Form Templates › Mortgage Forms › All Form Styles

Mortgage Forms

- All Forms189

- Application Forms51

- Blog Forms5

- Briefing Forms20

- Calculator Forms17

- Conditional Logic Forms25

- Contact Forms48

- Data Collection Forms7

- Eligibility Forms5

- Feedback Forms8

- Intake Forms7

- Lead Capture Forms84

- Lead Qualification Forms38

- Referral Forms5

- Registration Forms17

- Request Forms10

- Solar Forms5

- All Forms189

- Automotive Forms14

- B2B Forms21

- Debt Forms10

- E-Commerce Forms8

- Finance Forms30

- Healthcare Forms17

- Insurance Forms12

- Marketing/ Digital Agency Forms26

- Mortgage Forms7

- Real Estate Forms27

- Recruitment Forms6

- SaaS Forms8

- Startup Forms2

- Training Forms8

- Travel Forms5

- Utilities Forms4

- Web Design Agency Forms22

Choose form style

Form Templates › Mortgage Forms › All Form Styles

Mortgage Forms

- Form Design ServiceBuild My Form

Remortgage Application Form

Remortgage Application Form

A Remortgage Application Form is a document that is used to apply for a new mortgage on a property that already has a mortgage on it. It is typically used to replace an existing mortgage with a new one, often to take advantage of a better interest rate or to release equity from the property.

The form will typically require information about the borrower’s income, employment, credit history, and details about the property in question. The lender will use this information to determine whether to approve the remortgage and under what terms.

A Remortgage Application Form is a form designed to gather information from individuals who are interested in refinancing their current mortgage. This form helps lenders to assess whether an applicant is eligible for a new mortgage with better terms, such as a lower interest rate, and to process their application.

People who are looking to refinance their current mortgage can benefit from a Remortgage Application Form, as it provides an easy and efficient way to apply for a new mortgage with potentially better terms. Lenders and mortgage brokers also benefit from this form as it allows them to gather important information about the applicant’s financial situation and credit history, which they can use to make an informed decision about whether to approve the application.

