Form categoryIndustries

- All Forms189

- Application Forms51

- Blog Forms5

- Briefing Forms20

- Calculator Forms17

- Conditional Logic Forms25

- Contact Forms48

- Data Collection Forms7

- Eligibility Forms5

- Feedback Forms8

- Intake Forms7

- Lead Capture Forms84

- Lead Qualification Forms38

- Referral Forms5

- Registration Forms17

- Request Forms10

- Solar Forms5

- All Forms189

- Automotive Forms14

- B2B Forms21

- Debt Forms10

- E-Commerce Forms8

- Finance Forms30

- Healthcare Forms17

- Insurance Forms12

- Marketing/ Digital Agency Forms26

- Mortgage Forms7

- Real Estate Forms27

- Recruitment Forms6

- SaaS Forms8

- Startup Forms2

- Training Forms8

- Travel Forms5

- Utilities Forms4

- Web Design Agency Forms22

Choose form style

Form Templates › › All Form Styles

- Form Design ServiceBuild My Form

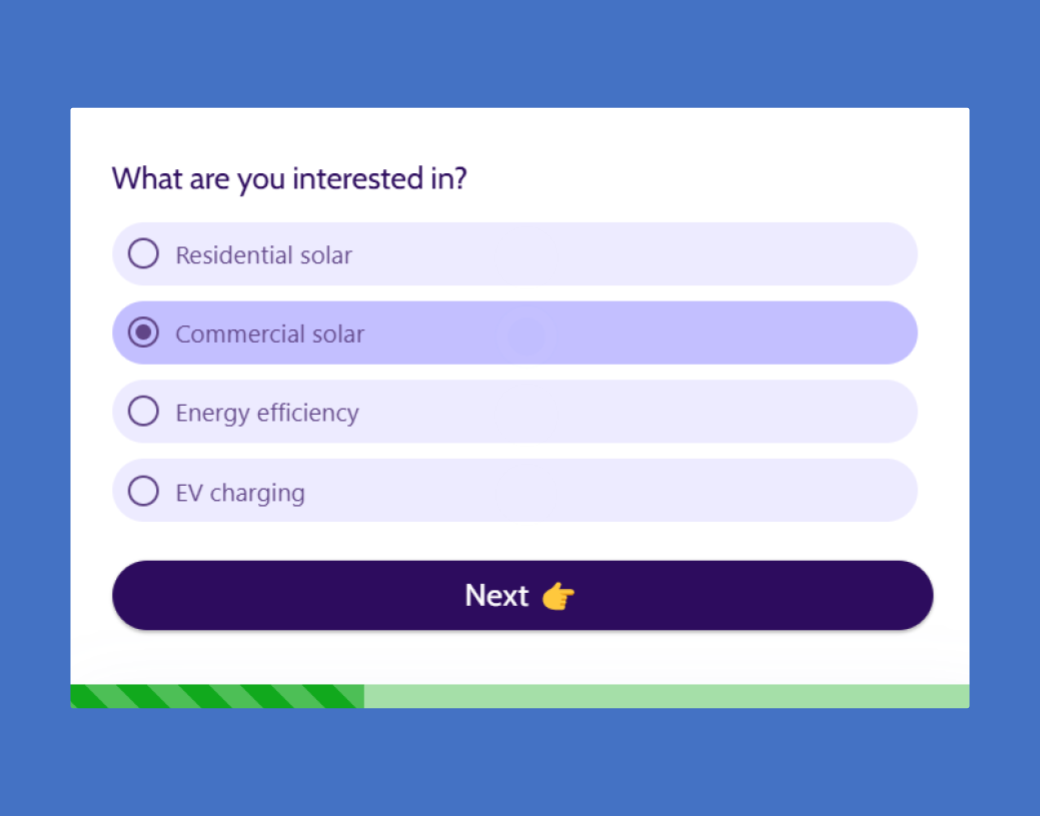

Solar Website Contact Form

Contact Forms

B2B Forms

A Solar Website Contact Form is a customized online form that allows solar firms to gather questions and...

