Form Templates › Insurance Forms › All Form Styles

Insurance Forms

- All Forms189

- Application Forms51

- Blog Forms5

- Briefing Forms20

- Calculator Forms17

- Conditional Logic Forms25

- Contact Forms48

- Data Collection Forms7

- Eligibility Forms5

- Feedback Forms8

- Intake Forms7

- Lead Capture Forms84

- Lead Qualification Forms38

- Referral Forms5

- Registration Forms17

- Request Forms10

- Solar Forms5

- All Forms189

- Automotive Forms14

- B2B Forms21

- Debt Forms10

- E-Commerce Forms8

- Finance Forms30

- Healthcare Forms17

- Insurance Forms12

- Marketing/ Digital Agency Forms26

- Mortgage Forms7

- Real Estate Forms27

- Recruitment Forms6

- SaaS Forms8

- Startup Forms2

- Training Forms8

- Travel Forms5

- Utilities Forms4

- Web Design Agency Forms22

Choose form style

Form Templates › Insurance Forms › All Form Styles

Insurance Forms

- Form Design ServiceBuild My Form

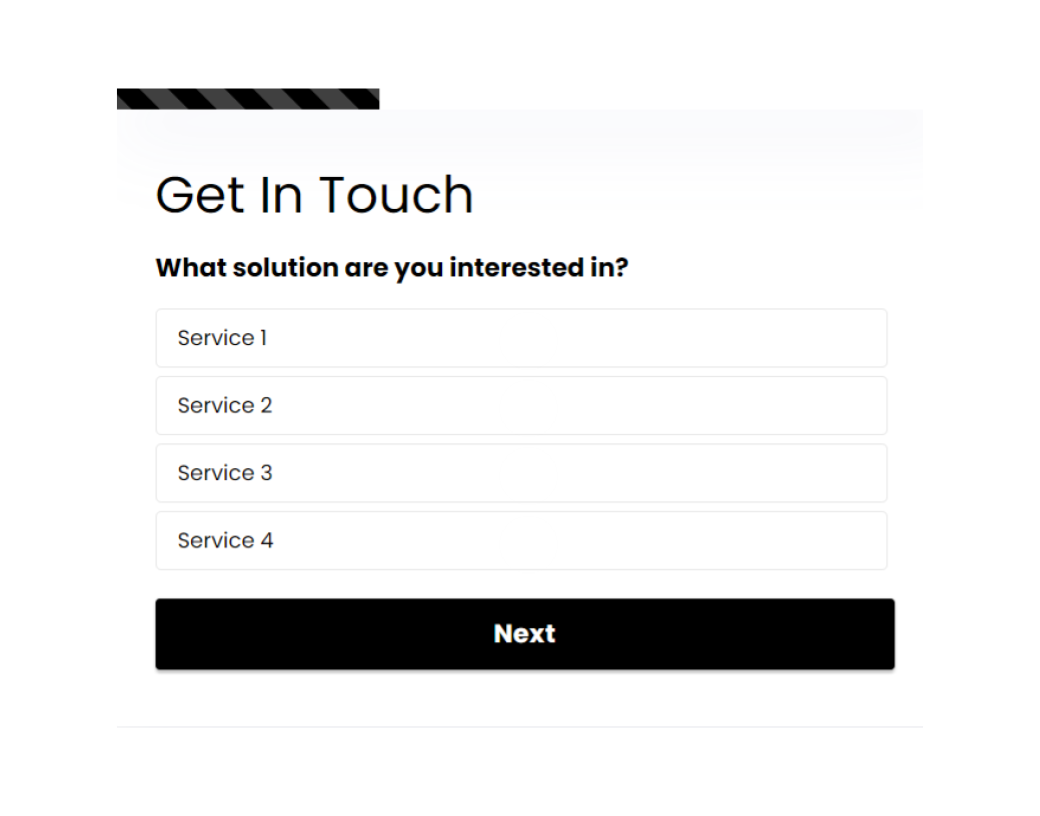

Contact Form B/W

Contact Form B/W

Contact forms are web-based tools that enable customers to contact directly with a company or group. These forms, which are typically embedded on a website, capture crucial information from users such as their name, email address, and a message or query. Contact forms provide an easy and effective way for visitors to contact us without having to utilize separate email software.

They improve the user experience by giving a simple way to ask questions, provide comments, and request services. Contact forms also assist organizations to manage and organize incoming messages, ensuring that requests are sent to the right department for prompt replies. This systematized approach not only enhances customer service but also assists organizations in maintaining a professional and responsive online presence.

Contact forms are critical for lead generation because they provide an organized and effective means for organizations to collect potential client information. Businesses that include contact forms on their websites may collect critical information such as names, email addresses, phone numbers, and specific queries from visitors who indicate interest in their products or services. This direct communication channel improves the user experience by making it easier for potential leads to contact us, boosting the probability of engagement and conversion.

Furthermore, contact forms may be created with qualifying questions, allowing firms to discover and prioritize high-quality leads. Data collected via these forms may be automatically incorporated into CRM systems and analytics tools, allowing for improved tracking, follow-up, and analysis of marketing initiatives. This automation not only saves time and money, but it also guarantees that leads are properly nurtured, resulting in increased growth and revenue. Overall, contact forms are an important part of any lead-generating strategy, since they improve customer relationship management and contribute to business success.