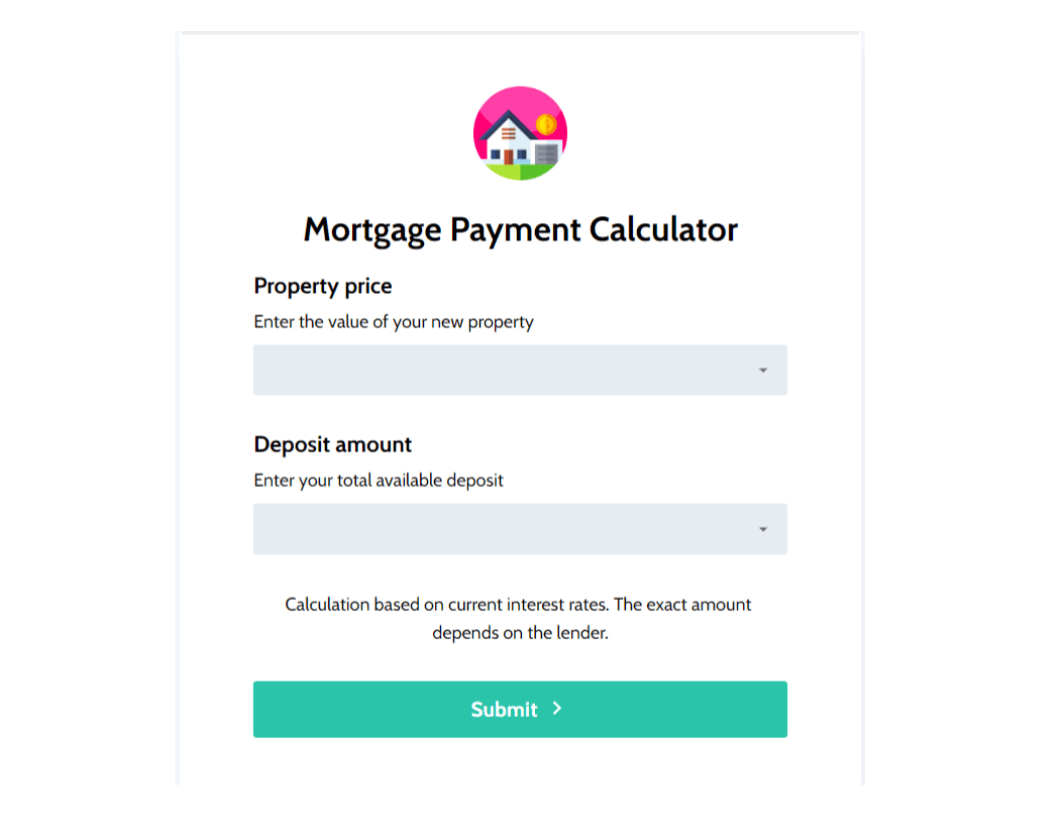

Mortgage Payment Calculator

Mortgage Payment Calculator

A Mortgage Payment Calculator form is an online tool that helps users estimate their mortgage payments based on various factors such as loan amount, interest rate, loan term, and down payment amount. The form typically requires the user to input information such as the loan amount, interest rate, loan term, and other relevant data, and then calculates the estimated monthly mortgage payment.

This type of form is often used by individuals who are considering buying a home and want to get a better understanding of the potential costs associated with a mortgage. Mortgage lenders and brokers may also offer this type of form on their websites as a tool to help potential clients.

A Mortgage Payment Calculator form is a tool that allows potential homebuyers to estimate the monthly mortgage payments they would need to make based on the loan amount, interest rate, and other factors. This form can benefit both homebuyers and mortgage lenders or brokers.

Homebuyers can use the calculator to get an idea of the affordability of a potential home, to compare different mortgage options, and to plan their monthly budgets. Lenders and brokers can use the form to attract potential customers and to provide an initial estimate of mortgage payments for prospective borrowers.

