Form Templates › Debt Forms › All Form Styles

Debt Forms

- All Forms220

- Automotive Forms16

- B2B Forms20

- Debt Forms13

- E-Commerce Forms12

- Finance Forms36

- Healthcare Forms25

- Insurance Forms13

- Marketing/ Digital Agency Forms32

- Mortgage Forms9

- Real Estate Forms31

- Recruitment Forms7

- SaaS Forms10

- Startup Forms3

- Training Forms9

- Travel Forms6

- Utilities Forms5

- Web Design Agency Forms25

Choose form style

Form Templates › Debt Forms › All Form Styles

Debt Forms

- Form Design ServiceBuild My Form

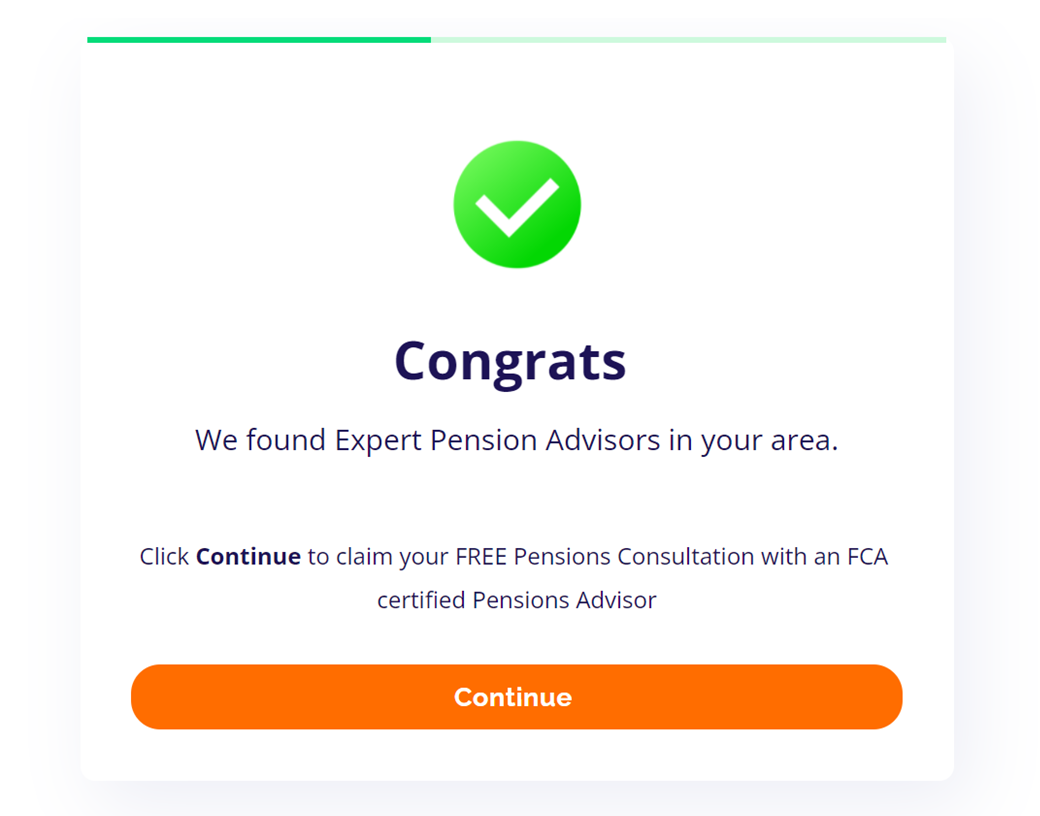

Pension Advisor Search Form

Pension Advisor Search Form

A Dynamic Pension Advisor Search Form is a type of online form that helps users find a suitable pension advisor based on their location and specific needs. The form typically asks for details such as the user’s location, the type of advice they are looking for, their age, their retirement goals, and any other relevant information.

Once the user submits the form, the system will generate a list of suitable advisors in the user’s area, along with their contact information and any other relevant details. This type of form is designed to help users make informed decisions about their pension planning and find an advisor who can provide them with the support and guidance they need.

A Dynamic Pension Advisor Search Form is a tool designed to help individuals find pension advisors that meet their specific needs. Users can input information such as their location, pension goals, and preferences for advisor experience and qualifications, and the form will generate a list of suitable pension advisors.

This type of form is typically used by people who are looking for professional advice on managing their retirement savings, and who want to make sure they find an advisor who is a good fit for their needs. Pension advisors and financial firms can also benefit from this type of form by using it to generate leads and connect with potential clients who are interested in their services.