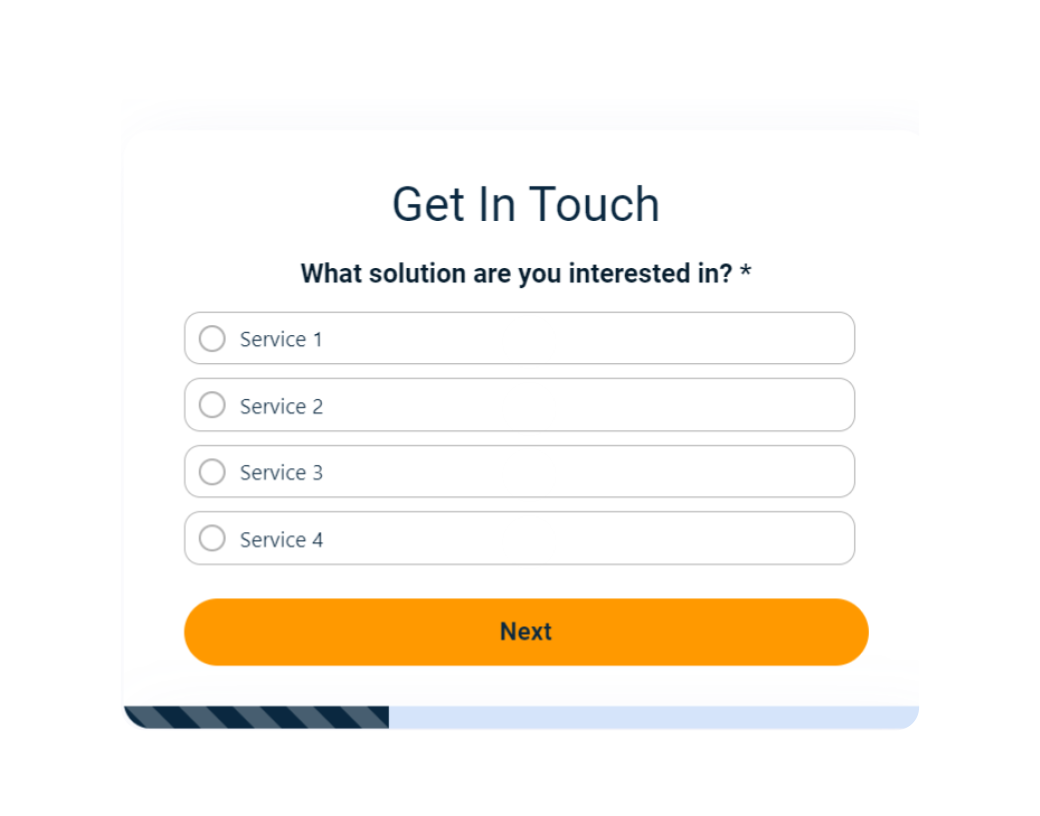

Modern Contact Form

Modern Contact Form

Modern contact forms are digital forms that are linked to websites or applications, allowing consumers to engage with businesses or organizations easily and effectively. They are intended to be user-friendly, mobile-responsive, and visually appealing, and frequently include features like auto-complete, real-time validation, and various field types to simplify the user experience. These forms may also be integrated with a variety of back-end systems, including CRM, email marketing tools, and analytics platforms, resulting in seamless data collecting and administration.

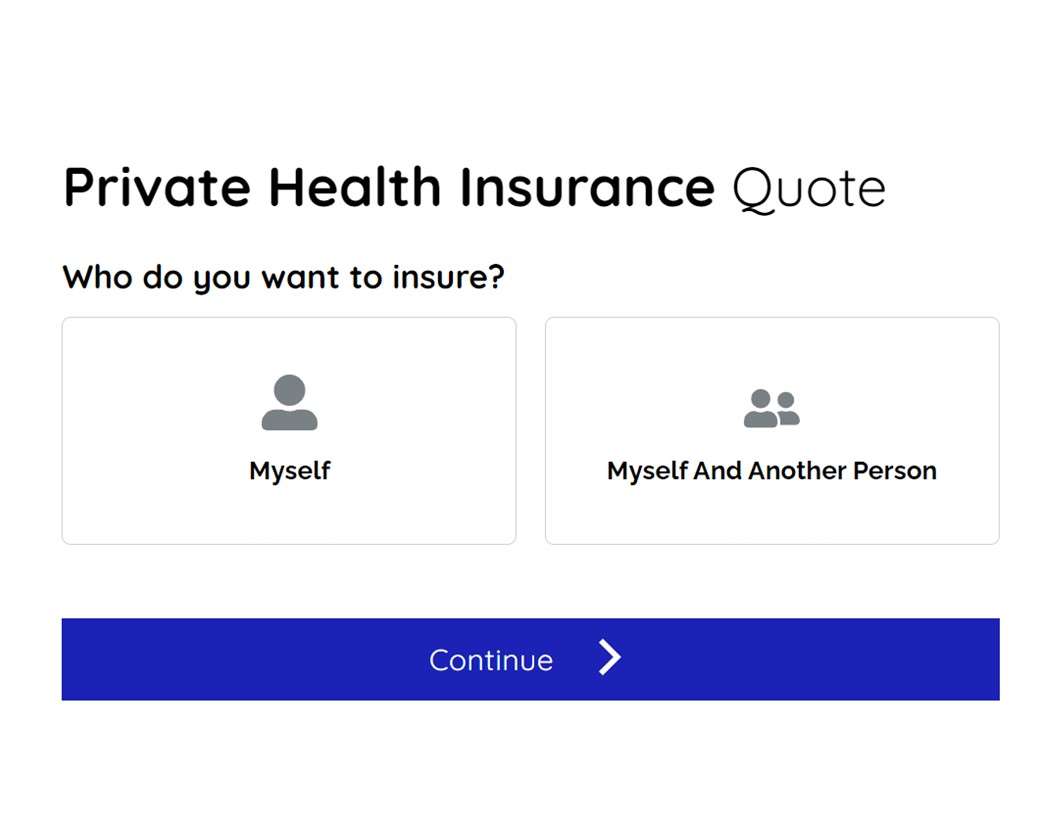

Private Health Insurance Quote Request

Private Health Insurance Quote Request

The Private Health Insurance Quote Request form is a document used by individuals or businesses to request a quote or estimate from an insurance company regarding the cost of purchasing private health insurance. The form typically collects personal information about the applicant and their health status, as well as the type of coverage they are seeking.

