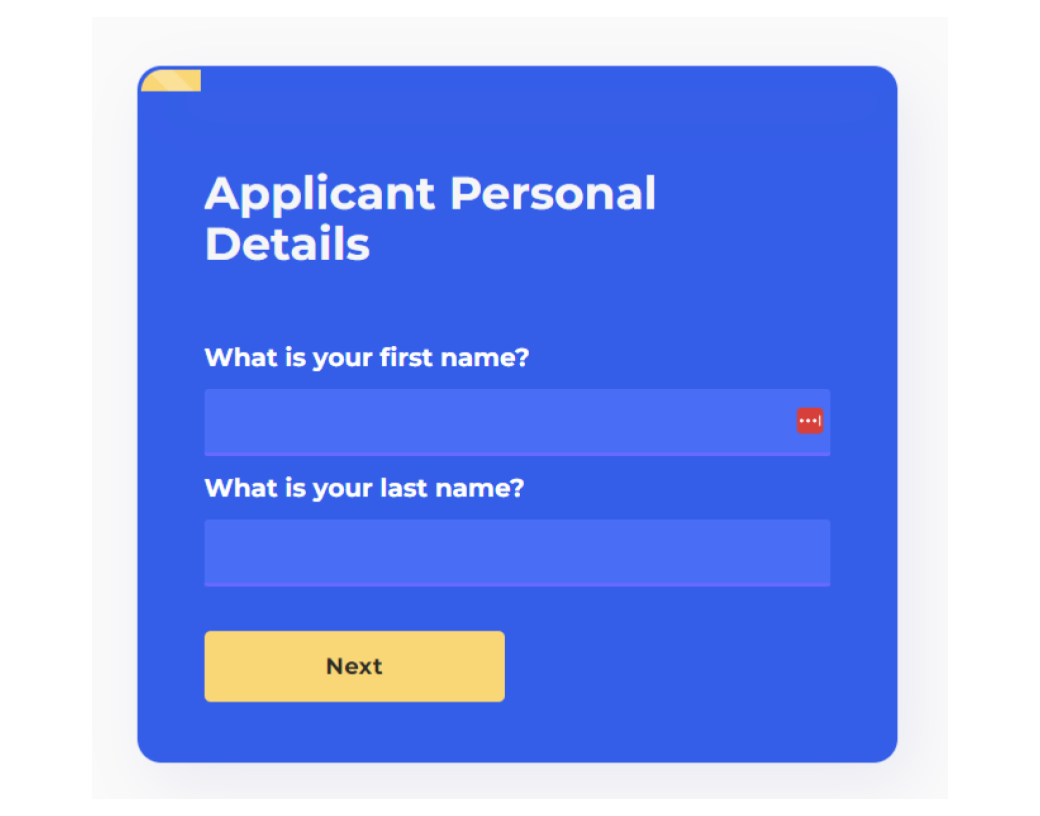

Personal Loan Application Form

Personal Loan Application Form

A Personal Loan Application Form is a document used by financial institutions to gather information from individuals who are applying for a personal loan. The form typically includes personal information such as the applicant’s name, contact information, income, and employment history.

It may also ask for information about the applicant’s credit score, current debts, and assets. The form may also include a section for the applicant to provide documentation such as proof of income, ID, and bank statements.

The Personal Loan Application Form is used by the financial institution to assess the applicant’s creditworthiness and to make a decision about whether to approve the loan. The form may also be used to collect a fee for the application process, and to provide the applicant with the terms and conditions of the loan.

Online personal loan application forms are becoming increasingly popular as they allow for faster and more efficient processing of applications and a more convenient way for borrowers to submit their application. It is important to make sure that the online form is secure and comply with laws and regulations for data protection and anti-discrimination.

The loan application form is an important step in the loan process. It provides the lender with the necessary information to determine the borrower’s creditworthiness and ability to repay the loan. The lender will use this information to decide whether or not to approve the loan, and if so, on what terms.