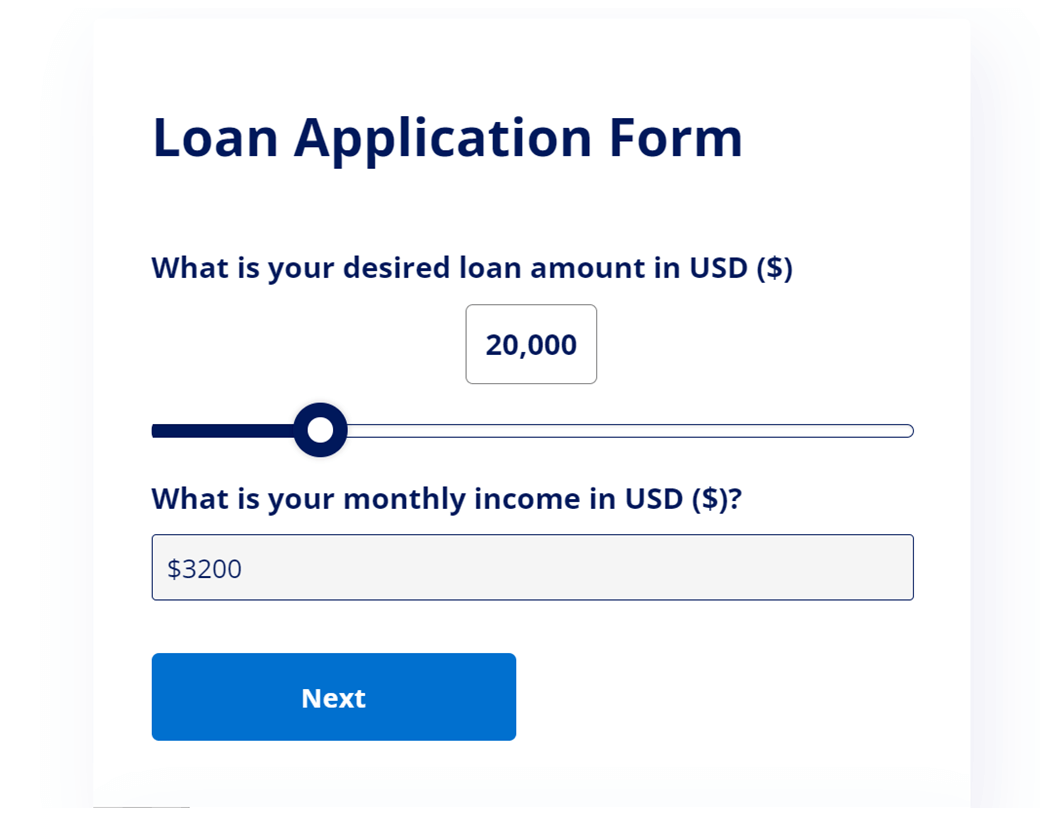

Simple Loan Application Form

Simple Loan Application Form

Simple Loan Application Form Template – Streamline Your Lending Process! Are you tired of manually collecting and organizing loan applications from potential borrowers? Look no further, our Simple Loan Application Form Template is here to simplify your lending process! With an intuitive and user-friendly design, our template allows you to gather all the necessary information from your borrowers in a streamlined and efficient manner. Benefits of using our Loan Application Form Template include: Customizable fields to fit the specific requirements of your lending business Electronic submission and storage of loan applications for easy tracking and management Secure and confidential handling of sensitive information Increased efficiency and productivity by automating the loan application process Whether you’re a bank, credit union, or private lender, our Simple Loan Application Form Template will streamline your lending process and provide a professional and organized experience for your borrowers. Try it out today and experience the difference!

Loan application form templates are used by individuals or organizations to collect information from prospective borrowers in order to assess their creditworthiness and determine whether to approve or deny their loan request. The template usually includes fields for personal and financial information, such as employment history, income, expenses, and debt obligations. This information is used to calculate the borrower’s debt-to-income ratio, credit score, and overall ability to repay the loan. The simple loan application form template serves as a standard way for loan providers to gather the information they need to make an informed lending decision.

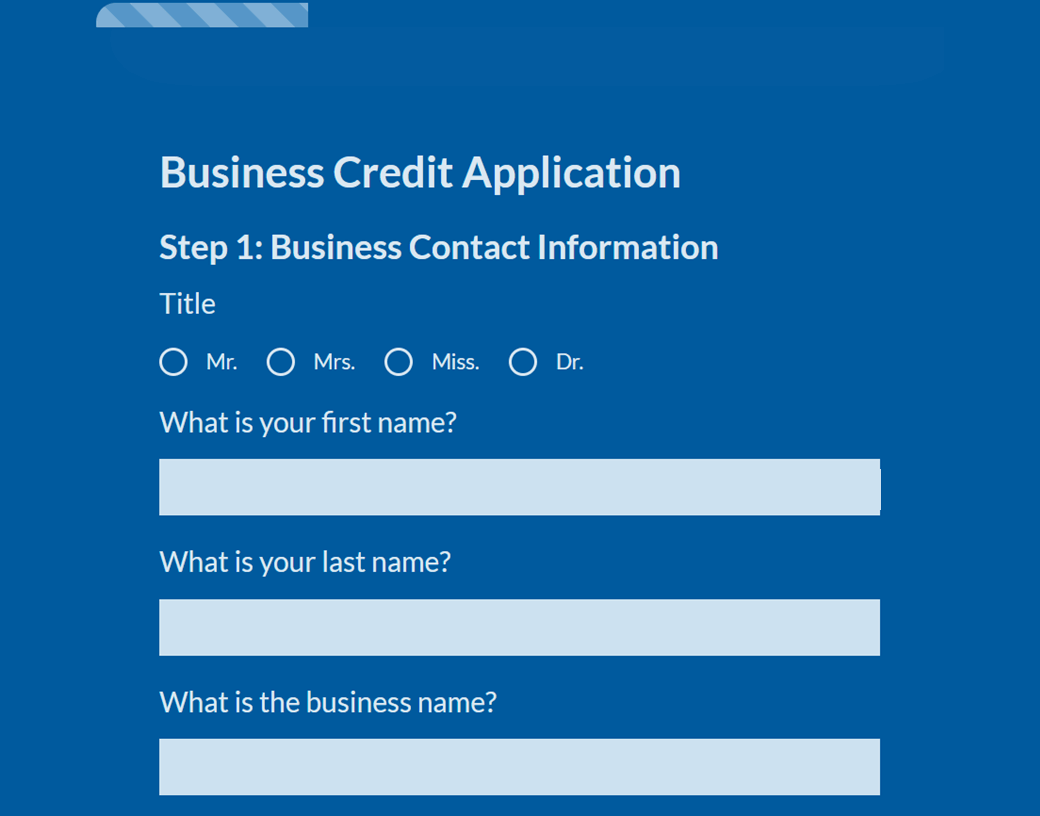

Business Credit Application Form

Business Credit Application Form

A business credit application form is used by companies to assess and approve the creditworthiness of their clients. It is typically used by suppliers, lenders, or credit providers to gather information about the potential borrower’s financial history, credit references, and business details. This form helps the lender make an informed decision on whether to extend credit to the business and determine the credit limit, interest rate, and repayment terms.