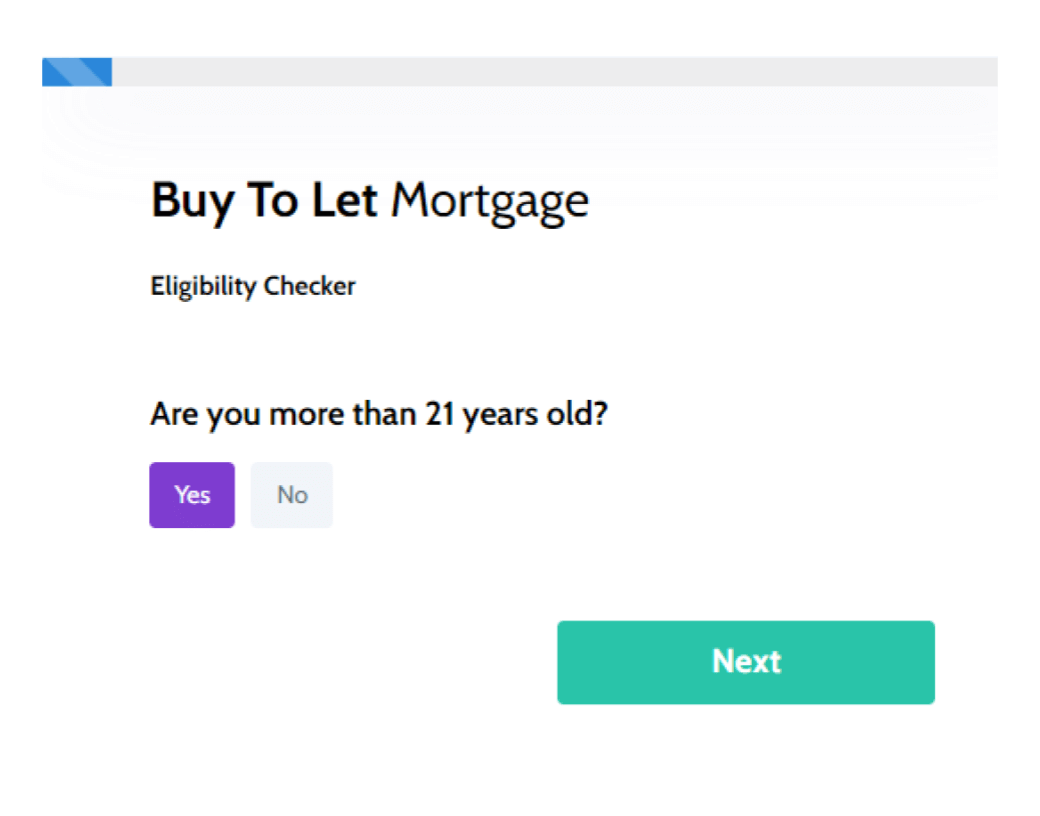

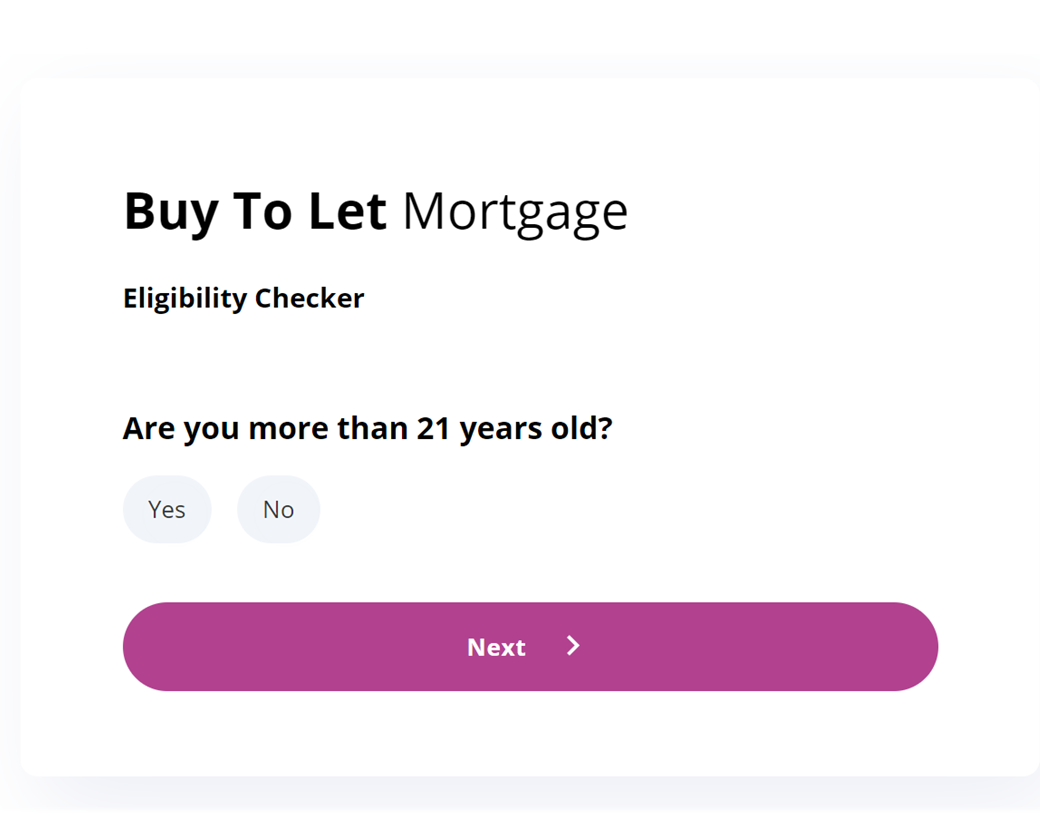

Buy To Let Mortgage Eligibility Checker

Buy To Let Mortgage Eligibility Checker

A Buy To Let Mortgage Eligibility Checker form is an online form that helps potential borrowers to check their eligibility for a buy to let mortgage. The form usually asks for some basic information, such as the borrower’s income, the property value, and the desired loan amount, and then runs a check to see if the borrower meets the eligibility criteria of the lender.

This form is designed to help potential borrowers save time and effort in their mortgage search by allowing them to quickly and easily check if they meet the lender’s criteria before applying. It can also be a helpful tool for lenders, as it allows them to pre-qualify potential borrowers and target their marketing efforts more effectively.

Overall, a Buy To Let Mortgage Eligibility Checker form benefits both potential borrowers and lenders by streamlining the mortgage application process and making it more efficient. A Buy To Let Mortgage Eligibility Checker form is a tool used to help landlords or property investors determine whether they meet the eligibility criteria for a buy-to-let mortgage. These forms typically ask for information such as the property value, the rental income, and the borrower’s financial information.

The primary goal of this form is to help landlords or property investors understand whether they can afford a mortgage to finance their investment property. This form can help investors save time by allowing them to quickly check their eligibility for a mortgage without having to go through the lengthy process of applying for a mortgage. Lenders may also benefit from this form as it can help them to prequalify potential borrowers and ensure that they are only considering applications from borrowers who meet their eligibility criteria.

