Data Collection Methods: 8 Types and Examples

In business, data is everything. Data replaces doubt with certainty and guesswork with facts. And the first step to making data-based business decisions is collecting quality data.

Data collection is, simply, how you gather data. Only once you have effective data can you make effective decisions.

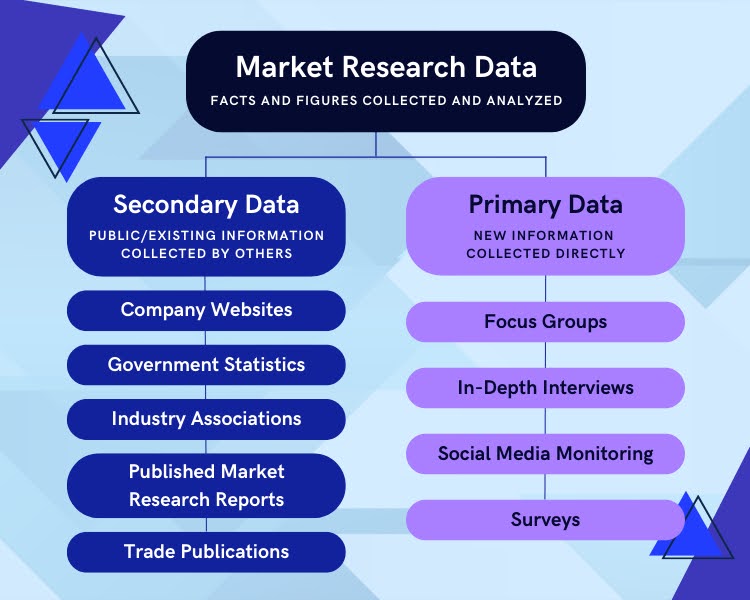

The two common methods of data collection are:

- Primary (firsthand) data collection.

- Secondary (existing) data collection.

You can also categorize data as quantitative (expressed by a number) and qualitative (subjective experience data) - more on this later!

In this blog we will help you:

- Choose the right collection process.

- Understand primary versus secondary data collection.

- Learn the advantages and disadvantages of five primary collection methods.

- Learn the advantages and disadvantages of three secondary data collection methods.

- Explore best practices in effective data collection.

- Data tracking, which is essential for businesses to thrive in today's competitive landscape. By accurately monitoring and analyzing data, companies can gain valuable insights into their operations, identify trends, and make informed decisions that drive growth

Keep reading for some informative insights.

Why Companies Need Effective Data Collection

Companies base decisions of all kinds on data.

For example, understanding buyer behavior, predicting a product’s performance and planning marketing campaigns. Many, perhaps all, of the world’s top companies are case studies in the importance of using data.

The larger a company gets, the more difficult it becomes to base decisions on experience and intuition alone. Organizations can only make effective decisions off the back of broad and accurate data.

