B2B Credit Application Forms: The Complete Guide

Most B2B enterprises run on credit, but this approach needs fixing. Granting loans by properly analyzing consumers' creditworthiness may be safe, particularly for midsized businesses. A mid-sized corporation, like an automobile, needs steady capital flow to function. A single overdue account might significantly reduce your cash flow. To mitigate risk, firms must thoroughly assess consumer credit applications. Credit application forms have evolved from paper to online forms, and many businesses now use automated credit application procedures to improve credit management.

Online business banking systems make the credit application process easier by offering safe and effective solutions for managing financial transactions and obtaining personalized financing choices. These systems allow businesses to easily monitor cash flow and submit loan applications, protecting data protection and expediting the process of obtaining the capital they require.

Continue reading to learn about the B2B credit application procedure, frequent problems, factors to examine before issuing credit, and more. You may also experiment with ready-made credit application templates to speed up the client onboarding process and consider using an automated credit application for your business.

What is the credit application form?

As the name indicates, a credit application form is a form that is filled out and completed by a business or a person who wants to apply for a line of credit with a lending institution. The information provided by the individual or business is then utilized to establish the borrower's credit history, job status, and ability to repay the loan.

The credit application form may also be used to offer credit to customers, allowing them to buy items on credit and repay them when they sell them. However, it is crucial to note that pursuing this road necessitates the development of a good credit application procedure to reduce the danger of bad debts and cash flow issues.

For business owners, establishing a strong credit history with a business credit builder can prove invaluable. This not only increases your chances of securing credit when needed but also enhances your business's credibility with lenders and suppliers.

A robust credit history can lead to lower interest rates, more favorable repayment terms, and higher borrowing limits, all of which contribute to the long-term financial health of your business.

What are credit applications for?

The fundamental goal of these credit applications is to collect relevant information from the client, allowing for an examination of their financials and determining the inherent risk involved with giving credit to that specific firm. Standard information in a B2B loan application includes the company name, address, kind of operations, duration of business activity, financial details such as revenue and cash flow, and credit references.

In certain situations, the B2B credit application may specify credit terms and conditions, such as payment deadlines, interest rates, and other fines or penalties.

Providing credit to commercial clients can benefit both your company and your consumers. It allows you to establish what may be a long-term and profitable connection, and it allows your consumer to purchase more from you through commercial debt. Yet, credit is a type of loan, and the money is not yours until it reaches your bank account.

A credit application form, although not eliminating risk, does give a way for risk mitigation. Instead, it creates ground rules between you (the seller) and your client (the buyer) so that both of you know what to anticipate. Finally, the credit application forms let you determine whether to grant credit and how much you're willing to give the buyer. These are three reasons why commercial credit application forms should be commonplace in the company.

1. If the customer defaults, give your company leverage

Defaults occur. Although you should not sign into an arrangement with a client thinking they would be unable to repay what they owe you, you should have a strategy in place to deal with the scenario if it does occur. You have the option to pick how you wish to settle outstanding debt, allowing you to do what is best for the firm. Use an arbitration provision, for example, to avoid costly lawsuits. Include conditions such as collection costs and attorney's fees that the consumer will be required to pay if they fail on the loan.

2. Collect Information About Your Clients

The credit application form is an excellent approach to getting vital information about your consumers, especially if you have yet to establish a connection with them. This information will assist you in determining how much credit to extend. Basic information like physical and mailing addresses, owners and their representatives, bank names and account numbers, and trade references should be included in the application form.

This information should be in your client database, and it will assist you in doing commercial background checks to determine how much credit you are willing to extend to them.

3. Defend Your Company From Danger

Providing credit to a consumer includes some risk, but you may safeguard your business by thoroughly screening prospective customers. You could contact such merchants if you asked for trade references on the application. Inquire about the customer's payment history, particularly whether there are times of the year when they are more prone to be late.

Check with the bank that they have an account and that it is active. Examine internet reviews to see what others have to say about the company's dependability. Your consumers are an important element of your company. By requiring a business credit application form, you can protect the firm and your connection with them.