The insurance company then uses this information to provide a personalized quote based on the applicant’s individual risk factors and coverage preferences. The primary beneficiaries of this form are individuals or businesses seeking to purchase private health insurance.

A Private Health Insurance Quote Request form is designed to gather information from individuals who are interested in purchasing private health insurance. The form typically includes questions about the individual’s age, health status, and coverage needs. The form benefits insurance providers who use the information to generate a quote for the individual and potentially sell them a private health insurance policy.

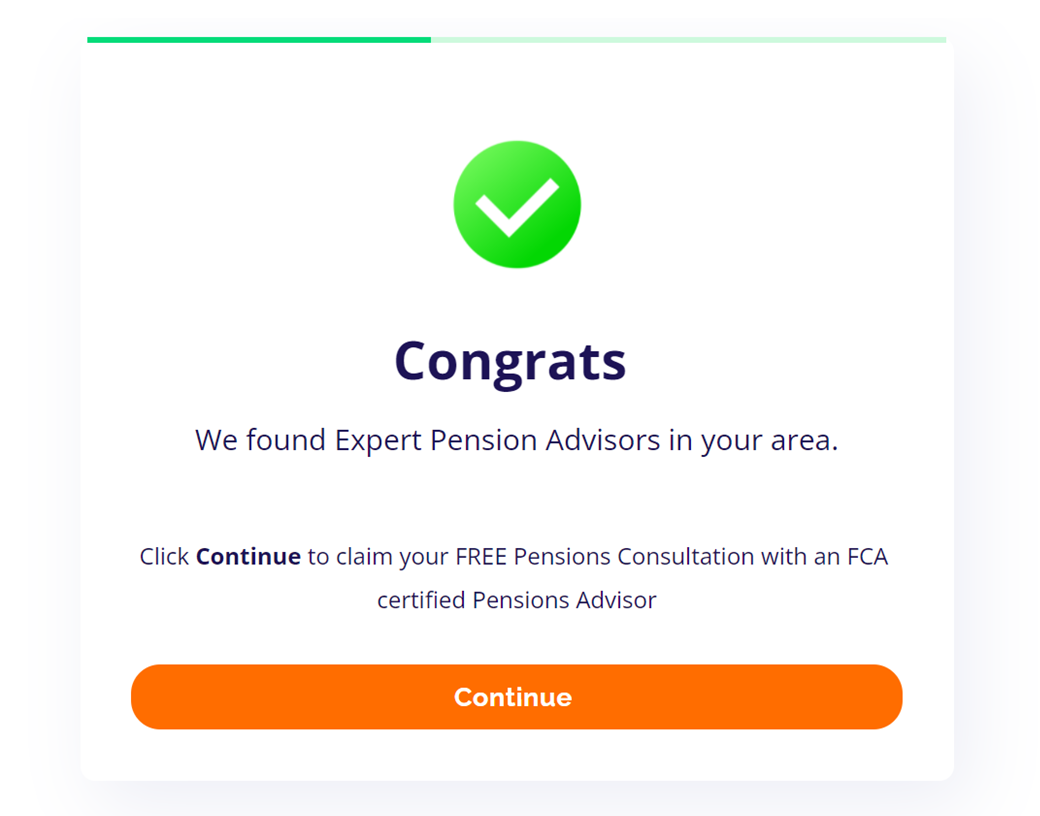

Pension Advisor Search Form

Pension Advisor Search Form

A Dynamic Pension Advisor Search Form is a type of online form that helps users find a suitable pension advisor based on their location and specific needs. The form typically asks for details such as the user’s location, the type of advice they are looking for, their age, their retirement goals, and any other relevant information.

Once the user submits the form, the system will generate a list of suitable advisors in the user’s area, along with their contact information and any other relevant details. This type of form is designed to help users make informed decisions about their pension planning and find an advisor who can provide them with the support and guidance they need.

A Dynamic Pension Advisor Search Form is a tool designed to help individuals find pension advisors that meet their specific needs. Users can input information such as their location, pension goals, and preferences for advisor experience and qualifications, and the form will generate a list of suitable pension advisors.

This type of form is typically used by people who are looking for professional advice on managing their retirement savings, and who want to make sure they find an advisor who is a good fit for their needs. Pension advisors and financial firms can also benefit from this type of form by using it to generate leads and connect with potential clients who are interested in their services.