Choosing the Most Effective Method

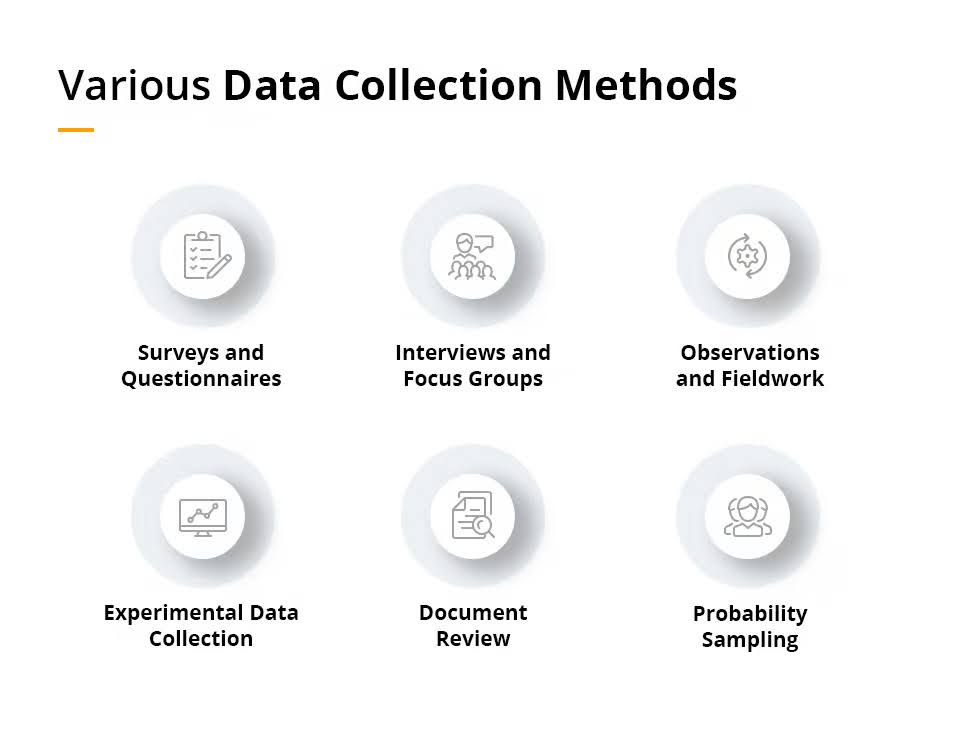

There are 8 common data collection methods, split into two categories.

Primary and secondary data collection methods serve different purposes. The method you choose will be guided by the outcome you’re looking for.

Let’s delve into the different methods.

Primary Data

You can use this data type to solve problems or study something relating to your business. It can include:

- How successful your sales and marketing strategies have been.

- How your customers are behaving.

- How well your operations are performing.

Primary data can be quantitative (measurable using numbers) or qualitative (subjective data based on human perspectives or customer opinions).

Secondary Data

This data type consists of existing data that’s useful to your business, such as data about your market, target demographics and risk environment.

Secondary data can include reports and publications. It often provides illuminating information about your external environment. Like primary data, secondary data can be quantitative or qualitative.

In short, if you want to learn about your business, collect primary data. If you want to learn about something external to your business, collect secondary data.

(Source: MarketResearch.com)

Understanding Your Goals

Before your collection process begins in earnest, you need a clear idea of the problem you want to solve and the results you want to generate.

Try to predict what kinds of data will help you make an informed decision. For instance, marketing teams should know these 10 B2B qualitative marketing metrics and KPIs. Every aspect of business has similar metrics to track and optimize - make sure you know yours!

If your goals are to learn something best expressed through statistics, then quantitative data collection methods are likely to be your preferred method. If you want to learn about how people respond to an aspect of your business, then qualitative data collection methods are more appropriate.

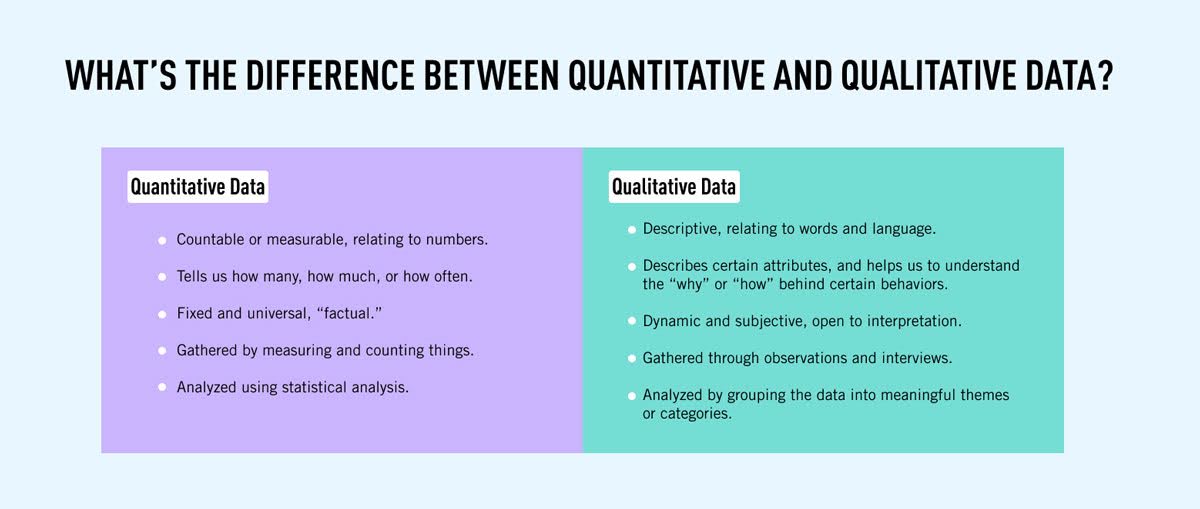

Quantitative Data vs Qualitative Data

What about these collection methods we talked about earlier? What separates quantitative and qualitative methods?