What is a business credit application form?

A business credit application is a formal document that a firm provides to a creditor when applying for a line of credit. This program gives critical information about the firm and its finances, allowing the creditor to assess the company's creditworthiness and capacity to repay the loan.

Essential elements to be included in a B2B credit application forms

A well-written credit application should be one of the pillars of any credit professional's credit extension strategy. Properly built and performed, it can:

- Assist in the choice to give credit to prospective consumers.

- Serve as a point of contact for obtaining information in the case of nonpayment.

- If litigation is required, the document can be used to enforce its terms.

Any financially stable buyer with a strong credit history should have no problem completing an application. If someone objects, it should indicate that something is wrong: either the buyer is already dealing with his financial means or he has something more to hide. If a potential consumer refuses to buy from you because you require a credit application, the deal is generally doomed to fail anyhow. So, even in this scenario, requiring a credit application assisted you in making a solid credit selection by eliminating a potential poor debt issue.

Elements we recommend be included in a thorough credit application:

All logistical and legal information about the customer, including their exact legal corporate name, legal status (i.e., corporation, partnership, LLC, etc.), relevant state or national identification numbers, the names of all principals or corporate officers, and, of course, the place of incorporation, address, phone, and fax numbers.

This complete profile can assist you in locating an elusive consumer in the case of nonpayment. The precise legal standing of the company is critical in terms of future collections. For example, if the firm is a corporation, you cannot attach the owner's assets unless you have a written personal guarantee.

- Date of application: Specifying the date is critical for determining when the agreement begins.

- Bank account details: In case you receive a judgment and need to attach company assets.

- Trade references: Ideally from your own business. Provides information about the company's payment history and relationships with other suppliers or vendors, showing trustworthiness and dependability.

- Names and contact information for current or former trading partners.

- Duration of the relationship.

- Payment history and credit conditions.

Unfortunately, customers generally only submit "good" references. Nonetheless, you should review the ones listed on the credit application. Use another source, if feasible, such as an industry credit group.

- Personal guarantee from the major shareholder: Recommended for any new client with less than 5 years of company or new overseas customers for whom you cannot access substantial credit information and references. Make sure to obtain the guarantor's home address, tax identification number, or Social Security number (in the United States), and comparable information from overseas consumers.

A shocking amount of firms fail during their first five years of existence, and it might be difficult to collect credit information on new international consumers. As a result, every firm that fits these qualities should be compelled to provide a Personal Guarantee under a strict credit policy.

The Personal Guarantee provides additional safety for you. If the purchasing firm is unable to pay your account, a Personal Guarantee allows you to collect funds from the shareholder's personal assets. Understand, however, that it is only as good as the guarantor's financial value.

Take notice of the section under "For Proprietors, Partners, and S-Corporations" on the Credit Application Form. Take notice of the second-to-last language in the Personal Guarantee, which reads: "I authorize the seller and their assigns to obtain a consumer credit report and contact my references as necessary."

You might ask why these stipulations appear on a commercial loan application.

The United States Fair Credit Reporting Act (FCRA) requires dealers to seek explicit written consent from customers before acquiring a consumer credit report.

When the buyer is a proprietor, partnership, or s-corporation, sellers in the US business sector have consistently relied on consumer credit reports since, in these cases, the individual's creditworthiness, not the company's, is being assessed for trade credit.

- Terms & Conditions: If the account ends up in court, you must demonstrate that the buyer was fully aware of the terms and circumstances of the sale. In the absence of a formal contract of sale, a signed credit application including this information serves as evidence.

- Arbitration clause: Include an arbitration provision in your credit application to get a tactical edge over the debtor. It allows you to define the jurisdictional location and manner of recovery when your client operates in a market where a credit application is not a recognizable or legally binding document. Arbitration is also often speedier and less expensive than filing a case, particularly in a foreign nation.

- Financial information: Evaluate the company's financial health and stability, including its capacity to produce income, manage costs, and meet financial commitments.