View Form

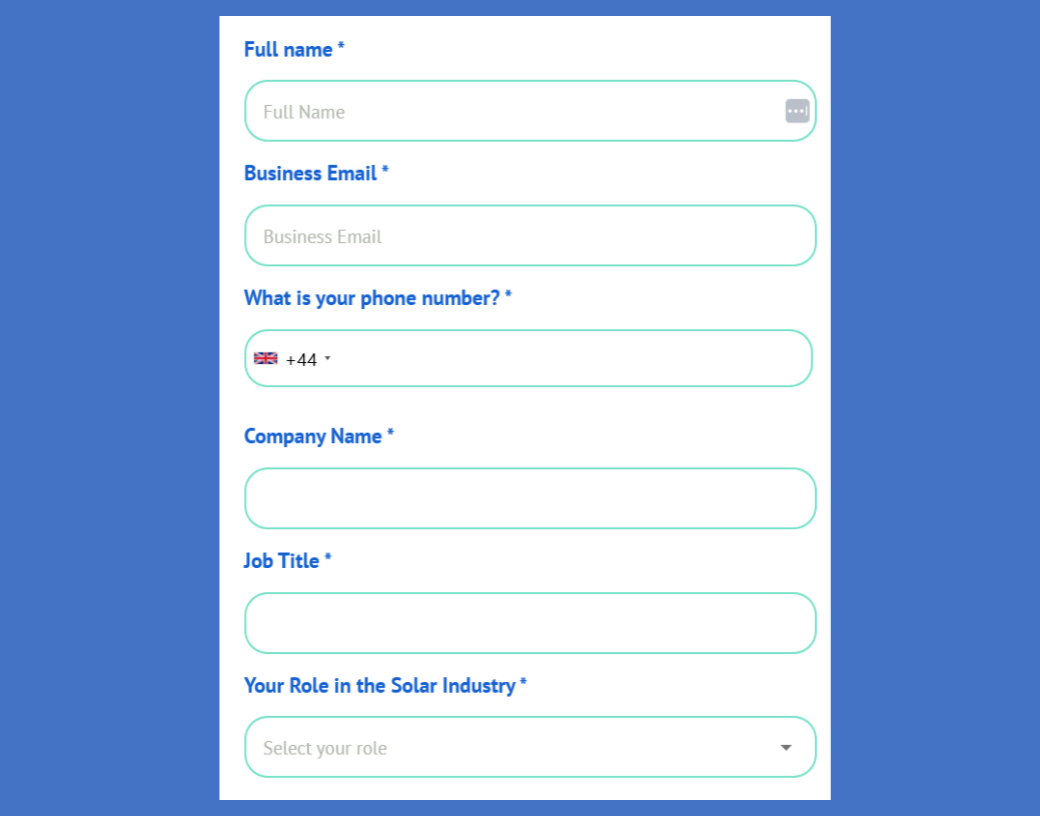

Solar Website Contact Form-Modern

Contact Forms

B2B Forms

A Solar Website Contact Form - Modern is a sleek and streamlined digital form created exclusively for solar...

View Form

Solar Contact Form- Modern

Contact Forms

B2B Forms

A Solar Contact Form - Modern is an improved version of the classic contact form, with a sleek and...

View Form

Solar Contact Form

Contact Forms

Marketing/ Digital Agency Forms

A solar contact form is an internet form used to collect questions and important information from potential...