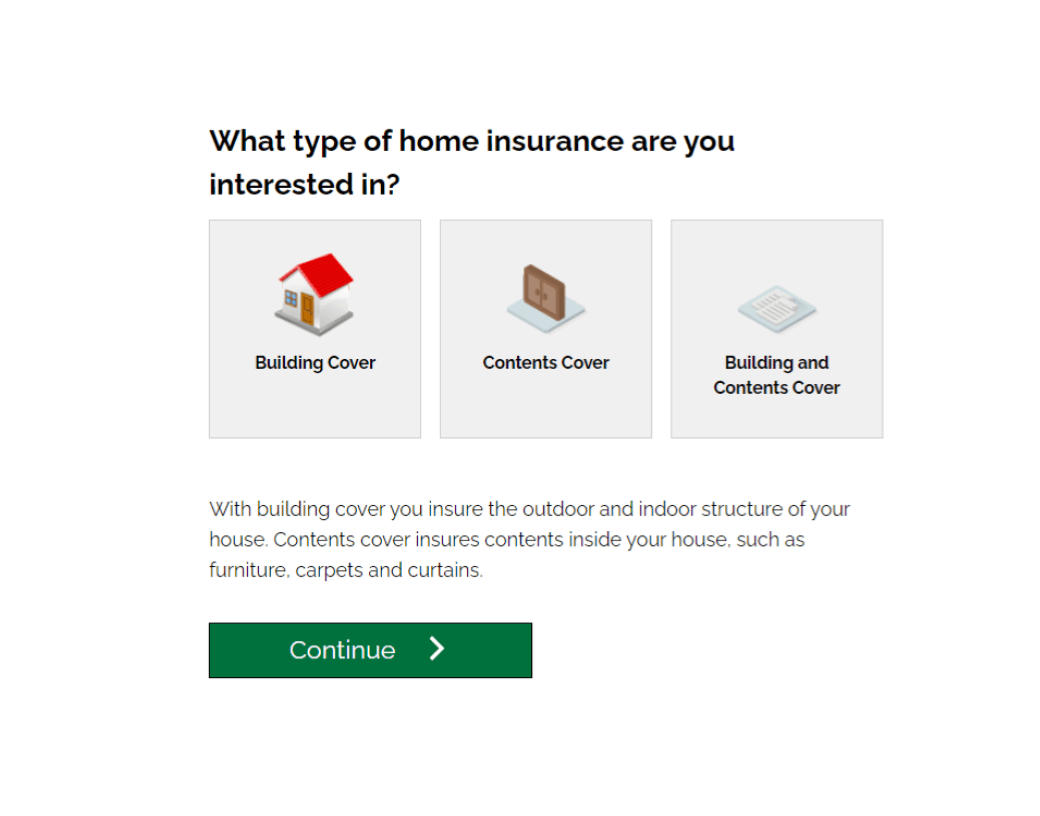

Building Insurance Lead Form

Building Insurance Lead Form

A Building Insurance Lead Form is an online form that collects information from individuals interested in obtaining a quote or more information about building insurance. This form typically includes questions about the individual’s property, such as the property type, location, age, value, and desired coverage. The information collected from this form can be used by insurance companies or agents to provide a customized quote or follow up with the individual to provide more information about building insurance policies.

A Building Insurance Lead Form is an online form that is designed to capture information from individuals who are interested in getting a quote for building insurance. The form typically asks for information such as the property’s location, type of property, the level of coverage required, and any previous claims history.

The form is designed to connect potential customers with insurance providers who can offer them a quote for building insurance. Individuals who are looking for building insurance can benefit from the form as it provides a quick and convenient way to get a quote from multiple insurance providers. Insurance providers can also benefit from the form as it allows them to generate leads and potentially acquire new customers.

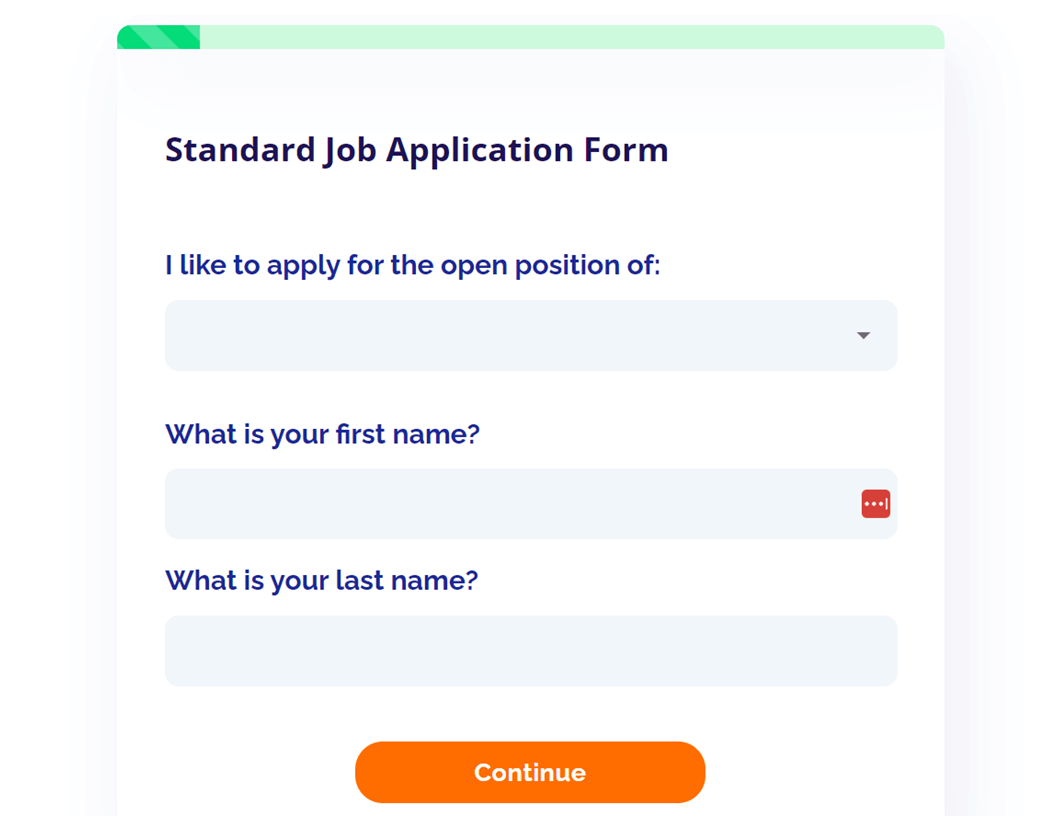

Standard Job Application Form

Standard Job Application Form

Our standard job application form provides information about a candidate’s background, skills, education, and work history. The form includes fields for personal information, employment history, education, references, and any other relevant information requested by the employer. Benefits of using a standard job application form include:

Consistency: Using a standard job application form ensures that all candidates provide the same information, making it easier to compare and assess applicants;

Efficient screening process: The standard job application form makes it easier for recruiters to quickly identify qualified candidates;

Legal compliance: The standard job application form helps employers comply with equal employment opportunity laws by avoiding questions that may discriminate against protected classes;

Organization: All candidate information is collected in one place, making it easier to keep track of and access when needed;

Time-saving: The standard job application form streamlines the recruitment process by eliminating the need for recruiters to create a new form for each job opening;

Overall, using a standard job application form can help make the recruitment process more efficient, organized, and legally compliant.