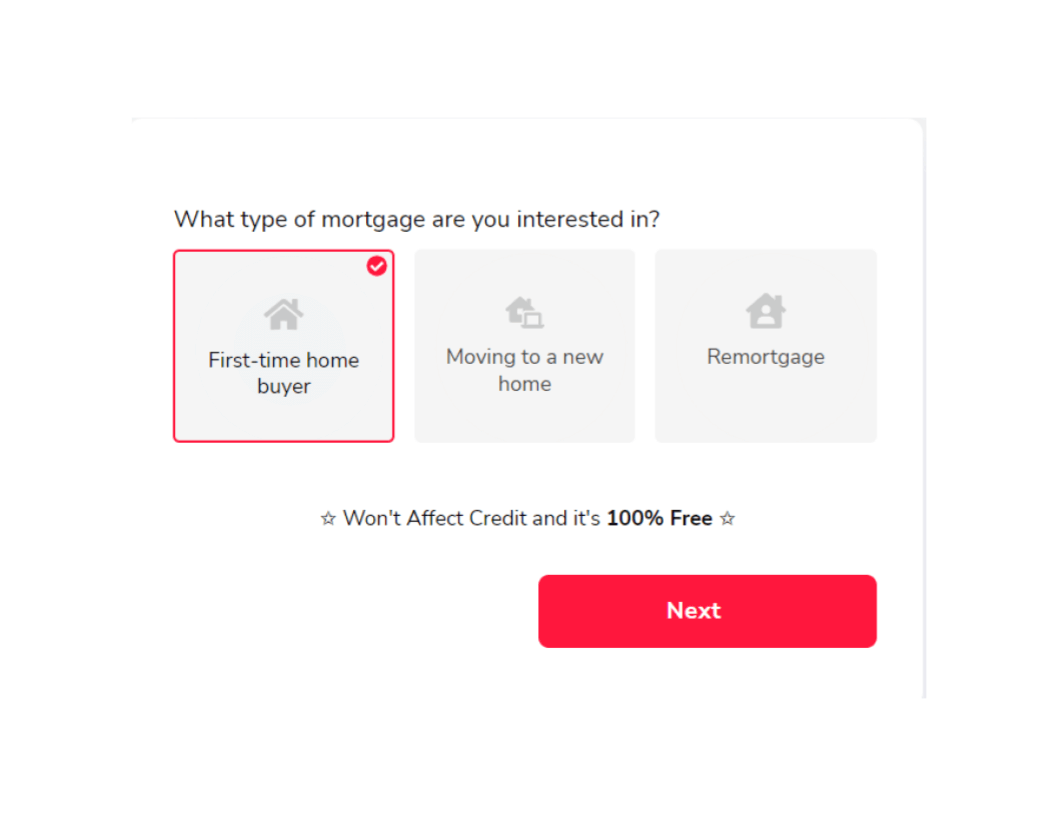

Mortgage Application Form

Mortgage Application Form

The Mortgage Application Form is designed to gather the necessary information required for a lender to evaluate a borrower’s ability to repay a mortgage loan. The form typically includes a variety of personal and financial information, such as income, employment history, assets, liabilities, and credit history.

The mortgage application process can be time-consuming and complex, but the use of a comprehensive form can help streamline the process and ensure that all necessary information is collected efficiently. The primary purpose of the Mortgage Application Form is to enable a lender to evaluate a borrower’s eligibility for a mortgage loan.

The form provides lenders with essential information about the borrower’s income, creditworthiness, and financial situation, which are crucial factors in the mortgage loan approval process. The lender uses this information to assess the borrower’s ability to make regular payments on the loan and determine the amount of the loan for which they are eligible.

The Mortgage Application Form benefits both lenders and borrowers. Lenders benefit by having a comprehensive form that collects all the necessary information in one place, making it easier and more efficient to process the application. This allows lenders to quickly assess the borrower’s financial situation and make informed decisions about loan approvals.

Borrowers benefit from the Mortgage Application Form by having a structured and organized process to provide the necessary information for the mortgage application. The form helps borrowers to identify the specific information required and ensures that all the necessary documentation is provided. This can save borrowers time and effort in gathering the required information and can help to streamline the application process.