There are several benefits to using a business credit application form template:

- Standardization: A template ensures that all applicants are asked the same questions, allowing for consistent and fair assessment of their creditworthiness.

- Efficiency: Using a template streamlines the application process, reducing the time and effort required to gather information from applicants.

- Accuracy: The template provides a clear and comprehensive set of questions, helping to ensure that all relevant information is collected and reducing the risk of errors.

- Record keeping: A template provides a standardized record of the credit application, which can be easily stored and retrieved for future reference.

- Cost savings: Using a template eliminates the need to create a form from scratch, saving time and money on the design and printing of forms.

- Legal compliance: A template may include language that meets legal requirements and protects the interests of the lender or credit provider.

- Improved decision making: By gathering consistent and complete information from all applicants, a template can help lenders make more informed and confident credit decisions.

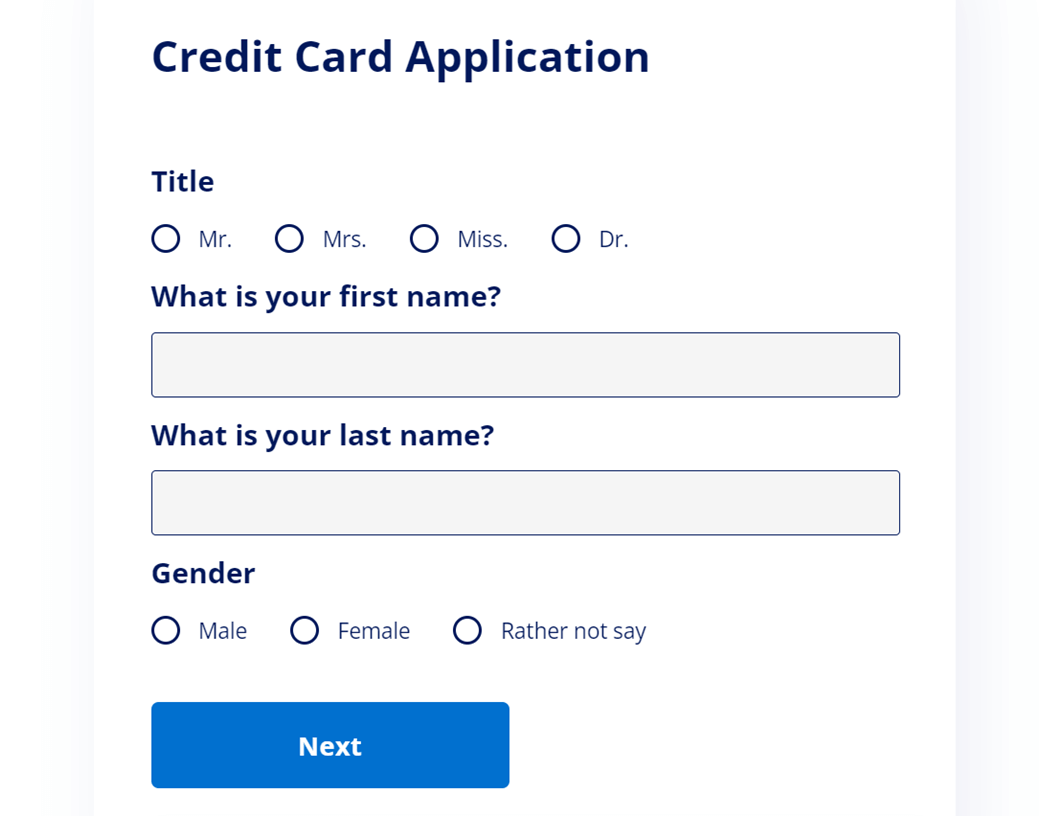

Credit Card Application Form

Credit Card Application Form

The generic credit card application form template is capable of gathering important information from potential credit card applicants. This information helps financial institutions and lending companies determine the applicant’s creditworthiness and ability to repay debt. The template can be used to gather information such as:

Personal information: name, address, date of birth, passport number, and contact information.

Employment and income: employment status, job title, employer name, and monthly income.

Financial history: credit score, debt, bill payment history, and other relevant financial information.

Credit card preferences: type of credit card requested, credit limit desired, and any additional features or benefits requested.

By gathering this information, the generic credit card application form template enables financial institutions to make informed decisions about granting credit to applicants. This helps to ensure that credit is granted to those who are most likely to repay it, thereby reducing the risk of default for the financial institution.