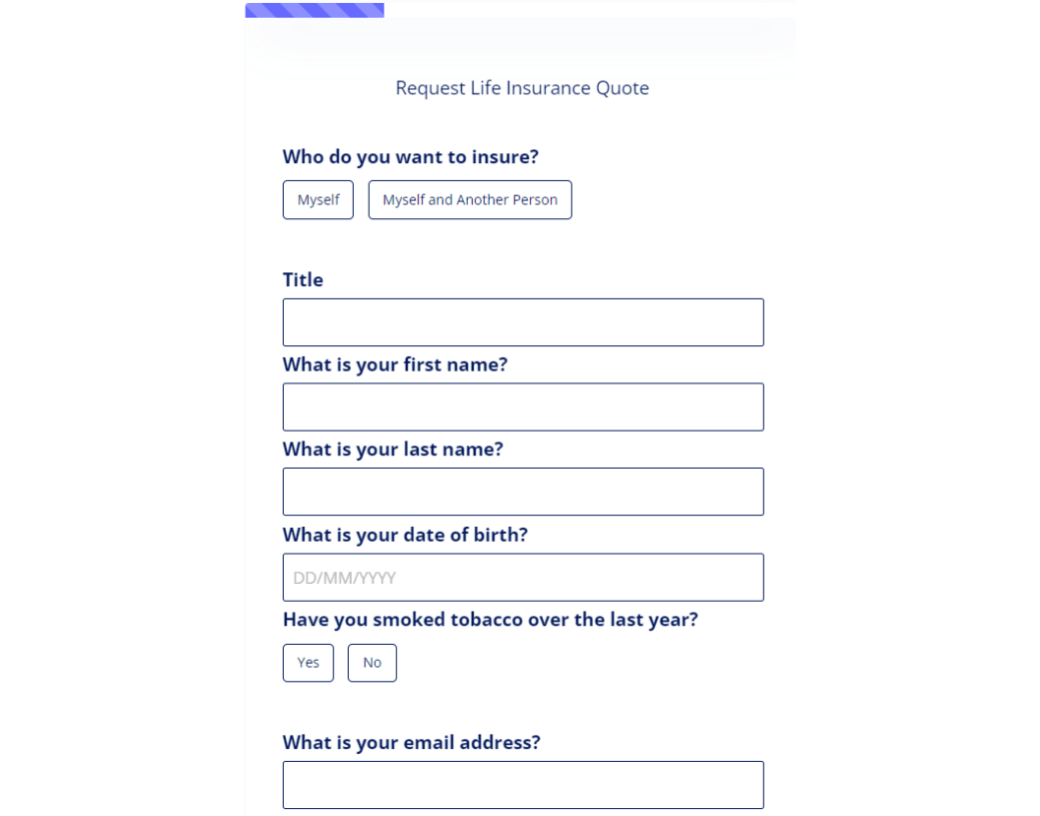

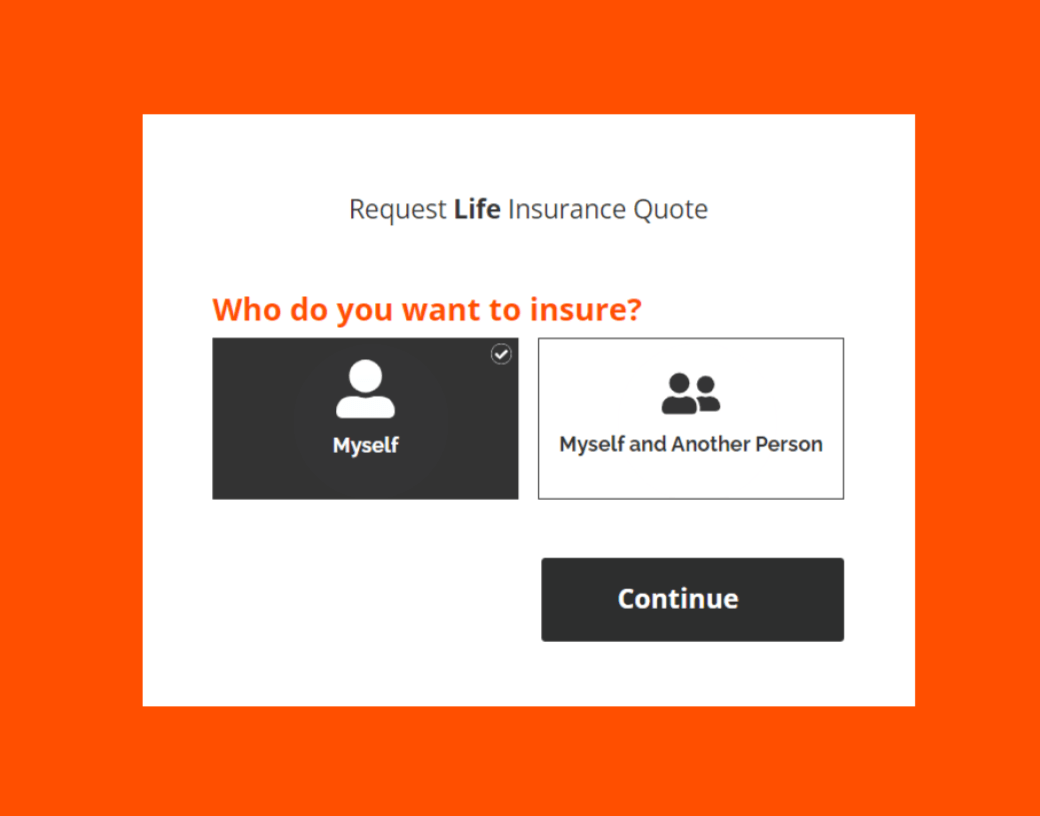

Request Life Insurance Quote

Request Life Insurance Quote

Request Life Insurance Quote form is a type of online form that allows users to request a quote for life insurance policies. The form typically collects information such as age, gender, health status, and other relevant details to help insurers generate an accurate quote.