- Annual revenue.

- Profitable margins.

- Cash flow statements.

- Balance sheets.

- Income Statements.

- Financial predictions (if applicable).

Bank References

They used to be required for a trade credit application, but unless the client files them alongside the application, you'll need a signed agreement to check the bank's reference. According to Jocelyn Sharrar, a Trade Credit Consultant at Dun & Bradstreet, some applicants are having difficulty getting banks to submit financial statements owing to privacy issues, and can't rely on being able to gather that information.

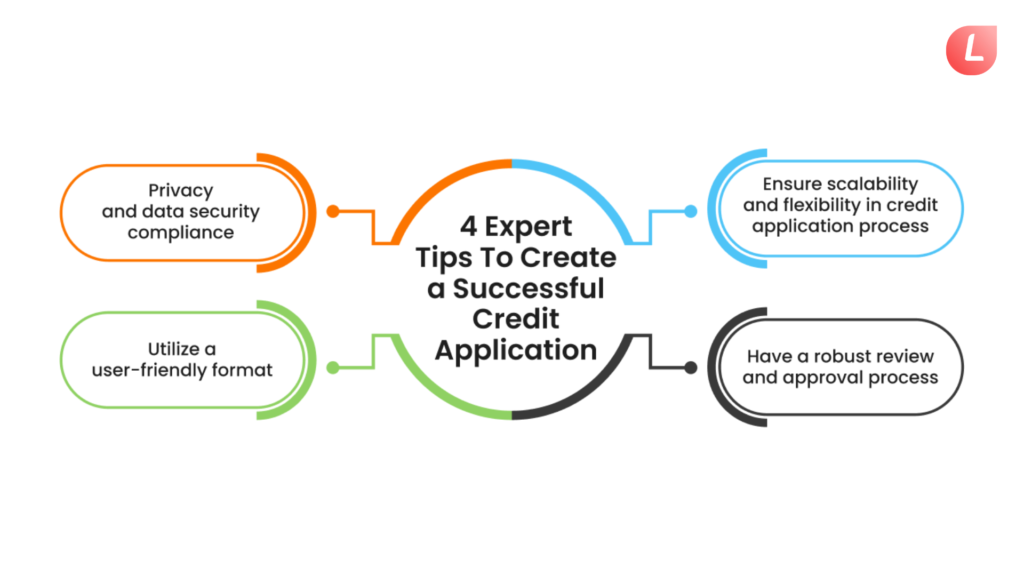

Expert tips to create a successful credit application form

There is nothing better than firsthand experience to back up your company finance application. So, we've compiled a list of professional advice to help you have the finest credit application procedure for your business.

Ensure scalability and flexibility in the credit application procedure: Create the application to support prospective expansion or changes in the company's demands over time. This enables the application to accommodate any changes or developments in the firm, ensuring that the loan arrangement is appropriate and sustainable over time.

Privacy and data security compliance: Ensure adherence to data protection rules and the security of sensitive information given by the organization. This displays the creditor's dedication to maintaining the confidentiality and security of the applicant's sensitive information, fostering confidence, and adhering to data protection standards.

Establish a comprehensive review and approval process: Outline the actions required in examining and approving the credit application, including projected timescales and contact information for updates or queries. This establishes expectations for the stages involved in analyzing the application, ensuring openness and accountability during the decision-making process.

Use a user-friendly structure: To make it easier for the applicant to complete the application, present it in a clear, organized, and understandable way. This improves the applicant experience by displaying information in a clear and structured style, minimizing misunderstandings and speeding up the application process.