The Mortgage Application Form typically includes several sections, such as personal information, employment history, income, expenses, assets, liabilities, and credit history. Depending on the lender’s requirements, the form may also include additional sections or questions to gather more specific information about the borrower’s financial situation.

In conclusion, a Mortgage Application Form is a vital tool in the mortgage application process, helping to streamline the process and ensure that all the necessary information is collected efficiently. The form benefits both lenders and borrowers by providing a comprehensive and structured way to gather and assess the borrower’s financial situation. By using a Mortgage Application Form, lenders can make informed decisions about loan approvals, and borrowers can have a more streamlined and efficient application process.

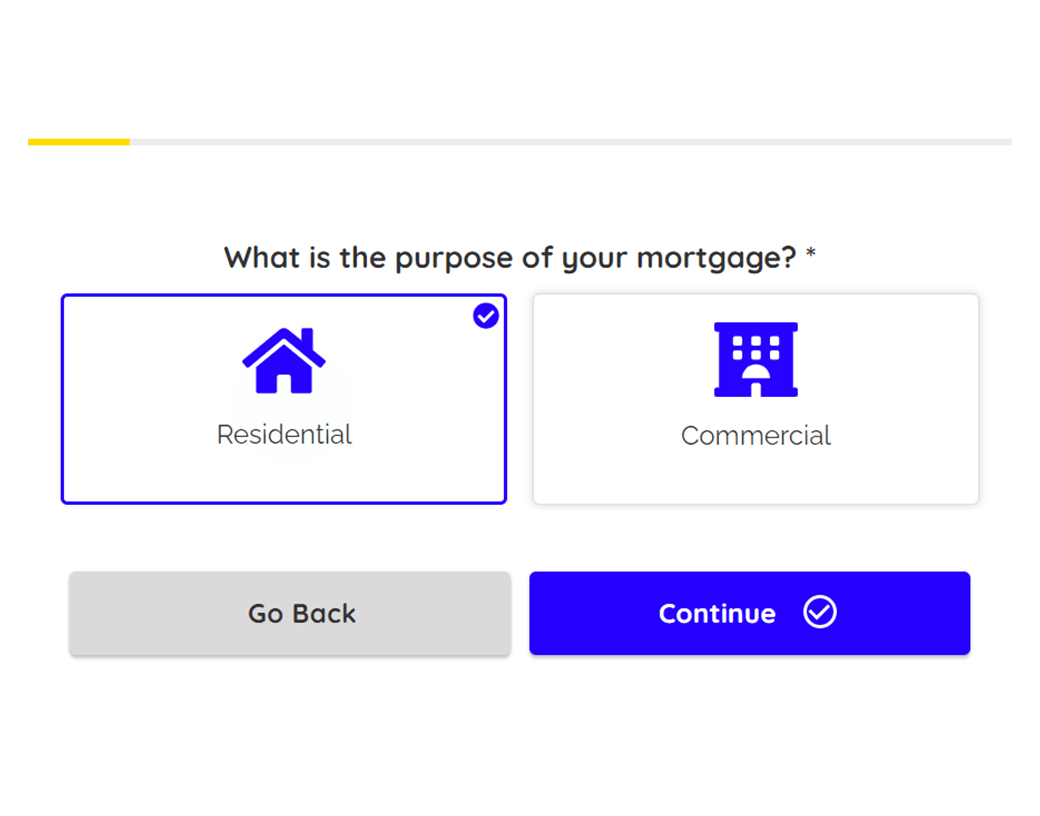

Buy To Let Mortgage Eligibility Checker

Buy To Let Mortgage Eligibility Checker

A Buy To Let Mortgage Eligibility Checker form is an online form that helps individuals check their eligibility for a buy-to-let mortgage. The form typically collects personal and financial information, such as the applicant’s income, credit score, and the property value. The form uses this information to assess the applicant’s eligibility for a buy-to-let mortgage, providing a quick and easy way for individuals to determine whether they can afford to invest in a rental property.

The form benefits individuals who are interested in purchasing a rental property and need to determine their eligibility for a buy-to-let mortgage. It can also be beneficial for mortgage lenders and brokers who can use the information collected from the form to provide targeted mortgage offers to potential customers.

A Buy To Let Mortgage Eligibility Checker form is a type of online form that helps potential borrowers determine whether they are eligible to receive a buy-to-let mortgage. This form typically asks for information about the borrower’s income, assets, and credit history, as well as details about the property they wish to purchase.