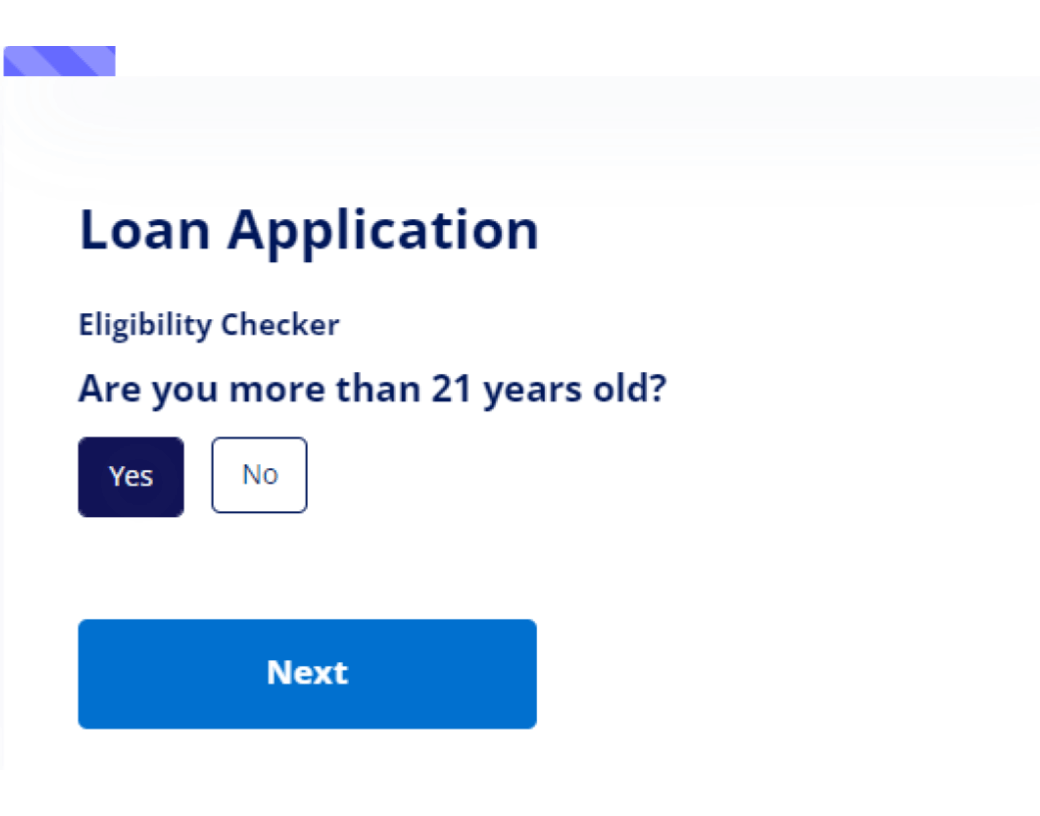

Loan Application Form Template

Loan Application Form Template

Loan application form template to collect leads and also check eligibility of loan applications.