Quantitative data represents things you can measure with a number. When people think of data, they typically think of quantitative data. Data-driven companies aim to contextualize their varied operations with numbers.

Whereas qualitative data represents subjective experiences. It’s gathered through interviews, focus groups and observations and it explores feelings, behaviors and motivations. The qualitative method is especially useful for predicting how consumers will respond to a new product or design changes.

But watch out! Don’t fall into the trap of seeking data that will support your hypothesis. This is called confirmation bias and it will lead you down the wrong path. You need data that will provide a true picture of a situation, not data that will simply support your preconceptions.

It’s also worth considering if this is a one-off exercise, or if your data collection methods will be part of a long-running monitoring programme. Long-running monitoring is more resource-intensive for qualitative data, being a manual process.

Now, let’s get into the different collection techniques and their pros and cons.

(Source: CareerFoundry)

Primary Data Collection Methods

Primary data collection is the gathering of data firsthand. Some common types include:

1. Surveys and Questionnaires

Advantages:

Online surveys and questionnaires let you reach a large number of people relatively easily. With large sample sizes, outliers are less prominent, making data more accurate and better for your analysis process.

Individual surveys are cost-effective thanks to minimal marginal costs. That means sending 1,000 surveys might not cost much more than sending one.

They’re also well-suited to being repeated at regular intervals, such as annually, biennially or another increment of time. By repeating surveys, you can build up a picture of changing circumstances.

Disadvantages:

Surveys and questionnaires have downsides, including low response rates and inconsistencies in how respondents interpret questions. Answers can change based on how someone is feeling that day, making comparisons and analysis more difficult.

2. Interviews

Advantages:

One-on-one interviews are a way to obtain in-depth insights from a select group of people. The interview method has many advantages over surveys, such as greater depth of answers. They can also provide data that other methods can’t, such as seeing how someone actually interacts with a product.

Disadvantages:

In-person interviews are time-consuming and expensive. And while they allow for depth of answers, they don’t provide much breadth. This limits use cases.

3. Observations

Advantages:

Observation is a data collection method where you watch testers interact with your website or product. It offers a firsthand and genuine view of how people use your product.

You can record the sessions using video and data capture. This guarantees data accuracy. You can also ask your testers to narrate their actions, which provides another type of valuable insight.

Disadvantages:

Observation data collection presents a technical challenge.

While observation sessions can be carried out concurrently by one of two team members, like interviews, they’re hard to scale. And how a tester approaches a product can depend on their feelings on a particular day.

4. Focus Groups

Advantages:

Focus groups offer the chance to speak to multiple people at once. A group setting also allows people to share and build on each other’s perspectives, which can produce more thought-out answers. A diverse group of people provide a broader perspective.

Disadvantages:

Focus groups have a few disadvantages. They can be affected by dominant personalities taking charge of the conversation or groupthink. Groupthink happens when a group’s desire for harmony or conformity leads to irrational thinking.

Focus groups are also harder to coordinate, requiring multiple availabilities for any time slot. Lastly, focus groups aren’t suited to the quantitative data collection method.

5. Experiments

Advantages:

Conducting experiments allows you to collect cause-and-effect data. Tests such as an A/B test isolate variables and tell you exactly what impact each change can have.

A/B testing is a core practice for digital businesses. Many common web and marketing tools have native A/B testing, making it relatively easy to do.

Disadvantages:

Experiments are intensive activities that only answer one question. A business will need to conduct many experiments and collect a lot of data to achieve the same results as other methods.

Secondary Data Collection Methods

Secondary data collection involves using existing data sets. It consists of third-party data research, financial statements, and census data.