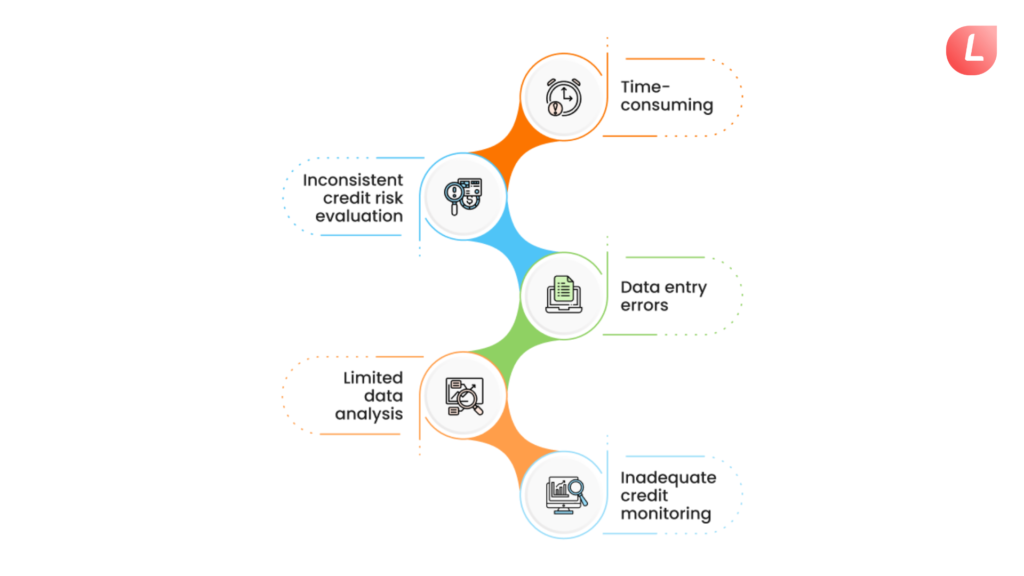

Challenges with the paper credit application form

The world is changing swiftly nowadays, which means we must constantly evolve our procedures to more efficient approaches if we are to keep up.

Document management and verification are major problems during the loan application process. The intricacy of analyzing several financial records and references might cause delays and mistakes in decision-making. This difficulty becomes especially acute when dealing with a significant volume of credit applications. Here are a few important challenges:

Inconsistent credit risk evaluation: Manual methods might result in inconsistent credit application assessments since various credit analysts may use different criteria or prioritize elements differently. This can lead to prejudice and incorrect credit choices.

Time-consuming: Manual credit application processes can be time-consuming, especially if businesses must manage a significant number of applications. This might cause delays in credit approvals, affecting corporate operations and customer relationships.

Limited data analysis: Manual methods might restrict the amount of data analysis that can be completed because analysts may not have access to all of the necessary information or the tools or resources to correctly evaluate data.

Data entry errors: Manual data input can lead to mistakes like typos and transposed numbers, which can influence credit decisions. Correcting these inaccuracies might take time and cause credit decisions to be delayed.

Inadequate credit monitoring: Manual application processes make it difficult to adequately manage credit risk since analysts may not have timely access to information regarding changes in a customer's credit profile or payment history. This can result in missed chances to identify possible credit issues early on and implement risk-mitigation actions.

These issues can lead to erroneous credit choices, delays in credit decisions, and higher credit risk. Amidst these hurdles, the necessity for a simplified and automated credit application procedure becomes clear. Transitioning to an automated digital transformation solution might help B2B businesses overcome these challenges and improve their credit risk management methods.

The power of automation in business credit application form

Automation in the credit application process refers to the use of technology and software systems to streamline and speed up the many steps of evaluating, authorizing, and managing credit applications. This automation comprises using advanced algorithms, data analysis, and digital workflows to replace manual chores and decision-making processes that were previously conducted by humans. The use of automation in credit application processing benefits both creditors and applicants by modernizing the efficiency, accuracy, and overall efficacy of the credit approval process.

Benefits of a digital credit application form

Automating the credit application process provides several benefits to both creditors and applicants. Let's go exploring.

Improved accuracy: Automated solutions provide consistent data collection, validation, and analysis, reducing mistakes and inconsistencies in application information. This results in more accurate credit determinations while lowering the likelihood of fraudulent or incomplete applications.

Enhanced efficiency: Automation simplifies the credit application process by decreasing manual chores, paperwork, and processing time.