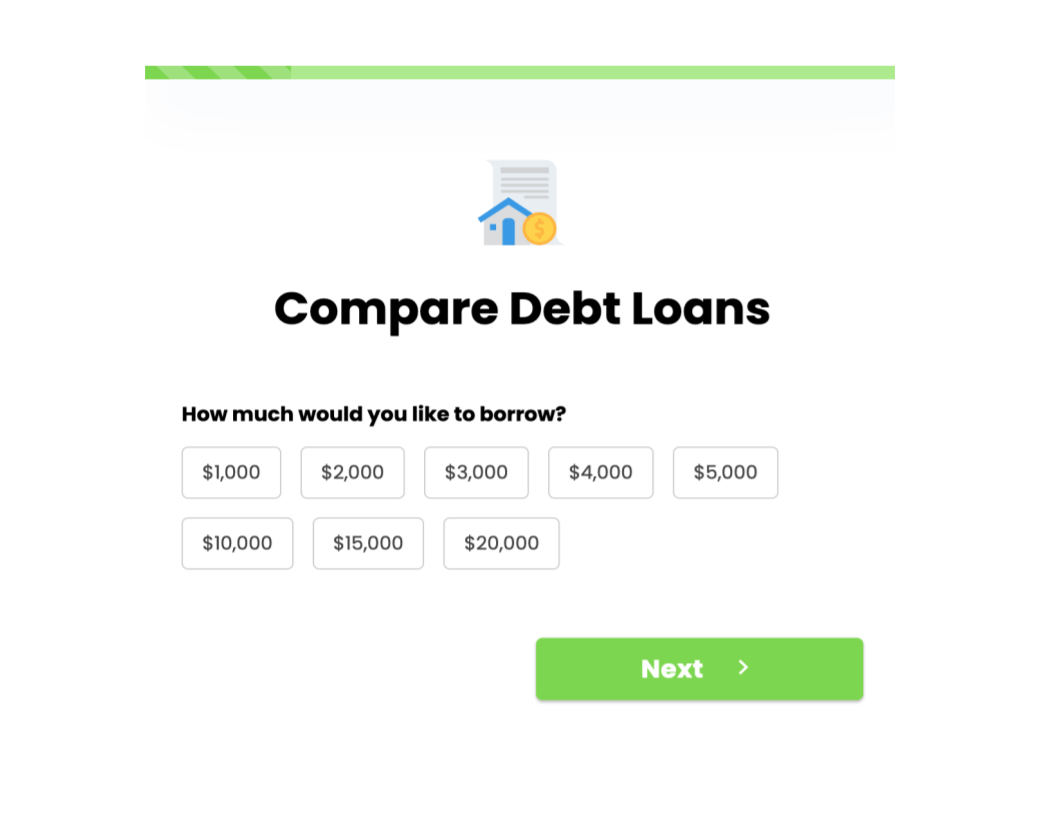

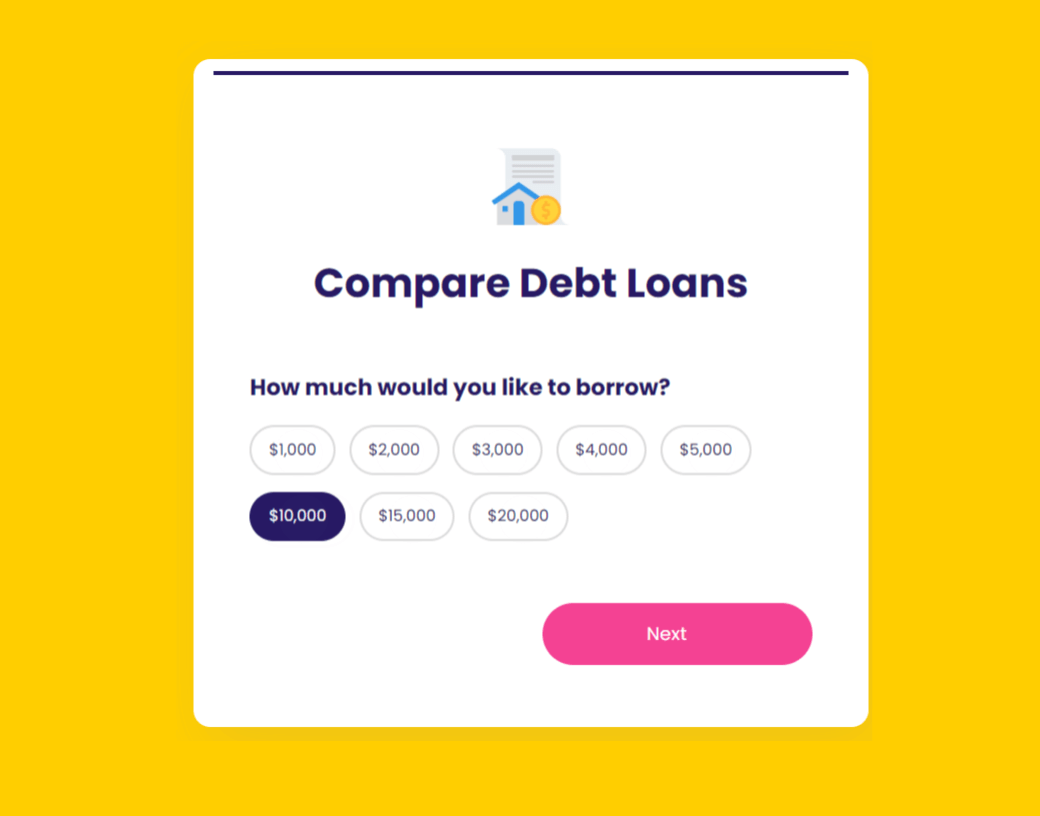

Compare Debt Loans

Compare Debt Loans

A Compare Debt Loans form is a type of online form that allows users to compare various loan options for debt consolidation. Users can input information about their current debts and financial situation, and the form will generate a list of potential loan options with different terms, interest rates, and monthly payments.

This form is designed to help users make informed decisions about which loan option may be the best fit for their needs. Lenders and financial institutions offering debt consolidation loans may benefit from this form as it provides a way to connect with potential customers who are actively seeking loan options.

A Compare Debt Loans form is designed to help users compare different loan options available to them for consolidating their debts. It usually requires the user to enter information about their current debts, such as the total amount owed, interest rates, and monthly payments, as well as personal information like credit score and income.