View Form

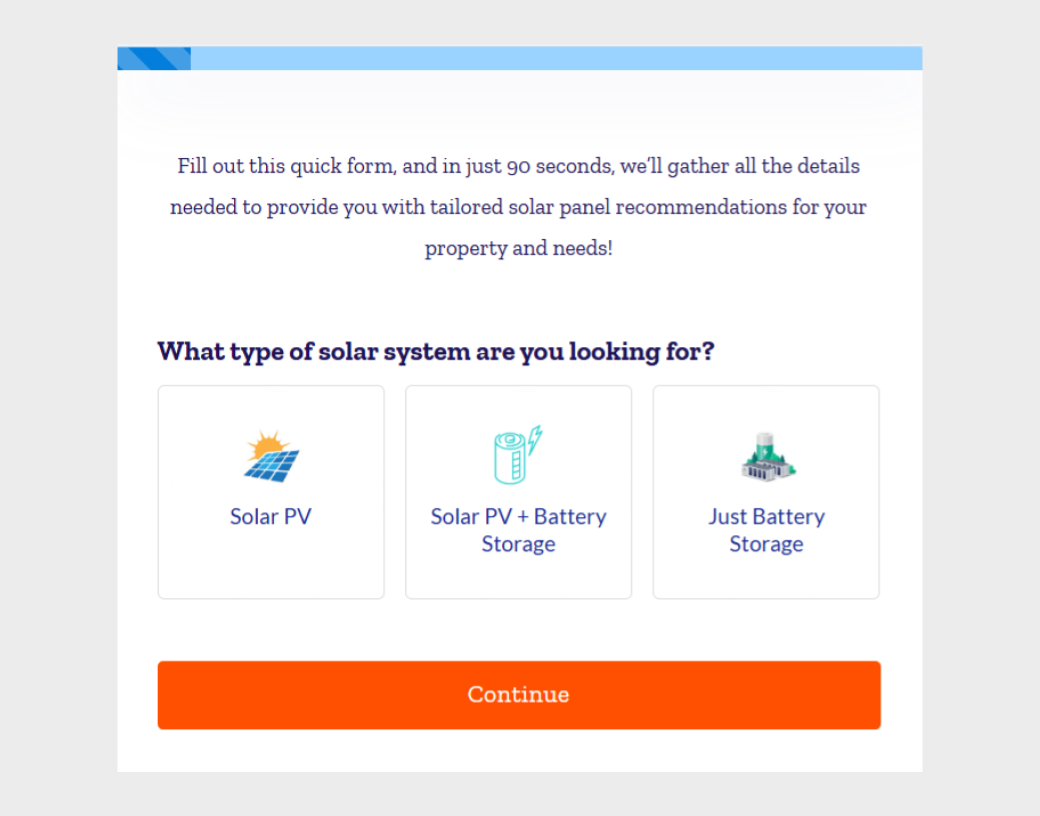

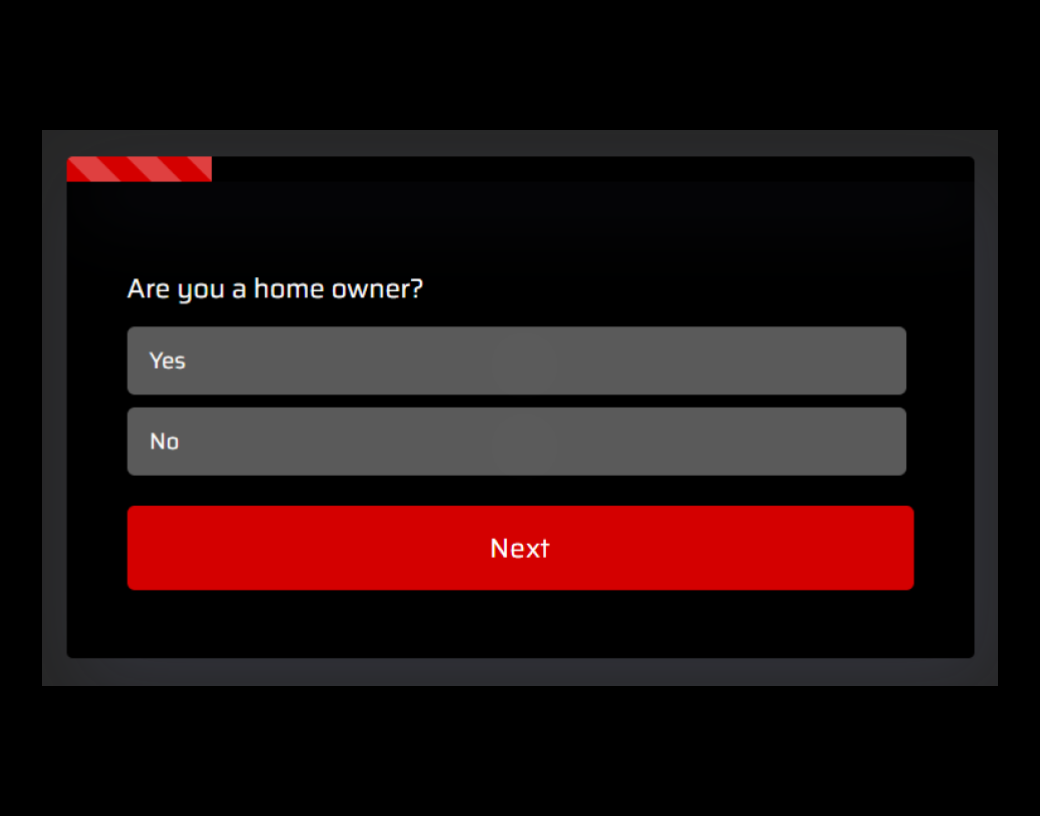

Solar single step contact form

Solar Forms

Marketing/ Digital Agency Forms

A solar one-step form is a simple lead-generating form that collects all necessary information from potential...