Improved customer experience: Automation improves the client experience by allowing for faster response times and more transparent communication throughout the application process. This improves client satisfaction and loyalty, resulting in beneficial connections between creditors and applicants.

Cost savings: Automated credit application processes save creditors money because they eliminate manual labor and administrative expenses. They use fewer resources to handle and process applications, resulting in greater operational efficiency and lower overhead expenses.

Improves regulatory compliance: Automated credit application systems can include regulatory requirements and compliance checks into the application process, assuring compliance with legal and industry standards. This lowers the risk of noncompliance fines while improving regulatory supervision and reporting capabilities.

Increase in scalability: Automated systems are scalable and can process a high number of credit applications without losing speed or accuracy. This scalability enables creditors to easily handle fluctuating application volumes and accommodate corporate expansion without putting additional load on resources.

Effortless integration: Automated credit application systems can work with other corporate systems including CRM software, accounting systems, and loan origination platforms. This interface offers easy data interchange and process coordination, hence increasing overall operational efficiency and cooperation.

Access to data analysis and insights: Automated systems extract important information and insights from credit application data, such as trends, patterns, and performance indicators. This data may be utilized to optimize operations, identify areas for improvement, and make strategic decisions that will promote corporate success.

Using technology to automate and enhance credit application procedures may help creditors increase productivity, profitability, and market competitiveness.

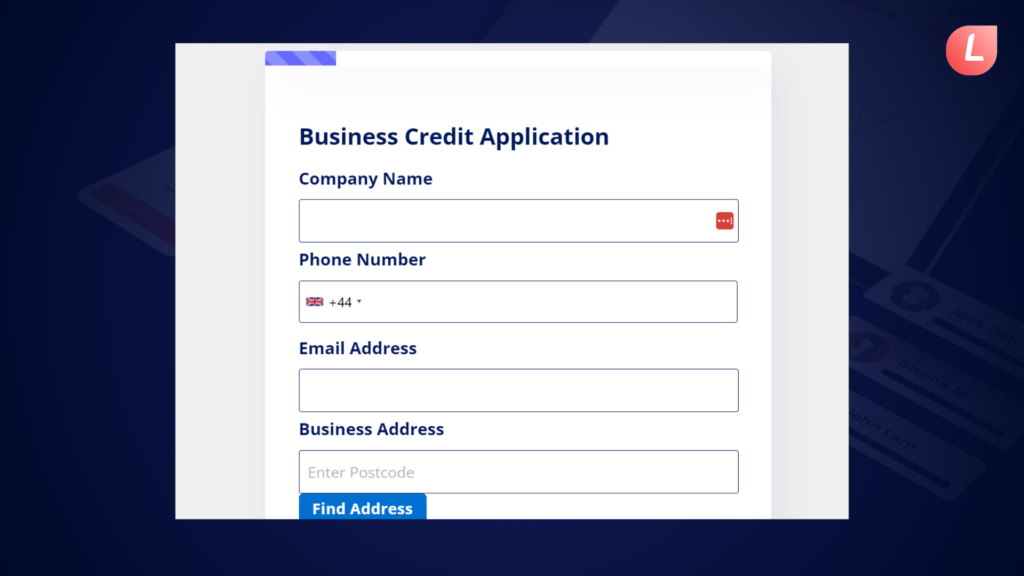

How to create a credit application form with the LeadGen App

To create a credit application form with the LeadGen App, follow these steps:

- Sign in to LeadGen App: Log in to your account or create one if you haven’t already.

- Choose a Template: Browse through the form templates and choose a suitable one for a credit application. You can start with a blank form or select a template designed for application purposes.

- Customize the Form: Customize the form with your business logo, colors, and brand fonts for a professional look.

- Conditional Logic: Add conditional logic to simplify the form by showing or hiding fields based on the applicant's responses.

- Set Notifications: Configure email notifications to get alerts whenever someone submits the credit application form.

- Embed or Share the Form: Embed the form on your website or share it via a link to collect applications directly.

- Review & Publish: Double-check the form setup, test it, and then publish it live.