The form may also ask for contact information, such as email or phone number, so that the insurer can follow up with the user. The main beneficiaries of this form are individuals or businesses looking to purchase life insurance policies.

A Request Life Insurance Quote form is designed to help potential customers of a life insurance company request a quote for a life insurance policy. This form typically asks for information such as the applicant’s age, health, occupation, and lifestyle to determine the appropriate coverage and premium rate.

The form benefits both the customer, who can receive a personalized quote and learn about available life insurance options, and the insurance company, who can collect information to assess the customer’s risk and provide a tailored insurance policy.

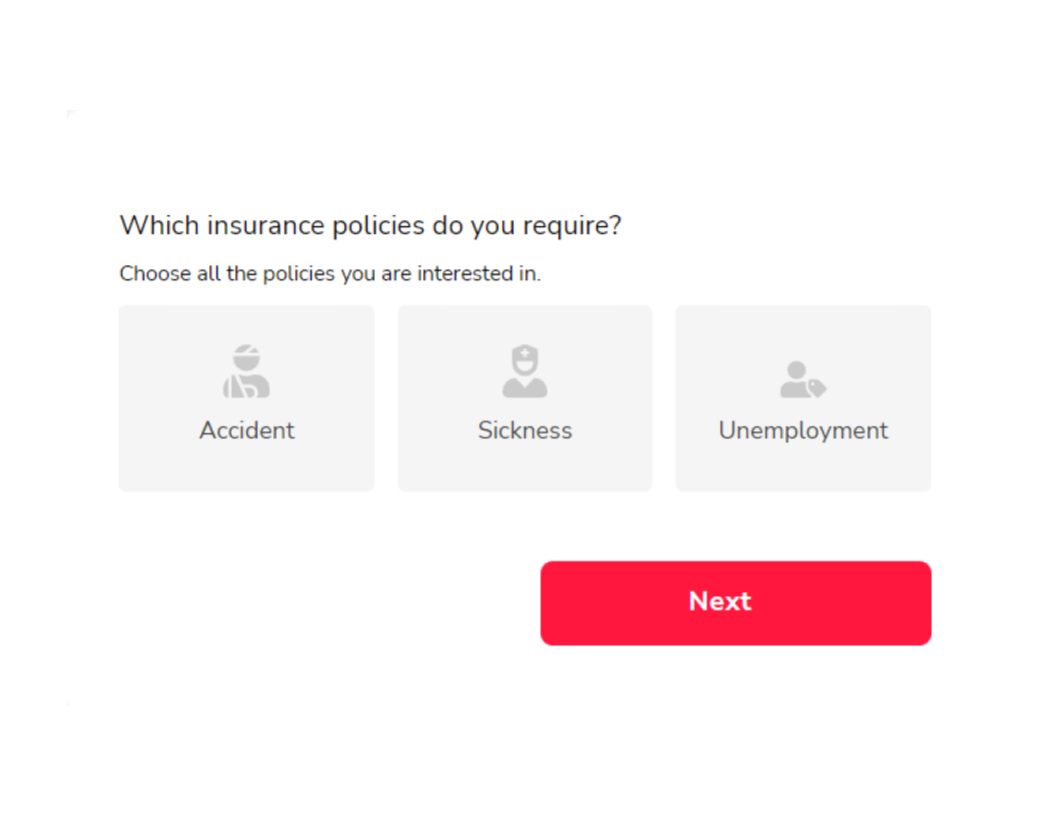

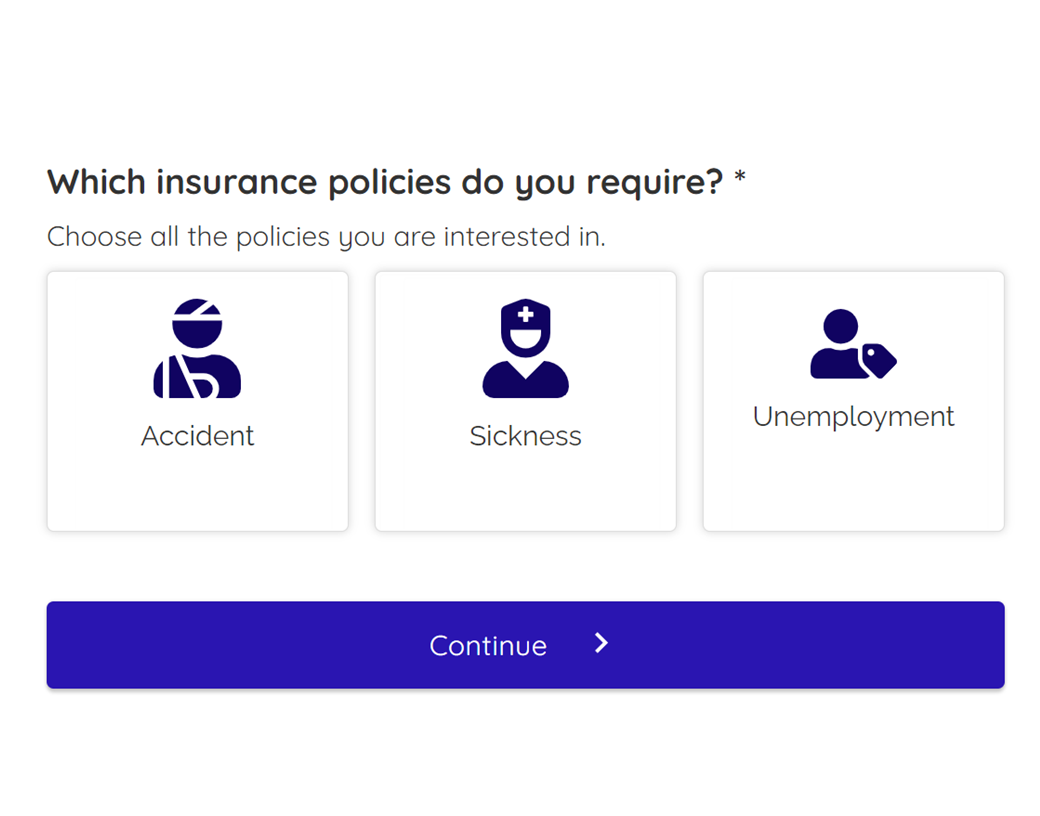

Income Protection Insurance Enquiry

Income Protection Insurance Enquiry

An Income Protection Insurance Enquiry form is a web-based form that aims to assist individuals who want to purchase income protection insurance. It is a comprehensive form that usually includes fields for personal information, employment status, income, and other relevant details that relate to the person’s financial situation.

The primary objective of the Income Protection Insurance Enquiry form is to provide individuals with information about income protection insurance policies, and to help them locate a policy that suits their specific needs. By furnishing detailed information about their financial status, the form helps insurance providers to offer custom policies that match their clients’ requirements and financial capacity.

The Income Protection Insurance Enquiry form is beneficial for individuals who work for themselves, have a well-paying job, or have significant debt. It helps them to identify income protection policies that cover their income in case of illness or injury, and can safeguard them from financial difficulties resulting from unexpected income loss. Insurance providers can also benefit from the Income Protection Insurance Enquiry form.