Advantages:

Secondary data can be cheaper than first-party data collection. A lot of data is publicly available at no cost. Company financial filings, taxpayer-funded data and reports from consultancy firms are often free.

Secondary data is also immediately available; it’s often easily downloaded and well-formatted. It can form the basis for quick decision-making.

Disadvantages:

Some secondary data is expensive. Research companies charge a high price for data. You are also at the mercy of how often reports are published so relevant data might be several years old.

Let’s look at three common types of second-party data collection:

6. Online Sources

Online sources of second-party data include government reports and industry publications. Governments produce white papers, statistics and annual reports, which can all be used in data collection.

Industry reports and publications provide in-depth business data. The internet is full of reports on almost any aspect of any industry you can think of!

7. Public Databases

Open data sources, such as the datasets accessed via data.gov.uk, can hold an immense amount of valuable data.

These datasets can help you understand your market, find investment opportunities and learn about potential customers.

8. Internal Data

Internal data is another type of secondary data. It includes customer records and sales figures, among other things. It can be used to highlight a company’s capabilities and product success.

Secondary data often provides a solid foundation for decision-making.

(Source: Future Processing)

Best Practices for Data Collection

Here are some tips to get the highest-quality data from your data collection.

Craft Effective Surveys and Questionnaires

A good survey comes down to reaching the right people and writing a good series of questions.

The right people could mean a broad cross-section of society or a tighter focus on specific groups. Scale is vital due to low response rates.

Use open-ended questions to get more information out of your respondents.

A good tip is to test your questions on your internal staff. Then, you’ll know if the questions are producing good data.

Conducting Ethical and Unbiased Interviews

Avoiding bias in interviews means avoiding any language that will trigger emotions or narrow the answers the interviewee might give.

For example, if you say, “I hope you like it,” your interviewee might feel pressure to like it or feel annoyed at an expectation to like something. It also defines the question in terms of like or don’t like, when there could be a wide range of other thoughts one might have.

Ethical standards in interviews is a complex subject but you should abide by a few key tenets:

- Informed consent - Interviewees should fully understand what they’re agreeing to.

- Privacy and confidentiality - Interviewees’ participation, data and answers should be safeguarded and disposed of carefully.

- No pressure - Interviewees should not be coerced into saying or doing something they don’t want to.

Ensuring Accurate and Reliable Observations

If you’re observing interactions with a prototype or MVP, you must be happy that it has the features or design elements you need.

Equally, you must avoid having your tester get distracted by aspects of the product that aren’t part of the study.

Managing Focus Groups for Productive Discussions

The success of a focus group depends on the steady hand of a facilitator. The facilitator creates a comfortable environment, welcomes the guests, encourages introductions, and establishes ground rules.

The facilitator also guides the session through each point of discussion, keeping the conversation on track, defusing any tension should it arise, and making sure everyone has their say.

Designing Controlled and Relevant Experiments

You must approach your experiments with a scientific mindset. You need a hypothesis, a control group and a method.

Don’t be tempted to test too many things at once - in fact, you should just be testing one thing at a time. That’s the best way of uncovering major challenges and how to fix them.

Evaluating the Credibility of Secondary Data Sources

Poor data quality is rife! Evaluate a data source against these five considerations:

1. Reputation - is the source known for being reliable?

2. Author - what profile does the author have?

3. Methodology - does the source have a clear methodology?

4. Bias - is the source compromised by an agenda, such as commercial intent?

5. Currency - are the source’s conclusions likely to be inaccurate due to the passage of time?

None of these alone are sufficient to base an evaluation on. Score a source across each for a complete evaluation.

Key Takeaways

With data guiding decisions across every industry and corporate function, data collection methods are becoming ever more important.

To choose the right data collection method, you need to understand two concepts: primary and secondary data and quantitative and qualitative data. Data can be a combination of primary and secondary and quantitative and qualitative.

Hopefully, you’ve learnt from this blog what they mean, but let’s recap one final time:

- Primary data is data collected by you.

- Secondary data is existing data collected by someone else.

- Quantitative data is data that has a numeric value.

- Qualitative data is subjective data provided by a person.

Wishing you good luck on your collection journey!