The form then provides the user with various loan options along with their interest rates, repayment terms, and monthly payments. The user can use this information to compare the different loan options and choose the one that best suits their needs.

This form benefits anyone who is struggling with multiple debts and wants to consolidate them into a single payment with a lower interest rate. It can be especially useful for those who have credit card debts or high-interest loans and want to find a more affordable way to pay them off. The form provides a quick and easy way to compare different loan options without having to contact multiple lenders or do extensive research on their own.

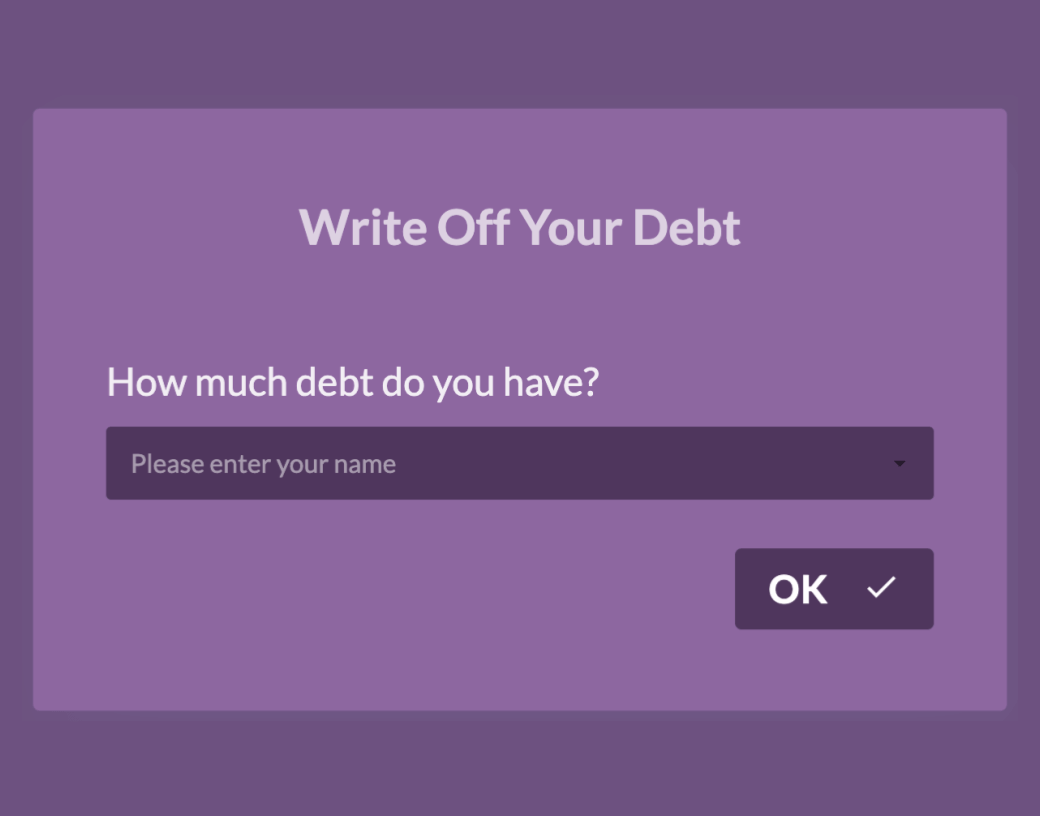

Write Off Debt Solutions

Write Off Debt Solutions

“Write Off Debt Solutions” is a term that refers to a type of debt relief program or service that helps individuals or businesses to reduce or eliminate their outstanding debt. This can include credit card debt, personal loans, medical bills, and other types of debt.