The form enables them to gather detailed information about potential clients, which enables them to offer policies that suit their clients’ specific needs and budgets. This can help insurance providers to grow their business and build long-term relationships with their clients.

Request Life Insurance Quote

Request Life Insurance Quote

Request Life Insurance Quote form is a type of online form that allows users to request a quote for life insurance policies. The form typically collects information such as age, gender, health status, and other relevant details to help insurers generate an accurate quote. The form may also ask for contact information, such as email or phone number, so that the insurer can follow up with the user.

The main beneficiaries of this form are individuals or businesses looking to purchase life insurance policies. A Request Life Insurance Quote form is designed to help potential customers of a life insurance company request a quote for a life insurance policy. This form typically asks for information such as the applicant’s age, health, occupation, and lifestyle to determine the appropriate coverage and premium rate.

The form benefits both the customer, who can receive a personalized quote and learn about available life insurance options, and the insurance company, who can collect information to assess the customer’s risk and provide a tailored insurance policy.

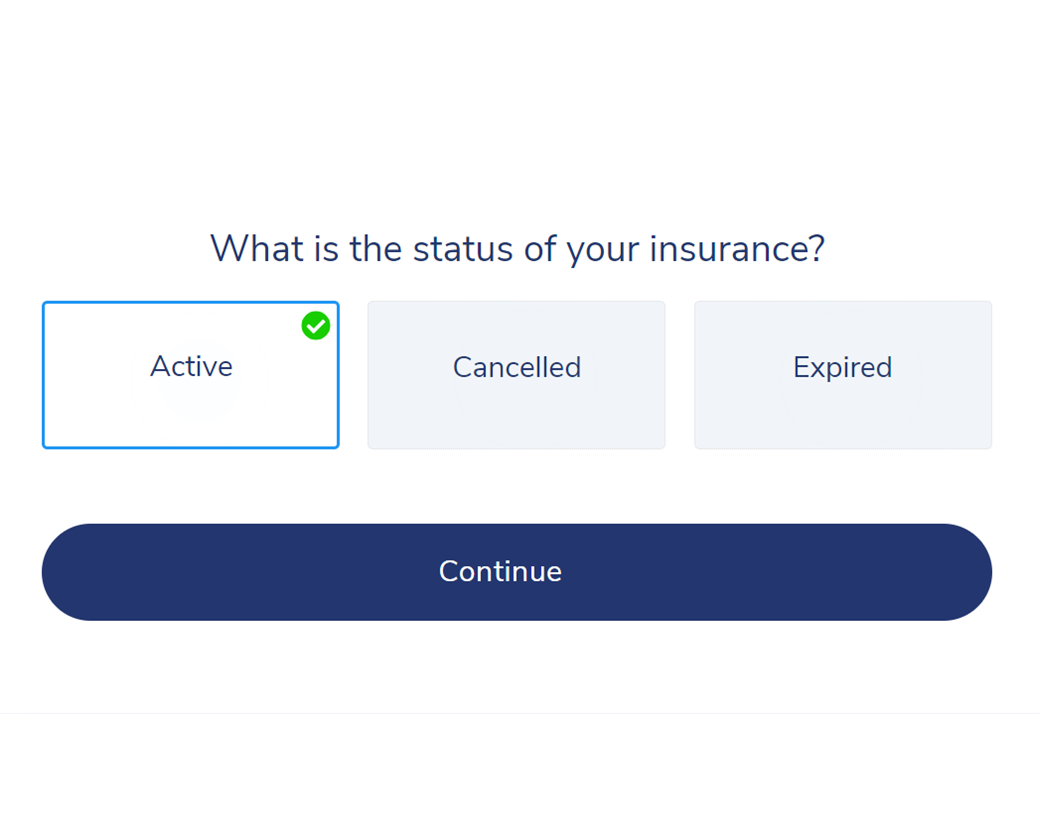

Check Life Insurance Status

Check Life Insurance Status

The term “Check Life Insurance Status form” usually refers to a document or an online tool given by an insurance company that allows policyholders or beneficiaries to verify the status of their life insurance policy. The form may request information such as the policy number, the name of the insured, and their date of birth. After this, the form should include information about the policy’s condition, such as its current value, premium payment history, and any outstanding debts or liens.