The form then provides the borrower with information about their eligibility for a buy-to-let mortgage, as well as information about the mortgage products available to them. This form is beneficial for potential buy-to-let borrowers who want to determine their eligibility for a mortgage before beginning the mortgage application process.

Find Expert Mortgage Advisor

Find Expert Mortgage Advisor

The Find Expert Mortgage Advisor form is an online form that allows users to connect with professional mortgage advisors who can help them find suitable mortgage products for their needs. Users typically fill out the form by providing some basic information about their mortgage requirements, such as their desired loan amount, credit score, and the type of property they are looking to buy.

The form then sends this information to mortgage advisors who will review it and contact the user to discuss their options. The main beneficiaries of this form are individuals who are looking for mortgage advice and guidance. The “Find Expert Mortgage Advisor” form is designed to help individuals find a suitable mortgage advisor who can guide them in making informed decisions about their mortgage.

The form typically collects information such as the individual’s location, contact details, and specific mortgage needs. The form is beneficial for people who are looking to buy a new home or refinance their existing mortgage and want to find a trusted advisor who can help them navigate the complex mortgage market. It is also beneficial for mortgage advisors who are looking for potential clients and want to expand their customer base.

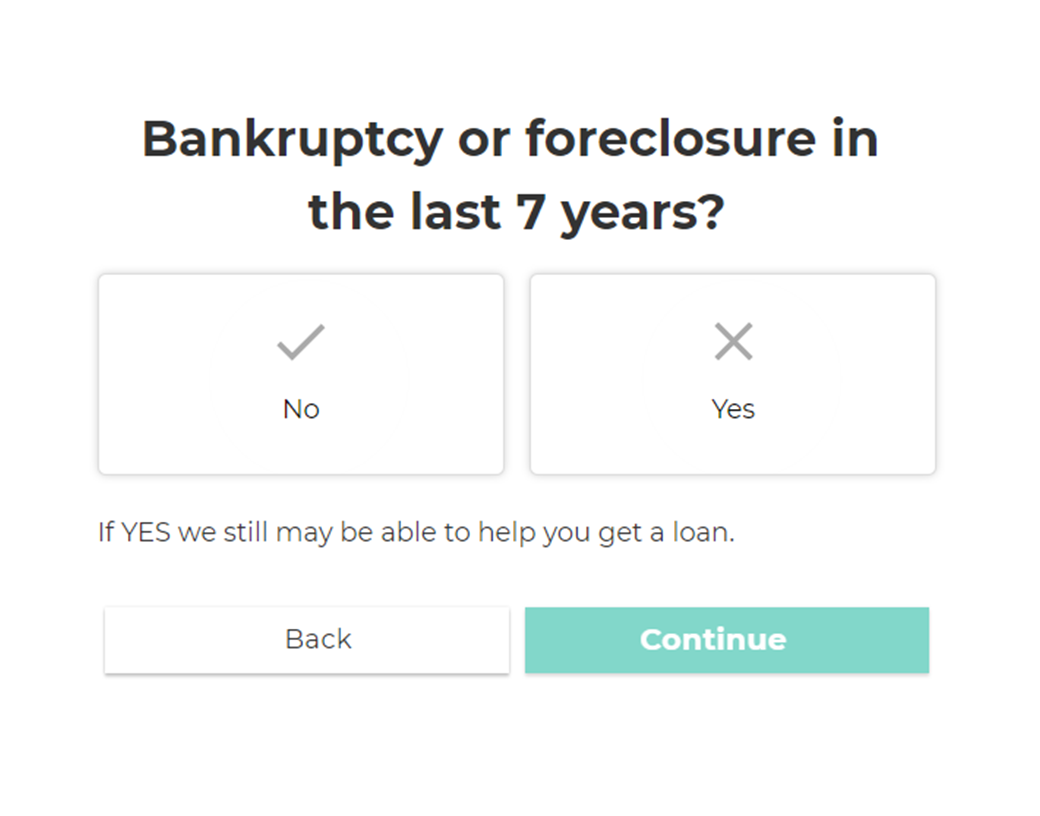

Mortgage Loan Application Form

Mortgage Loan Application Form

Qualify leads for mortgage loans with a multi-step form. Filter applications and identify the best leads for mortgage loan with this form template.