View Form

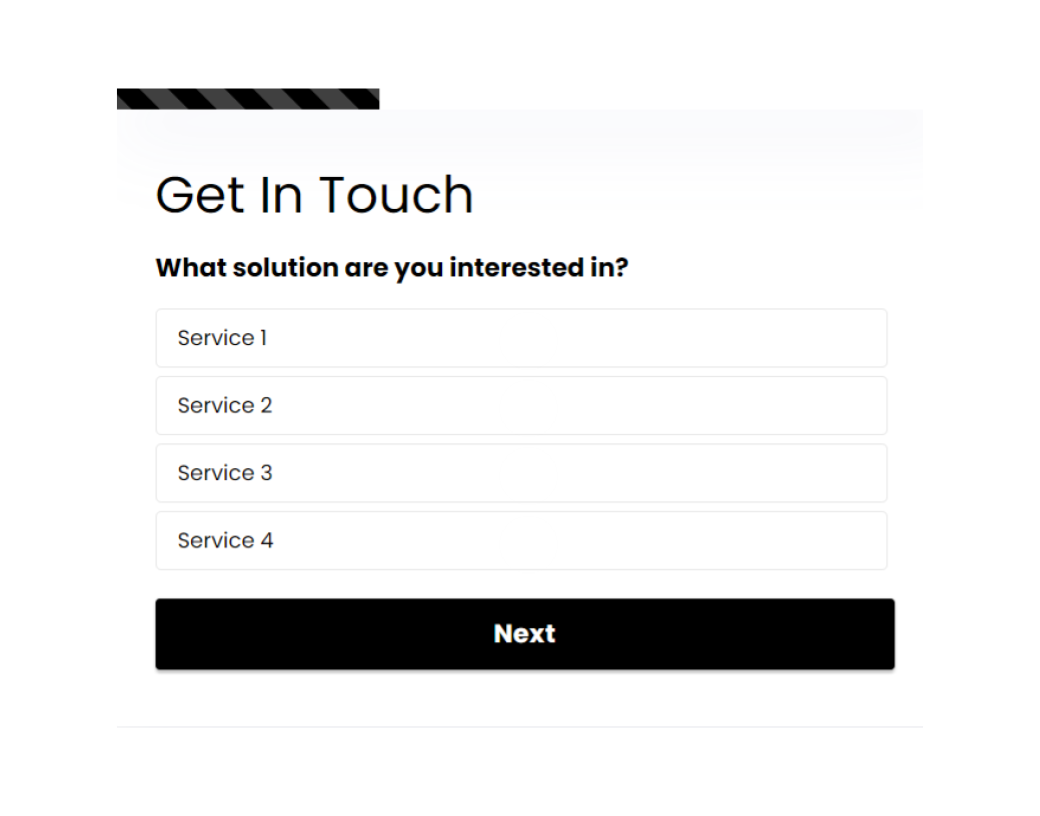

Contact Form B/W

Blog Forms

B2B Forms

Contact forms are web-based tools that enable customers to contact directly with a company or group. These...

View Form

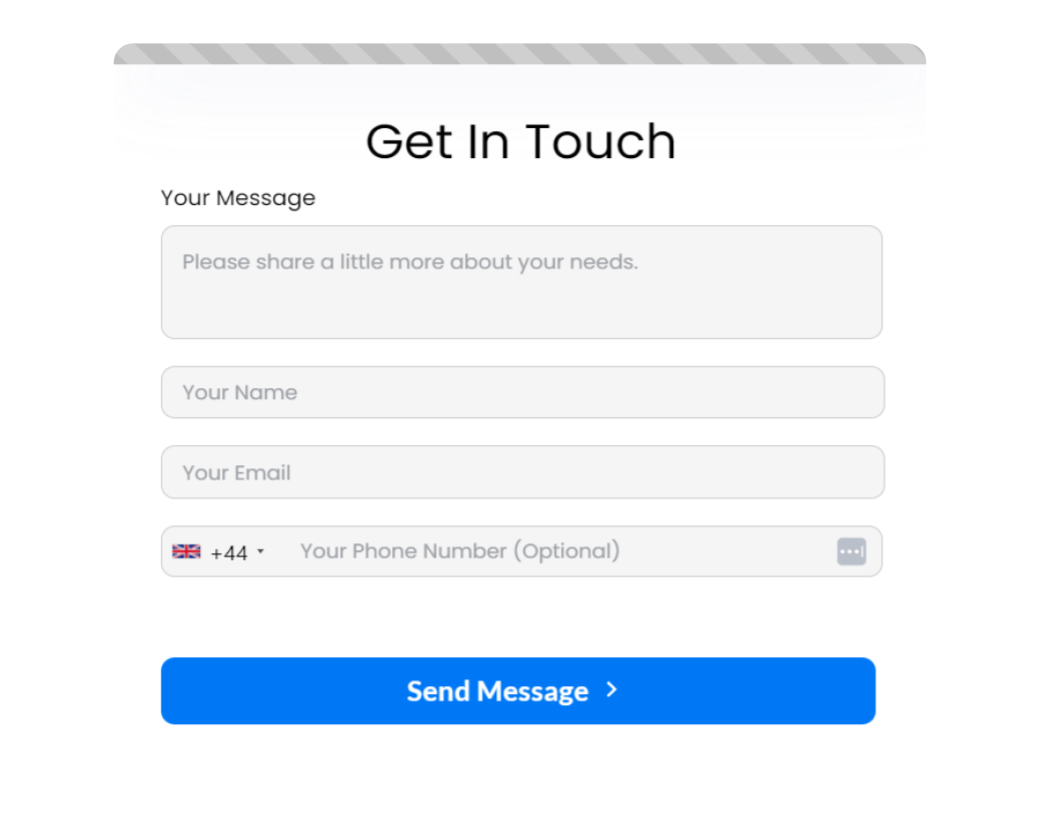

Website Contact Form-Simple

Contact Forms

B2B Forms

Website contact forms are online forms integrated into websites that allow visitors to interact directly with...

View Form

Modern Contact Form

Contact Forms

B2B Forms

Modern contact forms are digital forms that are linked to websites or applications, allowing consumers to...