It is critical to verify the status of your life insurance policy on a regular basis to ensure that it is still current and that you are up to date on premium payments. This can also assist you in identifying any potential difficulties, such as inaccuracies or conflicts in your insurance information.

The “Check Life Insurance Status” form is intended to provide policyholders or beneficiaries with information on the state of their life insurance policy. This document informs policyholders on crucial policy information such as the policy’s current value, premium payment history, and any outstanding debts or liens.

The major advantage of this form is that it allows policyholders to confirm that their life insurance policy is still active and that their coverage is current. This is significant because if a policy fails owing to nonpayment of premiums or other causes, the policyholder or beneficiaries may not receive the death benefit if the covered person dies.

Beneficiaries of a life insurance policy benefit from the Check Life Insurance Status form as well since it helps them to quickly determine whether their loved one had an active policy and whether they are eligible for a death payment. It assists them in avoiding any delays or problems while making a claim and getting the death benefit.

In conclusion, the Check Life Insurance Status form benefits both policyholders and beneficiaries by providing vital information on the policy’s status, ensuring that they are informed of any difficulties or changes to their policy and may take appropriate action.

Income Protection Insurance Enquiry

Income Protection Insurance Enquiry

An Income Protection Insurance Enquiry form is a web-based form that aims to assist individuals who want to purchase income protection insurance. It is a comprehensive form that usually includes fields for personal information, employment status, income, and other relevant details that relate to the person’s financial situation.

The primary objective of the Income Protection Insurance Enquiry form is to provide individuals with information about income protection insurance policies, and to help them locate a policy that suits their specific needs. By furnishing detailed information about their financial status, the form helps insurance providers to offer custom policies that match their clients’ requirements and financial capacity.

The Income Protection Insurance Enquiry form is beneficial for individuals who work for themselves, have a well-paying job, or have significant debt. It helps them to identify income protection policies that cover their income in case of illness or injury, and can safeguard them from financial difficulties resulting from unexpected income loss. Insurance providers can also benefit from the Income Protection Insurance Enquiry form.

The form enables them to gather detailed information about potential clients, which enables them to offer policies that suit their clients’ specific needs and budgets. This can help insurance providers to grow their business and build long-term relationships with their clients.

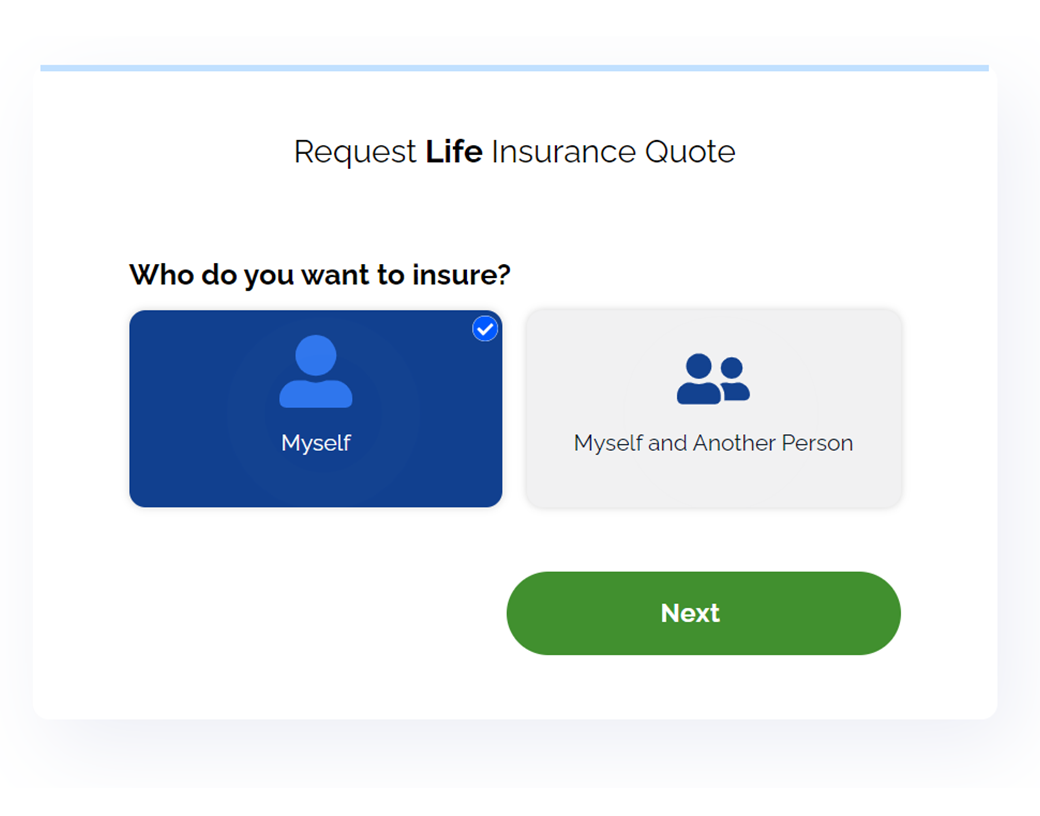

Life Insurance Quote Request

Life Insurance Quote Request

Request Life Insurance Quote form is a type of online form that allows users to request a quote for life insurance policies. The form typically collects information such as age, gender, health status, and other relevant details to help insurers generate an accurate quote.

The form may also ask for contact information, such as email or phone number, so that the insurer can follow up with the user. The main beneficiaries of this form are individuals or businesses looking to purchase life insurance policies.

A Request Life Insurance Quote form is designed to help potential customers of a life insurance company request a quote for a life insurance policy. This form typically asks for information such as the applicant’s age, health, occupation, and lifestyle to determine the appropriate coverage and premium rate.

The form benefits both the customer, who can receive a personalized quote and learn about available life insurance options, and the insurance company, who can collect information to assess the customer’s risk and provide a tailored insurance policy.