Write Off Debt Solutions typically involve working with a debt relief company or service provider to negotiate with creditors on behalf of the debtor. This may involve consolidating multiple debts into a single payment, negotiating lower interest rates or payment plans, or even negotiating a settlement that allows the debtor to pay a reduced amount in exchange for the debt being considered paid in full.

The goal of Write Off Debt Solutions is to help individuals and businesses get out of debt and regain control of their finances. By reducing or eliminating their outstanding debt, debtors can often reduce their stress levels and improve their overall financial health. However, it’s important to note that Write Off Debt Solutions can have long-term impacts on credit scores and financial histories, so it’s important to carefully consider all options and potential consequences before pursuing this type of solution.

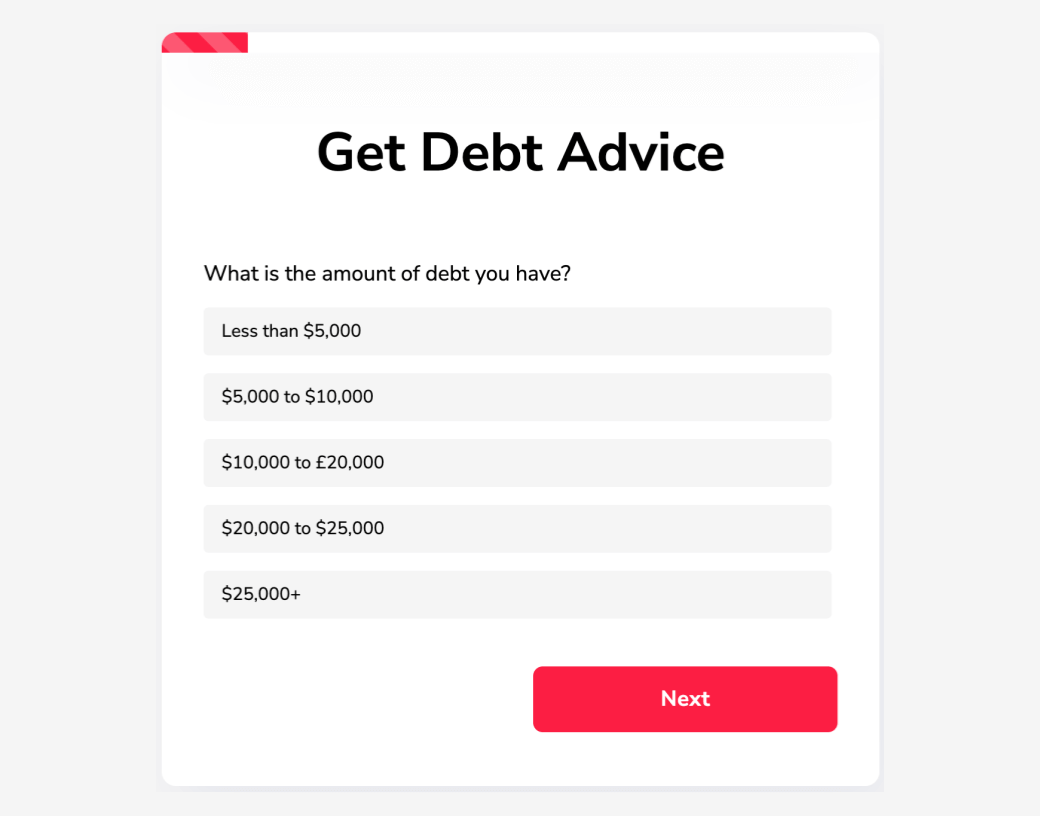

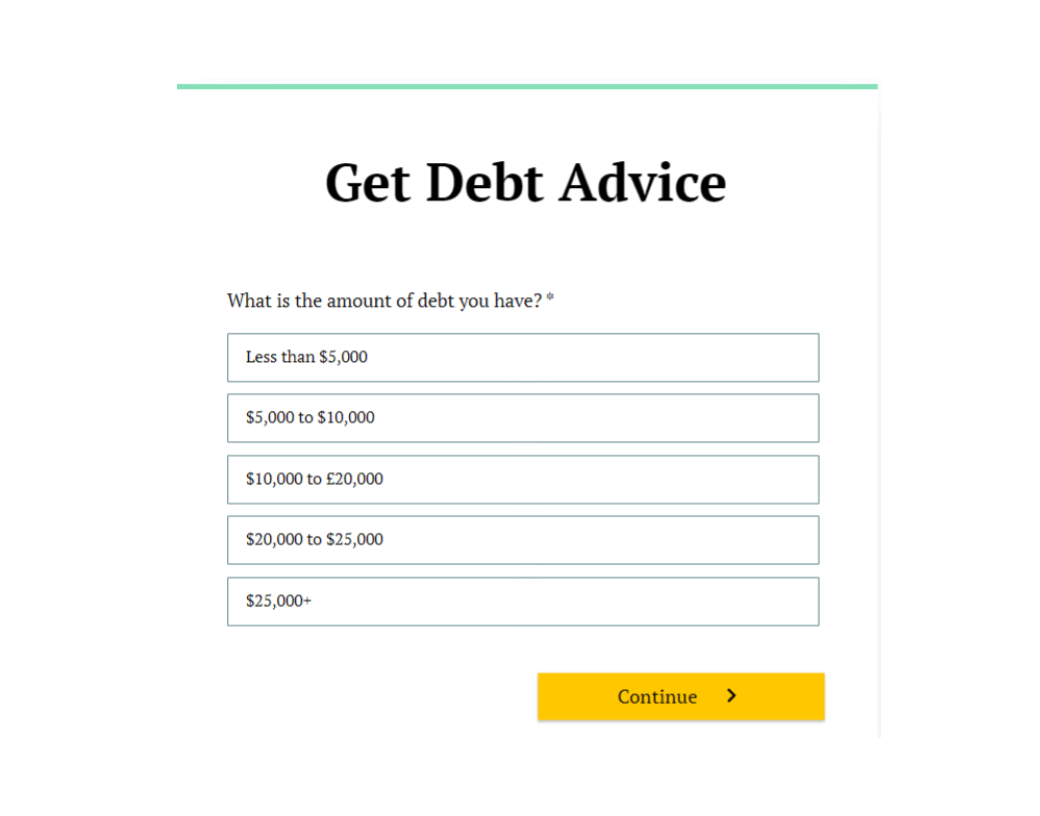

Debt Advice Lead Capture Form

Debt Advice Lead Capture Form

A Debt Advice Lead Capture Form is a web form that allows users to submit their contact information in order to receive advice on managing their debts. The form typically collects personal and financial details, such as income, expenses, and debts owed.

The purpose of the form is to generate leads for debt advice services and help those struggling with debt to get the assistance they need. The service providers who offer debt advice are the ones who benefit from this form by obtaining leads and potential customers.

A Debt Advice Lead Capture Form is designed to capture information about people who are struggling with debt and are seeking advice on how to manage it. This form typically asks for personal and financial information such as name, contact information, total debt amount, and sources of income.

The purpose of this form is to generate leads for debt advice services, such as credit counseling or debt settlement companies, and connect them with people who are in need of their services. The companies offering these services benefit from this form by acquiring potential customers and increasing their customer base.

Compare Debt Loans

Compare Debt Loans

A Compare Debt Loans form is a type of online form that allows users to compare various loan options for debt consolidation. Users can input information about their current debts and financial situation, and the form will generate a list of potential loan options with different terms, interest rates, and monthly payments.

This form is designed to help users make informed decisions about which loan option may be the best fit for their needs. Lenders and financial institutions offering debt consolidation loans may benefit from this form as it provides a way to connect with potential customers who are actively seeking loan options.

A Compare Debt Loans form is designed to help users compare different loan options available to them for consolidating their debts. It usually requires the user to enter information about their current debts, such as the total amount owed, interest rates, and monthly payments, as well as personal information like credit score and income.

The form then provides the user with various loan options along with their interest rates, repayment terms, and monthly payments. The user can use this information to compare the different loan options and choose the one that best suits their needs.

This form benefits anyone who is struggling with multiple debts and wants to consolidate them into a single payment with a lower interest rate. It can be especially useful for those who have credit card debts or high-interest loans and want to find a more affordable way to pay them off. The form provides a quick and easy way to compare different loan options without having to contact multiple lenders or do extensive research on their own.

Debt Advice Lead Capture Form

Debt Advice Lead Capture Form

A Debt Advice Lead Capture Form is a web form that allows users to submit their contact information in order to receive advice on managing their debts. The form typically collects personal and financial details, such as income, expenses, and debts owed.

The purpose of the form is to generate leads for debt advice services and help those struggling with debt to get the assistance they need. The service providers who offer debt advice are the ones who benefit from this form by obtaining leads and potential customers.

A Debt Advice Lead Capture Form is designed to capture information about people who are struggling with debt and are seeking advice on how to manage it. This form typically asks for personal and financial information such as name, contact information, total debt amount, and sources of income.

The purpose of this form is to generate leads for debt advice services, such as credit counseling or debt settlement companies, and connect them with people who are in need of their services. The companies offering these services benefit from this form by acquiring potential customers and increasing their customer base.