Once published, you can track form submissions and view the collected data in your LeadGen App dashboard.

FAQs

What are the different types of credit application forms?

Credit application forms come in three varieties:

Consumer credit applications for personal loans or credit cards.

Commercial credit applications for firms seeking trade credit.

Mortgage loan applications for real estate acquisitions.

How can a business credit application form help mitigate risk?

A company credit application form reduces risk by collecting critical information about potential clients, allowing for a full assessment of their creditworthiness. It enables organizations to assess criteria such as financial soundness, payment history, and credit use, resulting in more informed decision-making and lowering the chance of default or late payments.

What are some tips for determining creditworthiness?

Consider credit history, income stability, debt-to-income ratio, payment history, employment verification, and asset review. Consider credit ratings and historical financial behavior to effectively assess creditworthiness.

What are the red flags on a credit application?

Inconsistent information on a credit application, gaps in job history, a high debt-to-income ratio, recent delinquencies or bankruptcies, and frequent changes in address or contact information are all warning flags.

Why do we need a credit application form?

A credit application is required to analyze the creditworthiness of new consumers or clients, reduce risk, define credit conditions, and ensure appropriate lending practices. It enables firms to make educated credit decisions and successfully manage cash flow.

How long does it take for a credit application to be reviewed?

A credit application may usually be assessed and a decision made within a few days to a few weeks. However, by using automated credit application processing systems, lenders may significantly cut the time it takes to analyze credit applications and deliver faster, more efficient service to consumers.

What is an example of business credit?

A trade credit agreement is one kind of business credit in which a supplier permits a firm to purchase products or services on credit terms, such as net 30 days, allowing the business to pay for the purchases later after getting the goods or services.

What is the difference between B2B credit applications and B2C credit applications?

B2B credit applications include businesses offering credit to other businesses, with an emphasis on trade credit conditions and commercial financial data. B2C credit applications are for businesses that give credit to individual customers, with an emphasis on personal credit history and consumer financial behavior.

What happens when you submit a credit application?

When you submit a credit application, the lender will analyze it to determine your creditworthiness and capacity to repay the loan. They will usually look at your credit record, income, job history, and other financial information before making a judgment. After reviewing your application, the lender will decide whether to approve or refuse your credit request.

What’s Included in a Business Credit Application?

- Business information: company name, address, contact information, and legal structure.

- Financial data: revenue, profit margins, assets, liabilities, and credit history.

- Trade References: Details about prior credit agreements with suppliers or vendors.

- Ownership Information: The names, titles, and ownership percentages of corporate principals.

- Industry Sector: An overview of the company's industry, market position, and competitive landscape.

- Bank Account Information: Details and references.

- Tax ID: The number assigned to a business for tax purposes.

- Credit Purpose: The intended usage of the credit and the desired credit limit.

- Signature: Authorization and assent to credit checks and conditions acceptance.

Is a credit application a legal document?

Yes, a credit application is a legal document. When an individual or corporation makes a credit application, they are formally requesting a line of credit from a lender, and they usually supply personal and financial information that the lender analyzes to determine their creditworthiness. The applicant often accepts specific terms and conditions, such as permitting the lender to do a credit check.

By signing or submitting the application, the applicant legally affirms the accuracy of the information submitted and agrees to the lender's conditions. Falsifying facts on a credit application might result in legal penalties, since it may be considered fraud.

Summing Up

That's all there is to it. This primer on the fundamentals of online credit application forms should get you started thinking about how your company's credit application may be modified and converted to a digital application. Once credit applications are approved and trade credit is extended, businesses need loan servicing software to manage the ongoing relationship. Platforms like Bryt Software help lenders track payment schedules, automate borrower communications, and manage delinquencies for commercial credit arrangements.

Manually sending out credit applications and checking them for credit approval takes time and effort. It is also necessary to consider the probability of human mistakes. As a result, organizations all over the world use automation to streamline processes. LeadGen App, for example, assists B2B firms by creating credit application forms.