View Form

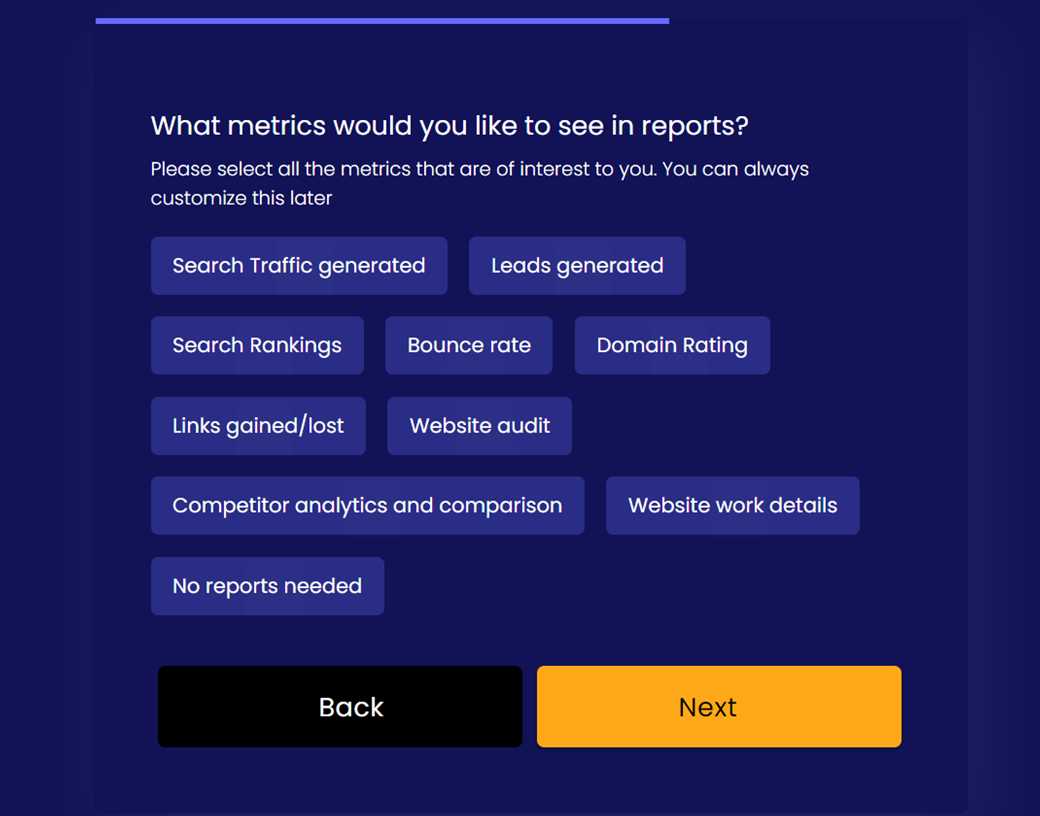

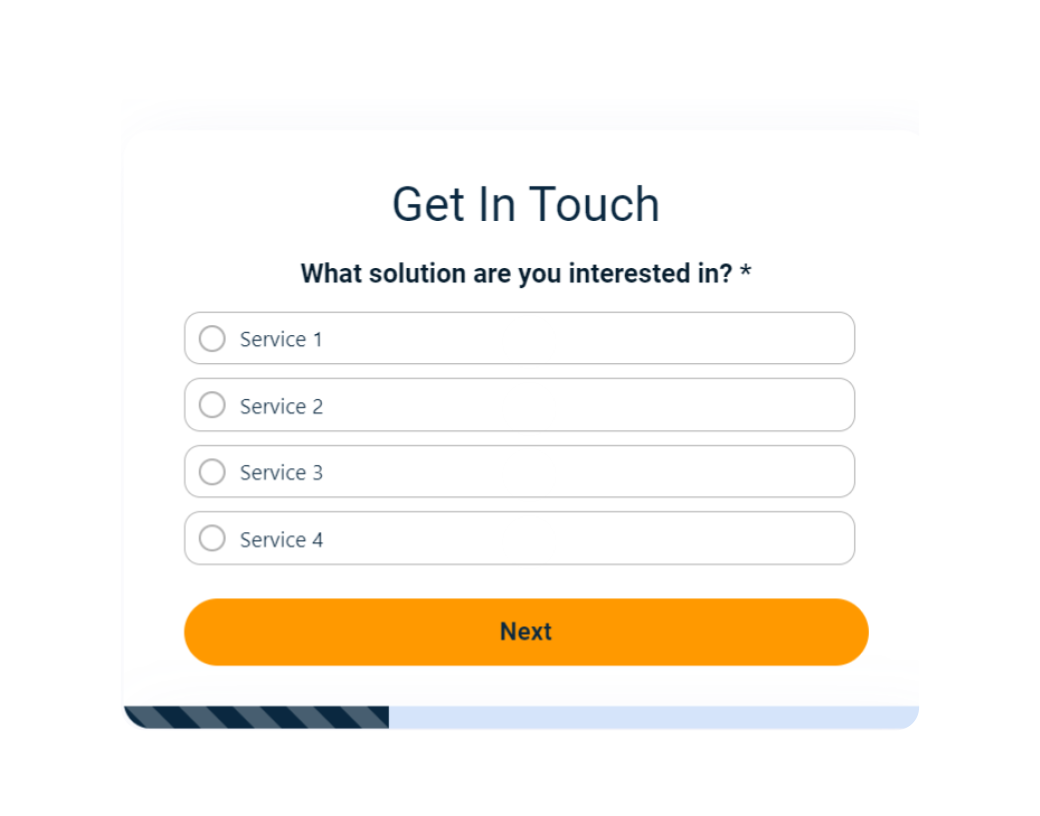

Performance Marketing Agency Lead Form

Lead Capture Forms

Marketing/ Digital Agency Forms

A Performance Marketing Agency Lead Form is a type of form used by performance marketing agencies to collect...