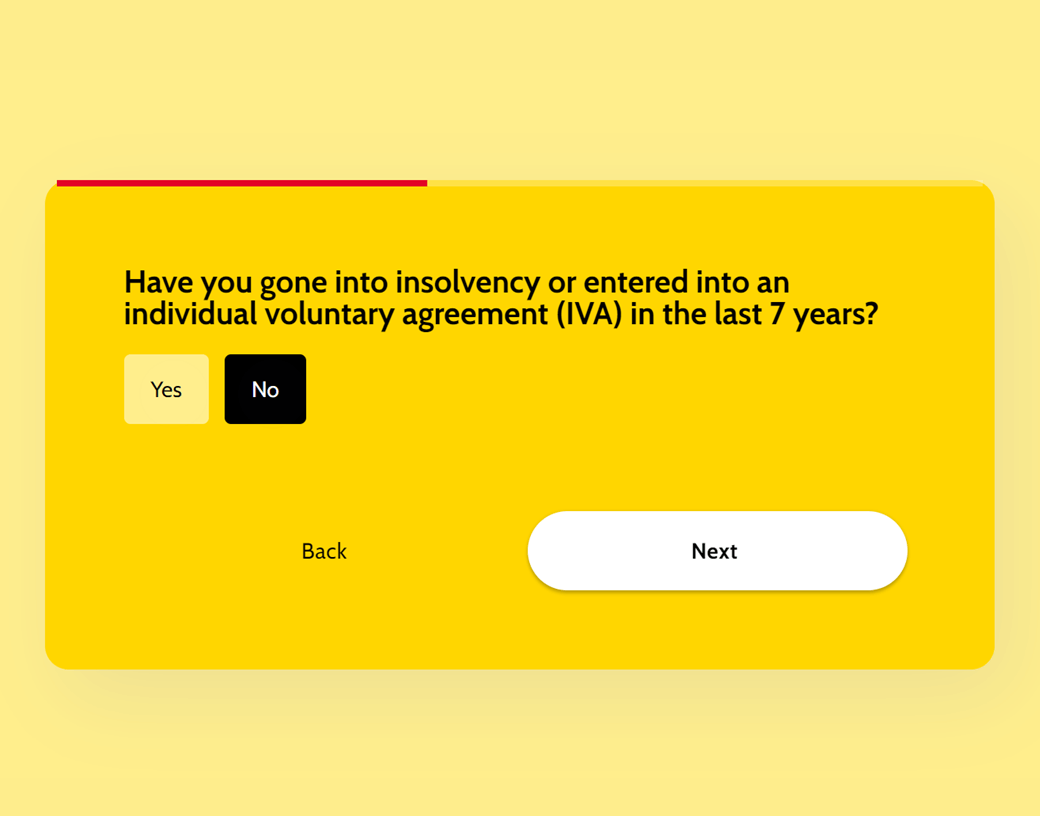

Loan Eligibility Checker

Loan Eligibility Checker

A Loan Eligibility Checker Form is an online form that helps individuals determine if they are eligible to apply for a loan. It typically requires users to provide basic information about their financial situation, such as income, credit score, and employment status, to determine if they meet the minimum requirements for a particular loan product.

The Loan Eligibility Checker Form benefits both lenders and borrowers. For lenders, it can help to pre-screen potential applicants and ensure that only qualified borrowers are applying for loans.

This can help to streamline the loan application process and save time and resources. For borrowers, the Loan Eligibility Checker Form can provide a quick and easy way to determine if they meet the basic eligibility criteria for a loan before submitting a full loan application. This can help to avoid unnecessary credit checks and loan denials, which can negatively impact a borrower’s credit score.

Overall, the Loan Eligibility Checker Form can help to make the loan application process more efficient for both lenders and borrowers, while also providing a valuable tool for individuals to assess their own financial situation and determine their eligibility for a loan product.

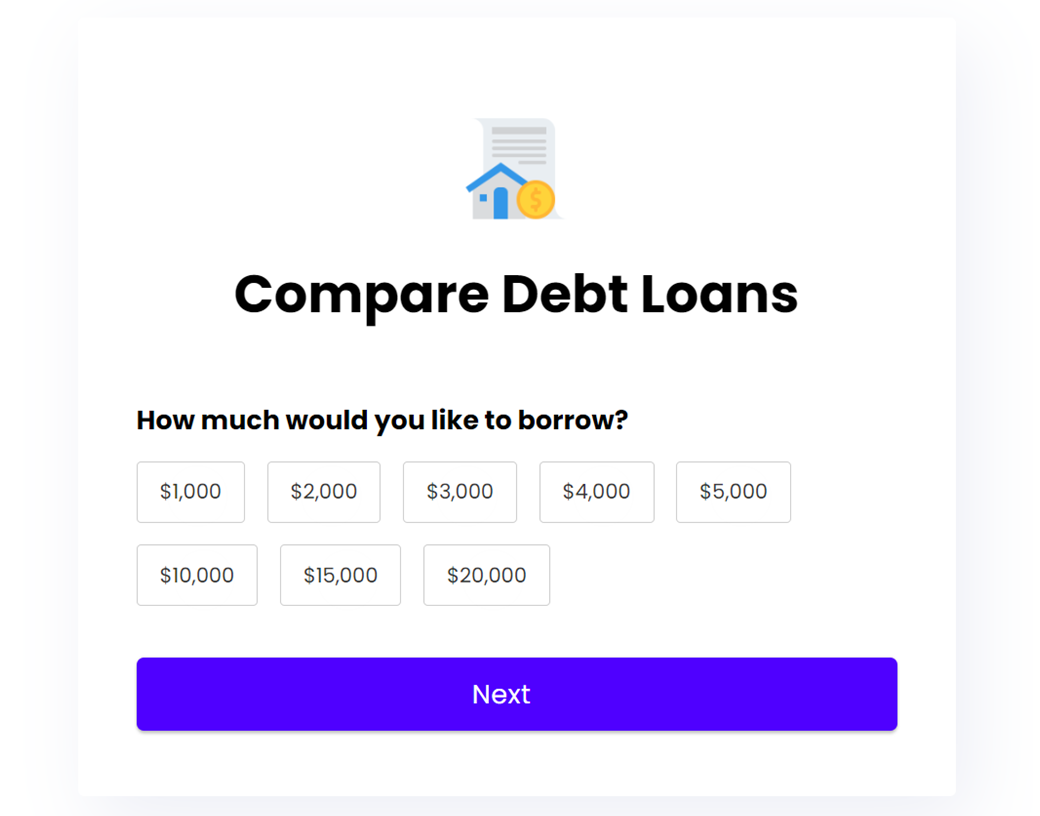

Compare Debt Loans

Compare Debt Loans

A Compare Debt Loans form is a type of online form that allows users to compare various loan options for debt consolidation. Users can input information about their current debts and financial situation, and the form will generate a list of potential loan options with different terms, interest rates, and monthly payments.

This form is designed to help users make informed decisions about which loan option may be the best fit for their needs. Lenders and financial institutions offering debt consolidation loans may benefit from this form as it provides a way to connect with potential customers who are actively seeking loan options.

A Compare Debt Loans form is designed to help users compare different loan options available to them for consolidating their debts. It usually requires the user to enter information about their current debts, such as the total amount owed, interest rates, and monthly payments, as well as personal information like credit score and income.

The form then provides the user with various loan options along with their interest rates, repayment terms, and monthly payments. The user can use this information to compare the different loan options and choose the one that best suits their needs.

This form benefits anyone who is struggling with multiple debts and wants to consolidate them into a single payment with a lower interest rate. It can be especially useful for those who have credit card debts or high-interest loans and want to find a more affordable way to pay them off. The form provides a quick and easy way to compare different loan options without having to contact multiple lenders or do extensive research on their own.