View Form

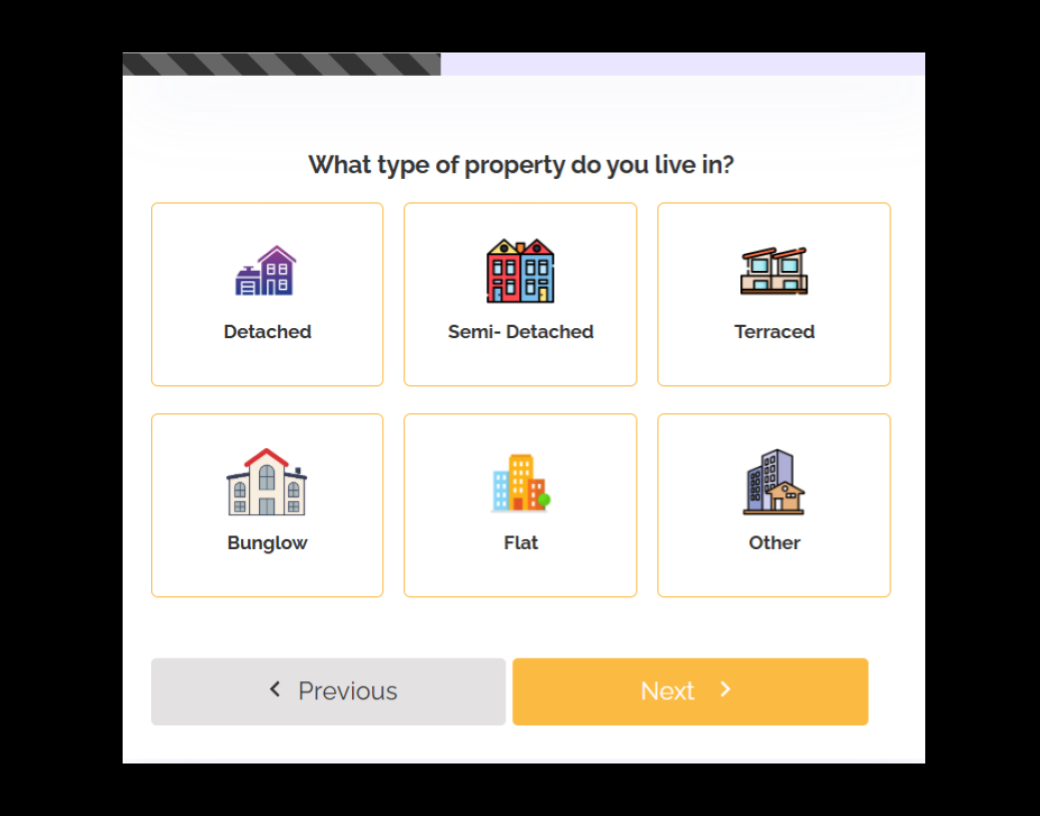

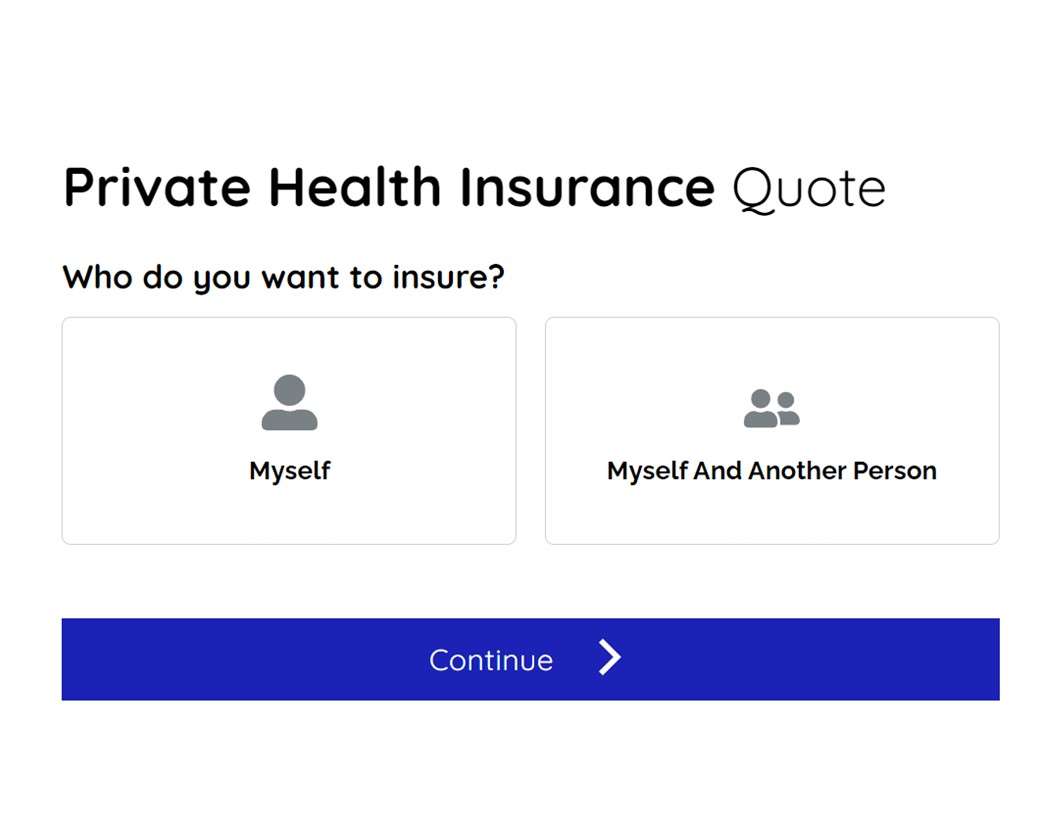

Private Health Insurance Quote Request

Lead Capture Forms

Healthcare Forms

The Private Health Insurance Quote Request form is a document used by individuals or businesses to request a...

View Form